Differences Between Credit Unions and Banks

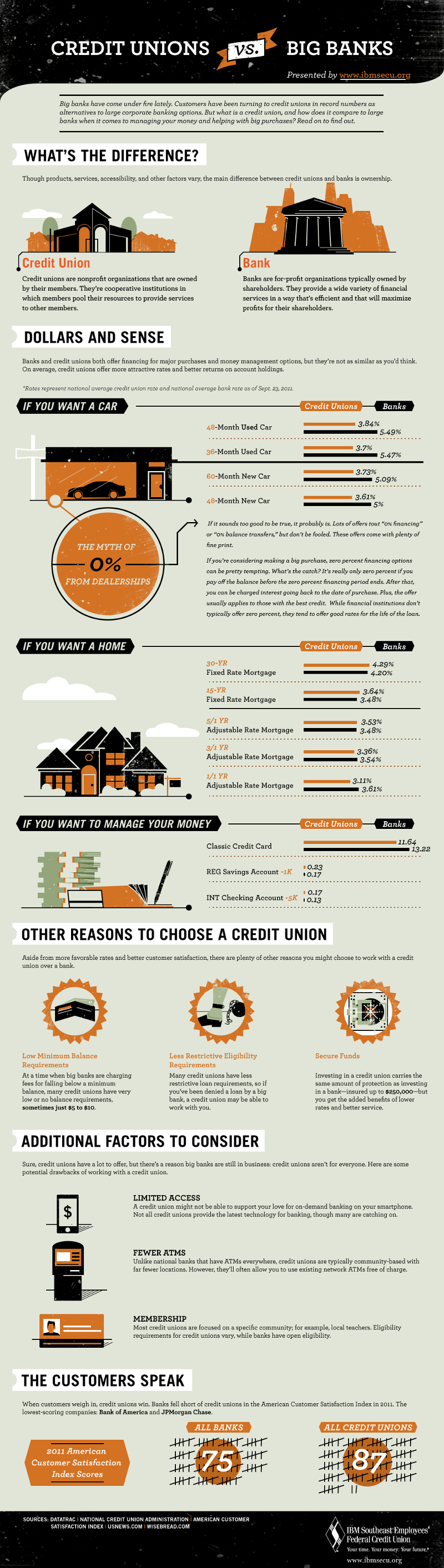

Credit unions and banks are both financing institutions that provide money related services to people who need money. Nevertheless, the two have very sharp differences in the way they operate, hence the reason why most people prefer one against the other. Credit unions for one are owned by members who are duly registered to the union.

They operate from what the members contribute to avail monitorial services to members singly who need the money, but at a certain interest rate, though very minimal. Banks on the other hand are profit oriented and mainly owned by shareholders. Banks provide a bigger array of services to its members than credit institutions; the interest rates to loans are much higher.

Reasons Why Credit Institutions are Preferred

Although banks can be found anywhere and are always ready to lend out services to customers, most people prefer using credit institutions. Here are some of the reasons why credit unions are preferred;

1. Low operating minimum balance

Credit unions allow members to have very low operating balances in their accounts, which mostly goes to as low as $5. Unlike banks which charge fees for members with low operating balances, credit unions do not charge anything, but the lending capability of a user declines. This is to mean that, a credit union member does not have to worry about paying additional fees just because their balance went too low. This is however not the case with banks, and you have to pay these fees when the balances are on overdrafts.

2. Mediocre loan requirements for approval

People with low income earnings per month prefer using credit unions for loans because, there are very few requirements that one should fulfill before he or she can have the loan approved. Although credit unions may have a limit on how much you can borrow within a given period of time, everyone is accommodated according to their level of income.

Banks on the other hand have to run a series of checks on the person’s credit score, assets and other valuable things that can be seized in case one is unable to raise the borrowed money. In addition to this, the time taken to approve loans in credit unions is very minimal as compared to the many days one has to wait for a bank to approve a loan.

3. Security of your funds

All financial institutions, whether a bank or a credit union are regulated by the monetary service, where they should have more than $250,000 as insurance. This is assurance enough that your money is safe whenever you use these institutions. With this in mind, the higher percentage of persons, especially civil servants will join credit unions because the services here are the same as those offered at banks, and the interest rates are minimal.

In addition to this, you may be a loyal customer to a bank for more than 30 years, and no reward program will ever be implemented to appreciate you. Credit unions however appreciate their members by giving tokens at the end of the year for continued support to reliable customers.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here. Brandon is currently the CEO of Aided.