The debt to equity ratio shows the proportion of stockholders’ equity and debt that a company uses to finance its needs. In other words, gives a measure of how much the company financially depends on its lenders and creditors compared to its stockholders.

Debt to Equity Ratio Formula

Debt to Equity Ratio = Total Debt (short and long term) / Shareholders’ Equity

Debt to Equity Ratio Video Tutorial With Examples

The ratio is useful for showing the potential risk that a company is subject to, however debt to equity ratio related risk varies tremendously based on the industry. A lower debt to equity ratio shows that a company depends primarily on its owners for financing, which usually puts it at a lower risk. With less of a reliance on creditors, the company won’t be subject to interest fees, late penalties, liens and other problems associated with using credit for business needs.

A high debt to equity ratio suggests that a company is heavily reliant on creditors compared to stockholders and may have a high financial risk. This is because creditors will have excessive interest rates with their financing which can add substantial financial liabilities. Also, if the company were to default on its loans, it may be at a risk of bankruptcy, repossession of assets, lawsuits, and other financial complications.

Debt to Equity Ratio Video Example 1

Debt to Equity Ratio Video Example 2

Long term debt includes real estate loans used to purchase production facilities or offices, financing for production equipment, startup capital loans, and any other financing obtained through creditors that has a long term repayment plan.

Short term debt generally includes loans that are due within one year such as credit card debts, accounts payable, or other business loans that are due in a short timeframe.

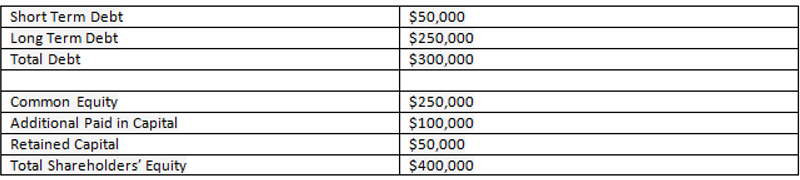

Shareholders’ equity includes investor financing, owner financing, retained capital, common equity, and additional paid-in capital and other forms of stockholder equity. Preferred stock is sometimes not included in the calculation because it can be viewed as a form of debt by some analysts. The example below does not include preferred stock in its debt to equity calculation.

Debt to Equity Ratio Written Example

A sample debt and equity chart for XYZ Baking Corp. is shown below, and from this chart we can obtain its debt to equity ratio.

Using the debt to equity ratio formula, we calculate the following:

$300,000 (total debt) / $400,000 (total shareholders’ equity) = 0.75 or 75%

This means that XYZ Baking Corp. is likely in a good financial position, as most of its financial needs are supplied by company shareholders rather than creditors. For every $1.00 that shareholders own, $0.75 is owed to creditors. This may be a good debt to equity ratio for a bakery, but the XYZ’s ratio needs to be compared to competitors for a more accurate judgment.

How to Interpret the Debt to Equity Ratio

Every industry has what can be considered a “normal” range for a debt to equity ratio. For example, some industries that are startup capital intensive, such as manufacturing and farming, may commonly have very high debt to equity ratios.

However, because these industries may have fewer other business risks associated with them, such as a stronger market demand for their products, lower interest rates, asset protection against liens, subsidies, or other financial protections, having a high debt to equity ratio may not be a detriment at all.

Also, many companies are expected to have a high debt to equity ratio at their founding, but if the ratio begins to decrease over time it suggests that the company is become stronger financially and is able to fund more of its financial needs using its own capital and shareholder equity.

The debt to equity ratio is also used by many lenders to determine their risk of lending (among many other financial calculations), and they will normally take the business’s industry into account.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.