The Impact of Fraud On a Business

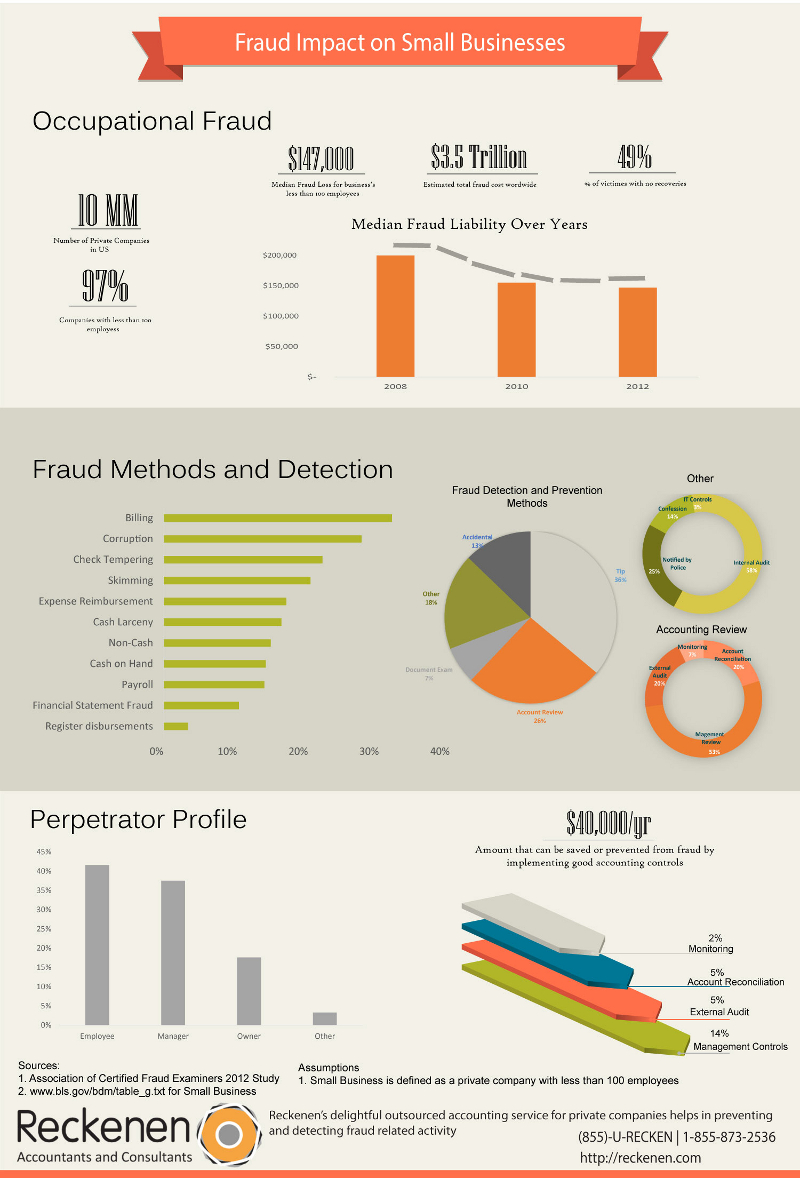

Costing over $3.5 trillion on a global scale, the cost of fraud is an ever increasing concern for today’s small business owner. From being overcharged for supplies to incorrect time cards that inflate hours that have been worked, over 97% of companies with fewer than 100 employees have experienced some sort of fraud within the last year. What’s worse is that almost half of them will never be able to recoup the losses they’ve experienced through fraud. Some small businesses don’t even realize that fraud is going on! If you know what types of fraud to watch for, however, you can empower yourself to reduce your risks of having money stolen from you.

Here’s How You Could Save $40k Every Year

Implementing basic accounting controls can help to save the average small business almost $40,000 per year in fraud losses. One of the biggest controls to put in is management oversight. If you have a supervisor always looking over the books, there is less of a chance that fraud can go undetected. Some small businesses may even choose to add an extra level of review by having another supervisor review the books too. Add in external audits, internal audits, account reconciliation, and basic employee monitoring and you’ve got a great recipe you can cook up that will save you money.

Do IT Controls Work?

One of the more common ways that small businesses attempt to control fraud costs is to put in technology controls to limit their employee’s access to critical information. Though it seems like this would be an effective control, IT controls only account for detecting 3% of the fraud cases that have been documented. On the other side of the spectrum, internal audits were able to find almost 60% of all fraud cases. Though IT controls can help to eliminate a small number of fraud cases, the statistics show that the average small business owner would be better off investing in more internal audit procedures.

Stopping Those Expense Reimbursements

You’ve got an employee who gets to be reimbursed for mileage since they’re using their own vehicle for work. How hard is it to add an extra mile to a trip both ways to add an extra dollar or so to the reimbursement you’re paying out? If you then expand that thought to an employee that makes 50 trips for you per month, you could be losing $600 in fraud. That’s why a thorough management review off all reimbursement paperwork, as well as other accounts payable and receivable documentation, is absolutely necessary to stop fraud. Think about it – if you’ve got just 10 employees who have the same thinking as the example above, you’ll be losing $6,000 per year in fraudulent reimbursements. What could you do what that money?

Most Fraud Starts with the Employee

When it comes to small business fraud, most of it is perpetrated by your employees or your supervisors. That’s because these two groups account for a majority of the direct contact that happens with your finances. With the proper controls and monitoring policies and procedures in place, you’ll be able to reduce your fraud losses and protect your investments immediately.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.