An Overview of Mobile Wallets

This article dwells on the position of mobile money with respect to consumer perception and future predictions.

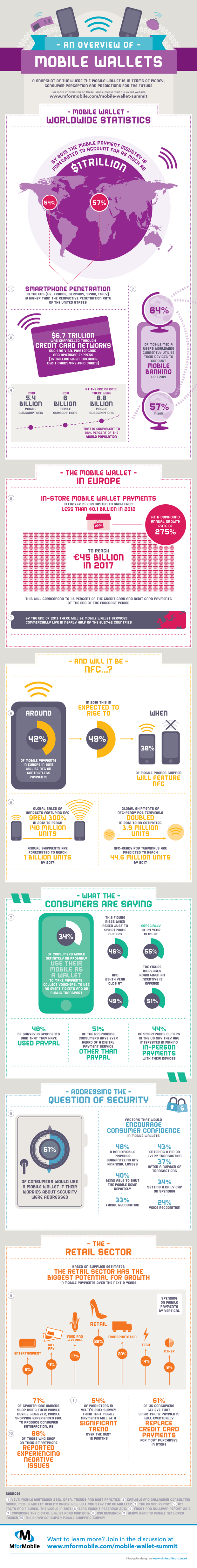

1. It was forecast that by 2015, mobile payment industry will account for as much as $1 trillion of which 54% is from the European Union and 57% is from the United States.

2. Approximately 64% of global mobile device users makes use of their devices to perform banking transactions. This has increased from 57% back in 2011.

3. Credit cards networks like VISA, MASTERCARDS and AMERICAN EXPRESSED witnessed cash transfers of up to $6.7 trillion. When debit cards and pre-paid cards are included, it increases to 15 trillion.

4. As of 2010, there were 5.4 billion subscriptions on mobile devices. This increased to 6 billion in 2011 and then 6.8 billion by the end of 2012. The 2012 value is an equivalent of the world’s population.

5. In Europe, mobile wallet payment is expected to grow from less than 0.1 billion Euros to 45 billion euros in 2017. This is representing a compound interest of 275%. This will correspond to 1.6% of credit and debit card payment by the end of 2017.

6. By December 2013, mobile payment services will be commercially available in almost half of the 29 EU countries. nfc or contactless payments will be responsible for about 42% of these transactions, this is expected to increase to 49% in 2018 and with time, as more phones are shipped, 38% of them will have nfc features.

7. With respect to sales of handsets with nfc features, there was an increase of 300% in 2012. This translates to 140 million units sold, by 2017, it is expected that 1 billion units will be shipped. More so, Shipments of nfc POS terminal doubled in 2012 to approximately 3.9 million units. These terminals are predicted to reach 44.6 million units by 2017.

8. Approximately 35% of mobile device users around the globe makes use of mobile devices as their wallet for making payments at different point of sales. For smart phone owners only, this figure rises to 46%, for ages 18-24 years old, it rises to 55% and for 25-34 years olds it stands at 49%. When incentives are added, the figure increases to 51%. Form a survey conducted, it was revealed that 48% of respondents made use of PayPal, 51% have heard of other payment options other than PayPal and 44% of US respondents who own smart phones say they are willing to make in person payments with their devices.

9. On the issue of security, 51% would make use of a mobile wallet if security was beefed up. The following factors will boost the confidence of consumers in using mobile wallet.

– 48% want financial institutions to guarantee financial losses.

– 40% prefer being able to remotely shut down their mobile device.

– 33% prefer being able to use facial recognition while 24% would prefer voice recognition features.

– 43% would be comfortable if they are able to enter a pin for every transaction.

– 37% would prefer a pin after a number of transactions.

– 34% would prefer a daily limit on spending.

10. As for the retail sector, it was discovered that it has the greatest growth potential in mobile payments over the next 2 years. 6% of the respondents spent on entertainment, 11% paid bills, 17% spent on food and beverages, 22% are interested in retail and 20% on transportation. 14% on technology and 9% based on other sectors.

11. It was discovered that for smart phone owners, 71% shopped with their mobile devices however, this kind of shopping fails to produce consumer satisfaction.

12. It is believed that 54% of marketers in Velti’s survey of 2012 that in the next year, there will be a significant trend in mobile payments.

13. For more than 60% of United States consumer’s, it is believed that in the near future, credit card payments will be replaced by smart phone payments for most transactions in shops.

14. 88% of those who shopped on their smart phones reported negative experiences with respect to their transactions.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.