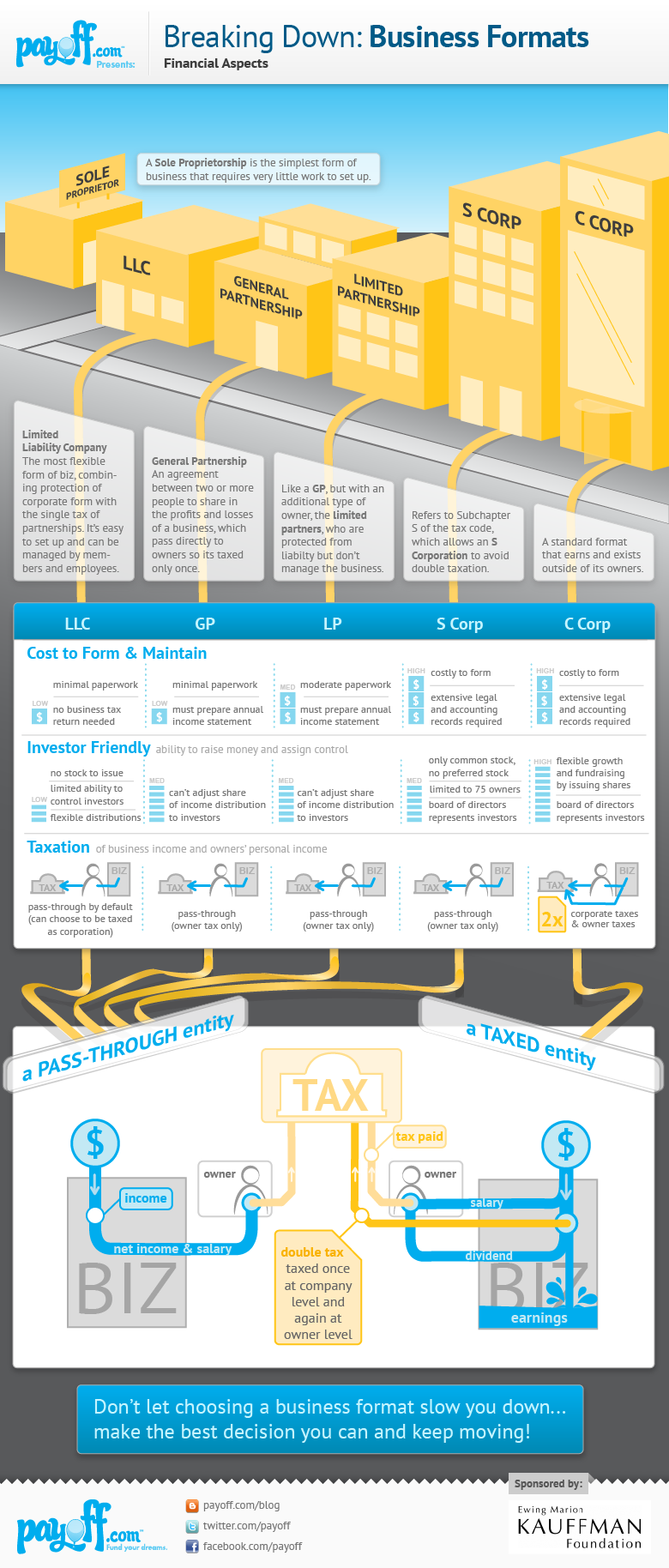

Breaking Down Business Formats

1. Sole Proprietorship

In the field of business this is the simplest to set up as it requires very little work to be done.

2. Limited Liability Company (LLC)

This is a flexible form of business which combines the protection offered by a single tax of partnership. Setting up this form of business is relatively easy and can be managed by employees. Formation of this type of firm requires minimal paper work and there is no return of business tax required.

3. General Partnership

This is formed based on the agreement between two or more parties to share the profit and loss from the business. This is taxed once because it is passed directly to the owner. This requires minimal paper work and there must be the preparation of annual income statement.

4. Limited Partnership

This is similar to general partnership except that there is an addition of a limited partner who is not involved in the management of the business and protected from liability. This requires moderate paper work and the annual income statement must be prepared.

5. S Corp

This allows an S Corporation to avoid double taxation. It is born out of the sub chapter S of the tax code. Establishing an S Corp is capital intensive, requiring extensive legal, accounting and administrative work.

6. C Corp

This is a format that exists and makes profits outside of its owners. It is expensive forming this type of organisation as it requires lots of legal and accounting records.

Raising Money and Assigning Control

• For a limited liability Company, it has a low level of investor friendliness. There is no stock to be issued as limited liability is used to control the investor leading to flexible distribution.

• For general partnership, there is a medium level of investor friendliness as the share of income distribution cannot be varied with respect to the investors.

• For S Corp, there is a medium level of investor friendliness as it features only common stock, no preferred stock with owners limited to 75 and the board of directors representing the investors.

• For C Corp, this is the preferred choice of most investors. There is flexible growth and the raising of funds through the issuing of shares while the board of directors represents the investors.

Taxation of Business Income and Personal Income

• For LLC, it is a “pass through entity”. The owner is taxed by default and has the option to choose to be taxed as a corporation.

• For general partnership, it is a “pass through entity” as only the owners are taxed.

• For limited partnership, it is a “pass through entity” as only the owners are taxed.

• For S Corp, it is a “pass through entity” as only the owners are taxed

• For C Corp, they pay corporate tax and owner taxes.

For the pass through entity, the income comes into the business, net income and salary goes to the business owner before tax while for a taxed entity, as revenue comes in, the business gets earnings, salary and dividends are paid and both are taxed.

It is recommended that business starters should not allow a business format slow them down hence make the best decision that can move you to the next level.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here. Brandon is currently the CEO of Aided.