Financial Debt And Its Impact On Your Emotional Estate

Is your career financially rewarding? Did you just receive a job promotion? Have you obtained employment with a new company with a great sign on bonus and yearly salary? Are you able to save a significant amount of your salary every month and spend money whenever you please? If so, you’re probably at the prime of your life and your financial well-being is the furthest thing on your mind.

What is Your Current Financial State

Are you on the opposite end of this stick? Do you have to worry if your pay day is before your rent is due to ensure your rent gets paid on time? Are late fees added on to your existing balance because you haven’t paid the bill yet due to a lack of funds? Are you receiving shut off notices in the mail? If you answered yes to any of these questions you truly understand how your finances tend to affect your emotional estate.

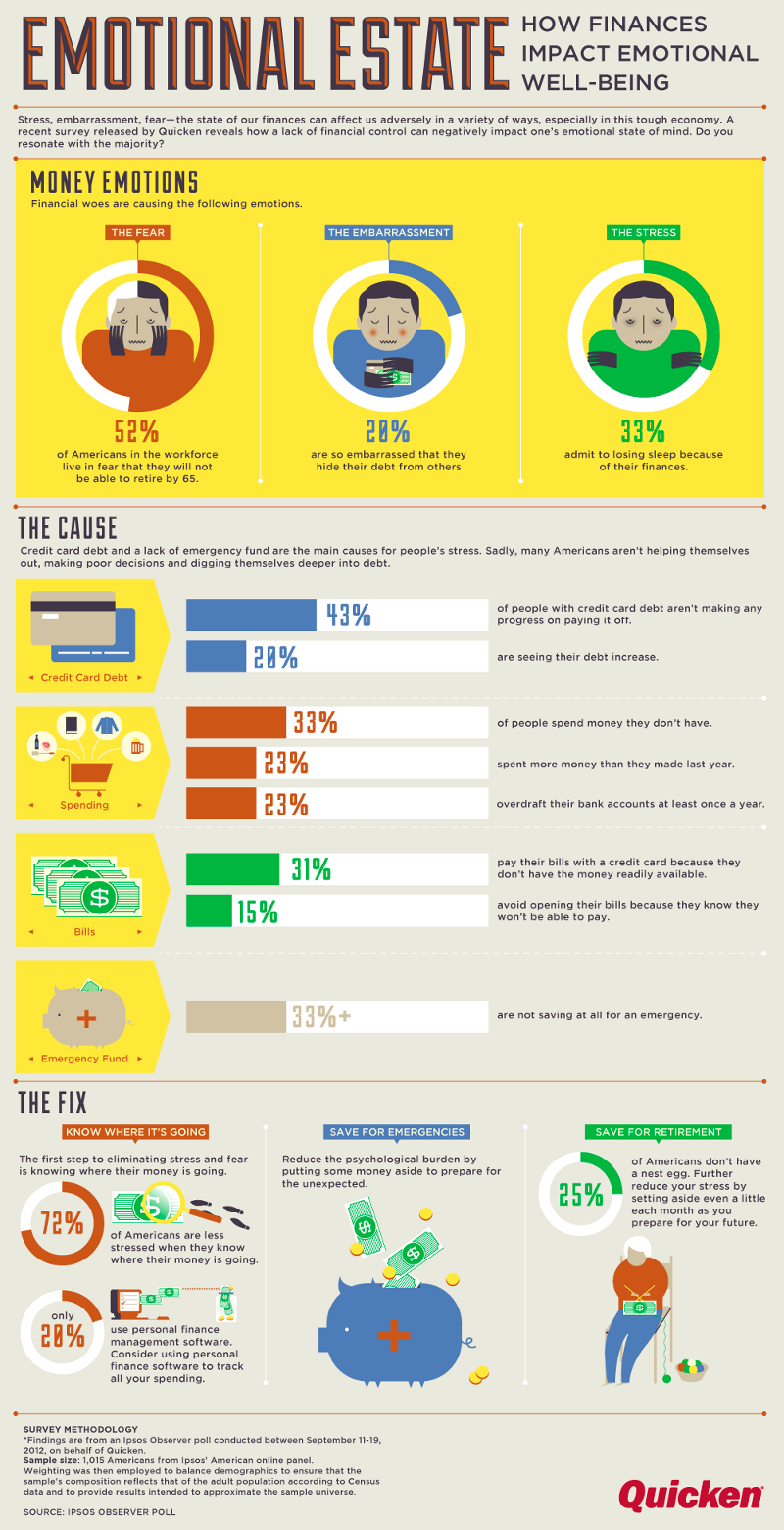

Do you often times fear coming home to an eviction noticed placed on your front door? Your financial worries are not only embarrassing, but it causes a tremendous amount of stress. Your lack of financial control tends to negatively impact your emotional well-being which can be detrimental to your health. Based on recent surveys, 52% of Americans live in fear because they will not be able to retire by the age of 65.

Are your credit cards used as your main source of payment for food and other important essentials? Are you in an immense amount of credit card debt? You are in the same position as 20% of Americans who are embarrassed of their debt. These people are so embarrassed that they hide their debt from others. The rest of Americans, which equates to 33%, are stressed out and often lose sleep as a result of their financial uncertainty.

Facing a Financial Crisis

Now that you are aware that you’re potentially in a financial crisis, it is essential that you understand the cause so that you can work toward improving your financial situation. About 20% of Americans have credit card debt that continuously increases because they tend to spend money that they don’t yet have.

Bills are another cause of debt as 31% of people pay their bills with credit cards and 15% avoid opening their bills because they won’t be able to pay them.

Tips to Getting a Handle on Your Finances

How can your financial problems be fixed? You must first begin by knowing exactly where your money is going. This can be achieved by writing down the amount of money you make in a month and keeping track of your monthly expenses. This will not only show you where you spend most of your money, but will help you budget accordingly. Any extra money should be saved for emergencies as you begin to prepare for unexpected events.

Your emotional estate is adversely affected by your financial well-being. However, if you understand the causes behind your debt you will be able to work toward a life of financial stability.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.