Avoid Getting the Life Sucked Out of Your Small Business

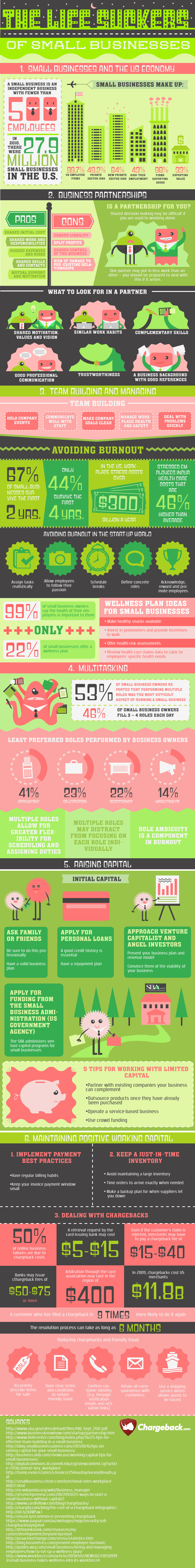

Burnout, chargebacks, and inadequate partnerships are the three killers of the modern small business. Over $300 billion is spent every year to address employee stress, while another $11 billion is spent in chargebacks, fees, and in bad debt losses. Add in a partner that doesn’t work like you do and your business is likely to be just another statistic. It doesn’t have to be that way, however. By taking these steps, you can begin a journey that helps your small business be a contender instead of a pretender.

Only 22% of Small Businesses Offer Wellness Plans

Despite 99% of small business owners saying that the health and well being of their employees is a priority, only 22% of small businesses actually do something about it. Wellness plans are an easy way for employees to invest into their health, find ways to cope during stressful days, and avoid burnout. From having a dedicated napping room for a quick lunch break power nap to having healthy snacks available, employers often don’t invest into a wellness plan because they feel like the costs of doing so will break them. Considering burnout and stress equates to $300 billion of losses per year, a small investment now could pay off in big returns for you later down the road.

Does Your Partner Really Work with You?

The primary stressor in a partnership is that one partner may end up putting in less work than you do. This is often the case when one partner is providing capital to a small business and the other is not. Partnerships can be very beneficial, but only if there is an underlying baseline of trust between the partners. Without that trust, similar values, working styles, and an overall vision that is equal are meaningless. If you’re looking for a partner, look for someone who has a great reputation, strong references, and a history of working in the small business you have.

The Ever-Present Issue of Chargebacks

Half of all internet-based business failures occur because of chargebacks. A chargeback is where a customer notifies the agency holding their card that a charge to a small business is unauthorized. The entire chargeback system is geared against the small business owner as well – from merchant fees to arbitration costs, one transaction alone that is challenged by a customer could cost a merchant upwards of $500. Even if the small business wins the case, there can still be fees assessed simply because a chargeback occurred. By retaining all communication records with a customer, having clear policies and procedures, and using a mailing service that allows packages to be traced, you’ll be able to reduce these cases of friendly fraud as much as possible.

What Is Sucking the Life Out of Your Small Business?

Many small businesses operate on a very small profit margin… if they’re even making profit at all. Unexpected costs and issues can literally suck the life out of that business before it ever got a chance to really get going. Whether you have chargeback issues which need to be addressed, burnout and stress related concerns, or you simply need to find a good partner to help you out, don’t let your small business just circle the drain. Take steps today to make your business competitive now and in the future!

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.