How Startup Funding Works

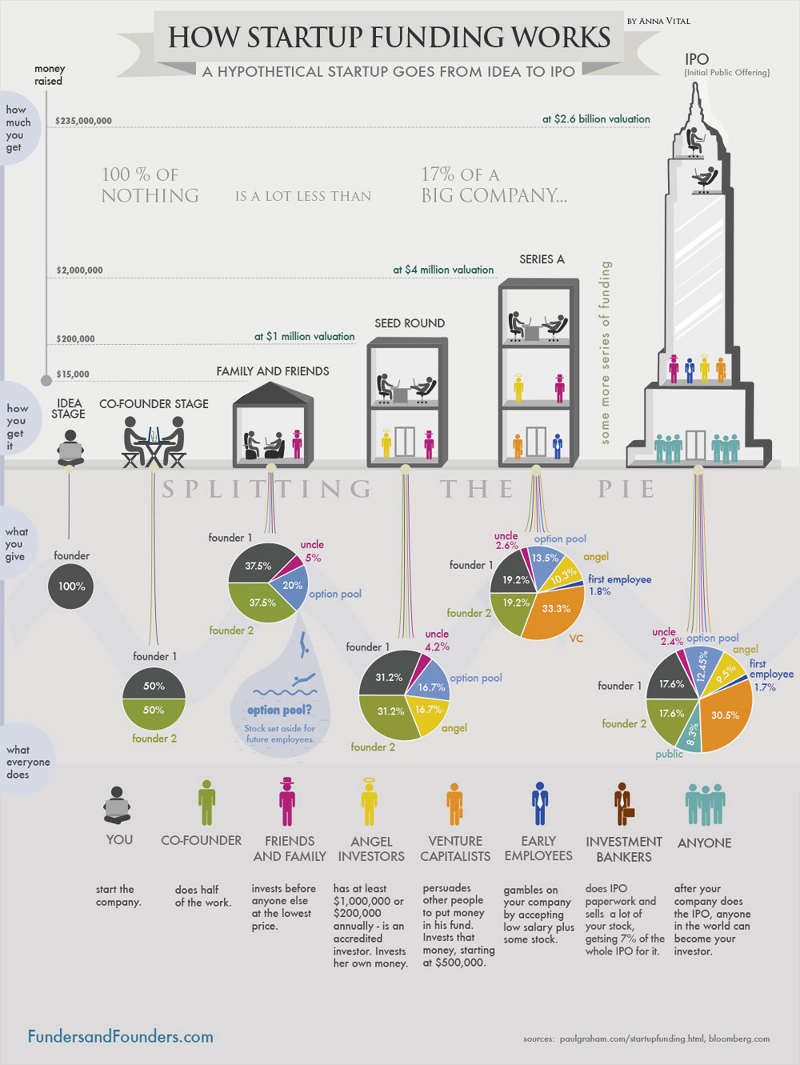

How does an idea go from just that to an IPO? If the idea has potential become a profitable venture, an initial $15,000 investment could eventually be worth $2 billion. At each step of the process, more and more people are brought onboard and additional financial resources are obtained.

Where it Starts

A typical startup begins with one person who has an idea. That person finances 100% of the startup and is the only person involved with the fledgling business. At some point, a partner or co-founder is brought in and the management, financial investment and any profit is split 50/50, or half of the pie. If the startup continues to show promise family and friends are approached to invest in the new company at the lowest price. The total investment jumps from the initial $15,000 to $200,000. The founder and co-founder still control the largest percentage of management and profits. Depending on how many family and/or friends contribute to the expanding pie, there possibly will be stock set aside for future employees in what is known as an option pool.

Growth Opportunity

At this point, the company will possibly move to what is known as the “seed round” when they are potentially worth about $1 million. More investment is needed so angel investors who can invest at least $1 million or $200,000 annually become crucial. They are accredited investors who invest their own money. As the “slice of the pie” multiplies, the two founders’ and initial investors’ slice shrinks slightly, as well as the option pool. The management structure goes from one tier to two tiers with the founder and co-founder at the top tier, investors in the bottom tier.

If all progresses on track as goals are reached, a $2 million investment by founders, family/friends and angel investors raises the company’s worth to $4 million as a new series of funding (Series A), is reached. This Series A funding comes from venture capitalists who persuade other people to put money in their funds which in turn invests that money in the new company. For the first time, employees are hired at typically low salaries, but with stock options. As more investors and now employees are on board, there are more slices of the pie and as a result the two founders, initial family and friends, angel investors, and option pool slices shrink while the venture capitalists slice becomes the largest.

IPO Anyone?

The founders have now reached the point whether to take the company public and hire investment bankers to do the IPO paperwork. After the company becomes an IPO anyone can invest in the company. And that is how the founder goes from 100% of nothing to owning 17% of a $2.6 billion company.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.