The Financial Burden of a Student

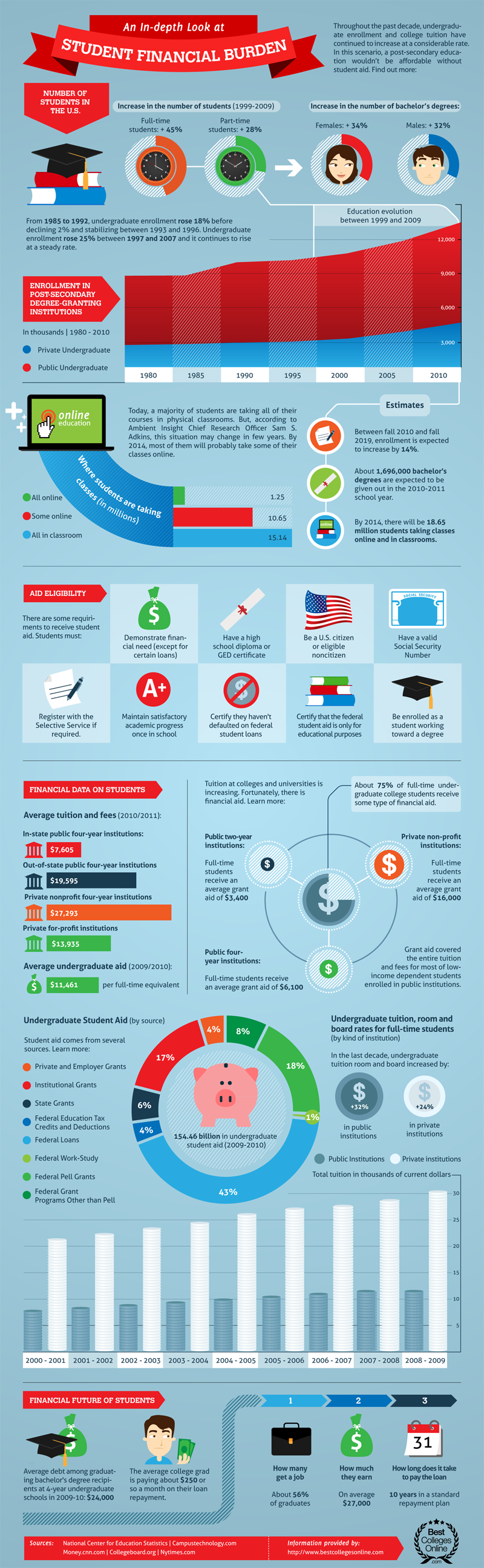

Recently, there has been an increase in undergraduate enrollment for students. This has been accompanied by an increase in the tuition required by colleges. From this development, it is obvious that most students will not be able to afford tertiary education without some sort of counterpart funding.

In the United States alone, the number of students has been on the increase. Between 1985 and 1992, there was an 18% increase in undergraduate enrollment, this declined by 2% before establishing between 1993 and 1996. It then increased by 25% between 1997 and 2007. Between 1999 and 2009, the number of full time students increased by 45% and part time students increased by 28% with males forming over 32% and females forming over 34%. Going by the present trend, it is expected that between the fall of 2010 and 2019, there will be an increase of 14% in enrollment, and expected 1,696,000 students will have a bachelor’s degree between 2010 and 2011, while by 2014, about 20 million students are expected to take classes in classrooms.

Online Education

Although most students today are taking their classes in the classrooms, online education is becoming a viable option as 1.25 million were taking classes online, 10.65 million were taking some classes online and 15.14 million took all classes in the classroom.

Requirement for Student Aids

Here are some requirements that qualifies you for aid as a student.

• Student must demonstrate that there is a need for a loan.

• Must have a GED certificate or a high school diploma.

• Must be a United States citizen or an eligible non-citizen.

• Possession of a valid social security number.

• If it is required, students must be registered with a selective service.

• Student’s academic progress must be satisfactory once in school.

• Students must not have defaulted in laws of federal student loans.

• Students must certify that the federal student’s loan is for educational purpose.

• Students must have enrolled as a student working towards a degree.

Financial Data on Students

For 2010/2011 the average tuition and fees are listed below;

• Out of state public four years institutions – $7,605

• Private non-profit four-year institutions – $19,595

• Private four- year profit institutions – $12,935

• For average undergraduate aid (2009/2010) -$11,461

As university tuition costs rise, there are increasing needs for financial support for students. The overview of this need is outlined below.

For public two year institutions, full time students can receive grants of up to $3,400 while for private non-profit institutions, full time students can receive an average grant of $16,000. Up to 75% of full time college students receive some form of financial aid or the other. For public four years institutions, full time students can receive up to $6,000 worth of aids. For most students that have low income, grant aid covers the entire tuition.

Undergraduate Students Aid By Score

• Private and Employer Grants – 4%

• Institutional grants – 17%

• State Grants – 6%

• Federal Educational tax Credit and Deductions – 4%

• Federal Loans – 43%

• Federal Work Study – 1%

• Federal Pell Grants – 18%

• Federal grant Programs other than Pell – 8%

In the last decade, rooms and board rates for full time students in public institutions increased by 32% while for private institutions, they increased by 24%.

The Financial Future of the Student

Studies have revealed that the average debt for a four year undergraduate program is $24,000 and they are paying $250 monthly on the average in order to fully repay the loan. About 56% of these graduates get jobs, earning $27,000 on the average. At this rate, it takes these graduates about 10 years to repay the loans.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.