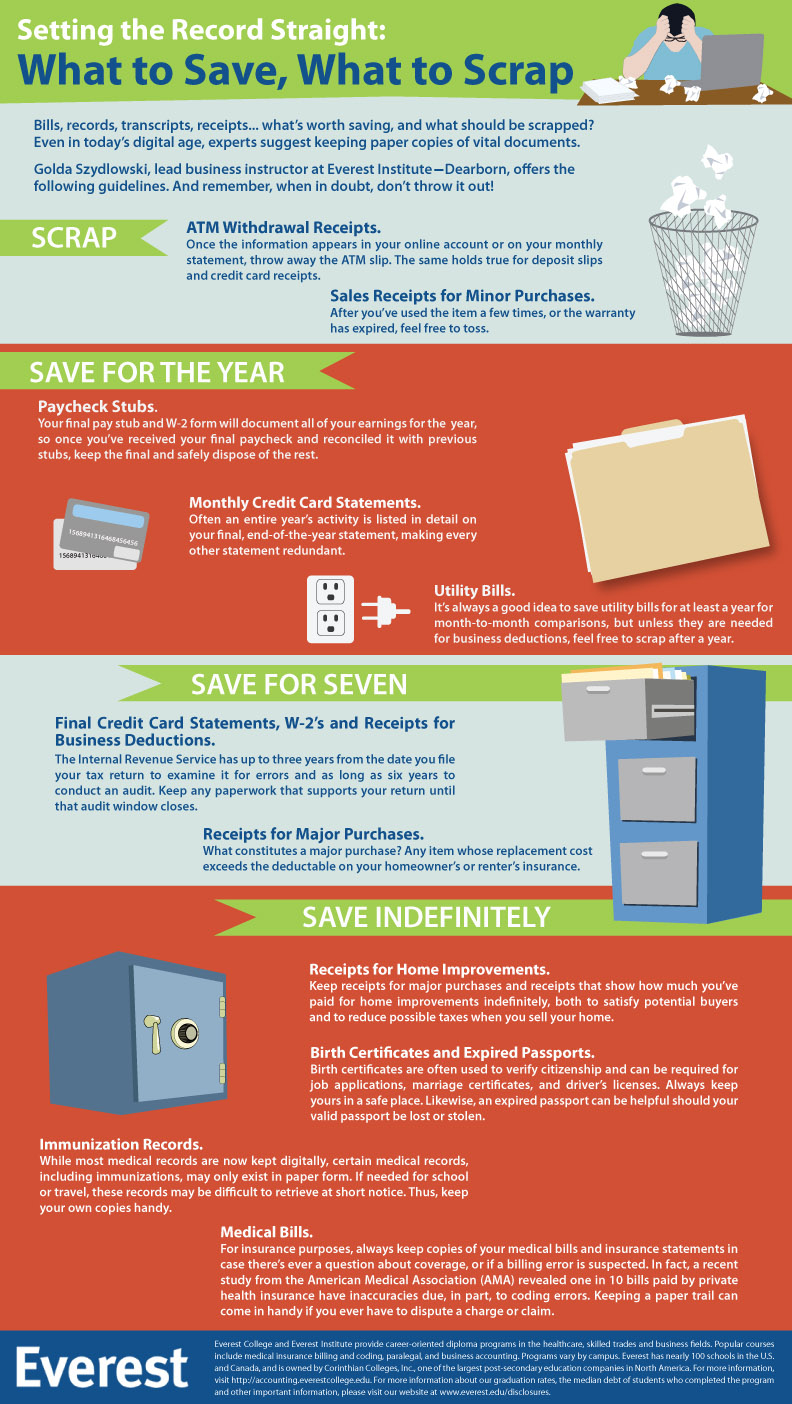

Setting the Record Straight

What to Save and What to Scrap

In everyday living, we have cause to handle documents like records, transcripts, and receipts. This generates the question, in all of these, which items should be kept and which ones should be scrapped? Remember also that if you are in doubt with respect to the importance of the information, do not throw it out the window.

Scrap

The following can be referred to as scrap. ATM withdrawal receipts should be disposed of as soon as details of the transactions appear on the online account or on your monthly statement. The same is true for deposit slips and credit card sales. For sales receipts of minor purchases, once the item has been used a few times, feel free to dispose of the item.

Save for the Year

Pay Check Stubs:

Your earnings for the year are documents by your final pay stub and W-2 form. Once you receive your final pay check, reconcile the details with the previous pay stubs and keep the final records. You can dispose of the rest.

Monthly Credit Card Record:

When the details are sent, the transactions for the entire year are present, this invalidates any other statement or account. They can not be disposed of.

Utility Bills: For the purpose of monthly comparison, utility bills can be kept. But after the year, except when needed for business deductions, they should be disposed of.

Save for Seven

Final Credit Card Statement, W-2’s and Receipt for Business Deductions:

It is necessary to keep all paperwork related to the above transactions for a minimum of 6 years. This is necessary because the internal revenue service has up to three years from the date of filing your ta return to check for error and up to six years to conduct an audit.

Receipt for Major Purchases:

When the replacement cost of an item exceeds or is greater than the deductibles on your home owners or renters insurance, the purchase of the item can be referred to as a major purchase.

Save Indefinitely

Receipts for Home Improvements:

These receipts should be kept as these reveal how much you paid for home improvements indefinitely. To reduce possible tax to be paid when you sell your home and satisfy potential buyers.

Birth Certificate and Expired Passports:

These are often used to verify the citizenship and it can be required for the purpose of job application, marriage certificates and drivers license. They should always be kept in a safe place. An expired passport can be helpful if your valid passport gets lost or if it is stolen.

Immunization Records:

Despite the digital form in which most records of this nature are kept, immunization records are still kept in paper form. This is necessary as if needed for school or travel. It might be difficult to retrieve these data at very short notice. Hence, it is necessary to keep physical copies handy.

Medical Bills:

These documents should always be kept because questions arising from insurance might require that these records be presented. Recently, a study from the American Medical Association revealed that for every 10 bills paid, one has an error, basically as a result of coding inaccuracy. Keeping a paper copy would prove useful especially when there is an unresolved dispute.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.