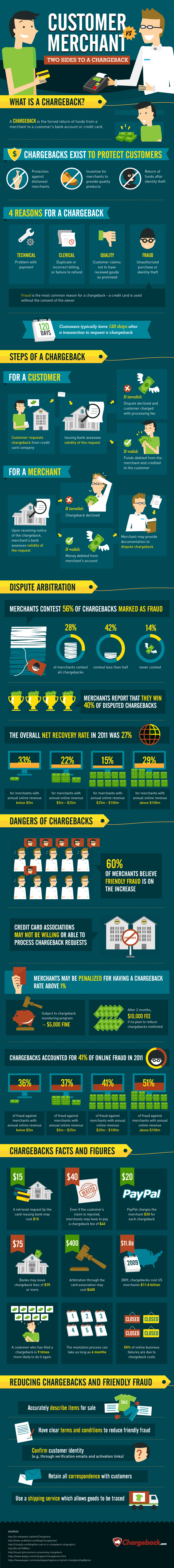

There Are Two Sides To Every Charge Back The Merchant Vs. The Customer

A chargeback is a forced return of funds from a merchant to a customer’s bank account or credit card. They are designed to protect the consumer from fraud, poor quality merchandise, shipping errors and to return funds after identity theft. Fraud is the most common reason for a chargeback; someone has used a credit card without the owner’s permission.

Time Limit

A consumer has 120 days to initiate a chargeback request. Step one is to request a chargeback from the credit card company. Then the issuing back will research the request to establish a chain of events to confirm a valid chargeback situation. If the request was found invalid the customer would be charged for processing the claim. If it is found valid the bank will chargeback the funds to the customer’s account.

A merchant is notified of a chargeback request from the bank, the merchant’s bank will access the validity of the request. The merchant can supply documentation to dispute the claim. If it is determined to be invalid it is declined and if it is determined a valid request the funds are returned to the consumers account.

Dispute

Arbitration and dispute for a merchant is all a part of a business day in today’s mobile economy. Merchants will dispute on average 56% of the chargeback requests they receive. Many retailers find that disputing these requests is an unavoidable part of doing business and 28% will dispute every request for a chargeback. On the other end of the spectrum 14% never dispute a chargeback request.

The big piece of new here is that merchants report that the win an incredible 40% of the cases that they dispute. The bottom line net recovery rate for the year 2011 was 27% of requested chargeback’s. The biggest impact is with merchant that operate online divisions. Online divisions have experienced 33% chargeback rate for those merchants with below 5 million dollars in online sales, with 22% for those between 5 – 25 million and 15% for 25 – 100 and 29% for those merchants with above 100 million in online sales.

Merchant Dangers

The dangers that are arising as a result this expanding mobile economy is that 60% of merchants believe that friendly fraud is on the rise. As the economy fluctuates banks may not want to or may not be able to process chargeback’s in the near future. Merchants may be penalized by merchant account processors for having chargeback’s about 1%. Many banks are considering chargeback monitoring programs that includes penalties ranging from $5000 to $10,000 dollars.

Chargeback Statistics and Fraud

Chargeback’s account for 41% of online fraud in 2011, each retrieval request process costs money either to the consumer or the merchant. An initial fee of $15 dollars is attached to the process on the banks end with a request to investigate. Even if the claim is denied a merchant may have to pay as much as $40 to defend their account. PayPal will charge a business account a fee of $20 to process a chargeback. Banks have been known to charge as much as $75 for a chargeback and in the year 2009 chargeback’s cost US merchants 11.8 billion dollars.

Not all chargeback request are intended to be fraudulent, statistically speaking a customer how has requested a chargeback is 9 times more likely to do it again. The resolution process can take as long as 6 months and as a result of this entire dispute process 50% of online business fail due to chargeback requests.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.