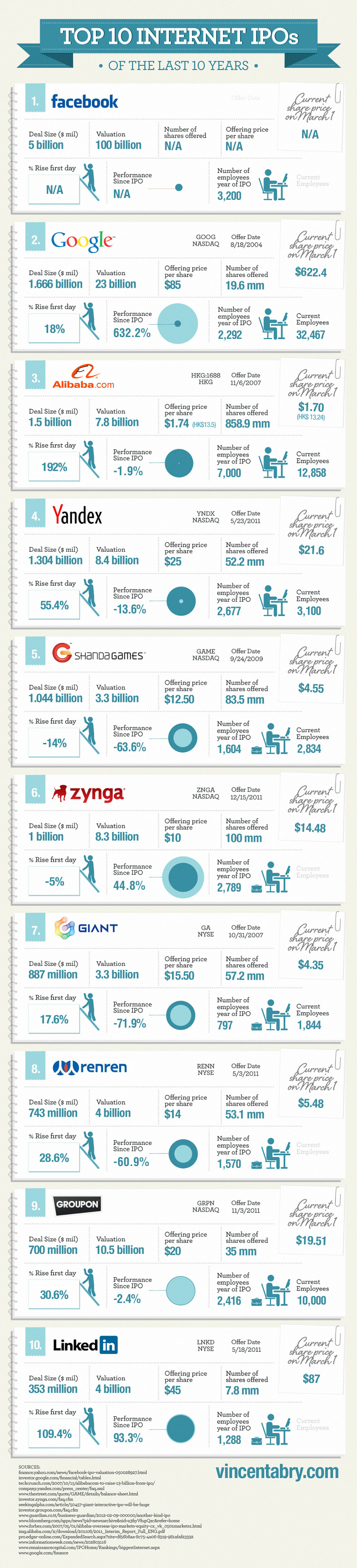

Top Ten Internet IPOs in the Last Decade

Here is a rundown of the top ten internet IPOs in the last decade. See which ones have found much success following their public offering and those that have seen significant losses.

1. Facebook

This number one site brought a deal size of 5 billion with a total valuation of 100 billion. The total number of employees at the time of their public offering was 3,200.

2. Google

The number one search engine made a deal size of 1.66 billion with a current valuation of 23 billion. The total number of shares offered was 19.6mm at $85 each. Within the first day, Google saw an 18% increase with a whopping 632.2% increase in performance since their IPO. Starting their IPO with 2,292 employees, Google currently stands at a workforce of 32,467 strong. For those that made the decision to invest in Google now see a current worth of $622.40 a share.

3. Alibaba

This deal size brought Alibaba 1.5 billion dollars with a total valuation of 7.8 billion. Within their first day they saw a 192% rise, but an overall 1.9% decrease in performance since their IPO. Offering 858.9mm shares, their price per share at the time was $1.74 with their current shares sitting at a worth of $1.70 to date. Their growth in employees has increased from 7,000 to 12,858 since their IPO.

4. Yandex

Launching their IPO in 2011, Yandex saw a total deal size of 1.304 billion with a valuation of 8.4 billion. With 52.2mm shares brought to the table priced at $25 a piece, Yandex has seen a 13.6% decrease in performance with a current worth of $21.6 a share. This is a far cry from the 55.4% rise seen on their first day nor prevented them from growing their employees from 2.677 strong to 3,100.

5. Shanda Games

Shanda Games brought a deal size of 1.044 billion during their IPO with a valuation of 3.3 billion. Offering 83.5mm shares at $12.50 a piece, they have seen a 63.6% decrease in performance causing their original shareholders to currently have a worth of $4.55 a share. Although this company made the list of the fifth top IPO, they immediately suffered a 14% decrease their first day, but has managed to increase their workforce from 1,604 to 2,834.

6. Zynga

Known for the popular games they bring to Facebook users, Zynga collected one billion dollars from their IPO at a valuation of 8.3 billion. Offering 100mm shares at $10 a piece, they have seen a 44.8% increase in performance since their initial offering. This is a drastic turnaround following the slight initial fall of 5% the first day. Their current workforce sits at 2,789 with little change in growth since then.

7. Giant

With Giant, they brought 887 million at the time of their IPO with a valuation of 3.3 billion. Having collected $15.50 out of the 57.2mm shares offered, they gained momentum on their first day with a 17.6% increase. Since the start, they have suffered horrendous losses with a 71.9% loss in performance with a current share price of $4.35. Their downslope has yet to discourage their company growth from 797 employees to 1,844.

8. Renren

Number eight on the list is Renren gaining a deal size of 743 million at a valuation of 4 billion. With a $14 share price and a total of 53.1mm shares offered, they have seen drastic falls in performance at a rate of 60.9% causing their current share worth to be a muzzling $5.48. This is a far cry from their initial 28.6% rise on the first day. Company growth has not really happened with this company as they sit at a stagnant workforce of 1,570 strong.

9. Groupon

Offering their IPO in 2011, they saw a deal size of 700 million and a total valuation of 10.5 billion. With 35mm shares at a price of $20, they saw an initial rise of 30.6% the first day. Their performance has gone on the slight downhill since then, falling 2.4% with a current share price of $19.51. This has not stopped Groupon from growing their employees from the initial 2,416 to 10,000.

10. LinkedIn

Known as the top network to connect with other professionals like yourself, LinkedIn saw a deal size of 353 million at the time of their IPO and a 4 billion valuation. With a price of $45 a share with a total of 7.8mm being offered, they have seen an enormous increase in performance since their IPO at a 93.3% rate. Maintaining momentum is something LinkedIn is used to seeing since their first day when they saw a 109.4% rise. Their current share price has doubled since their initial public offering with a worth of $87 a share and a workforce 1,288 strong.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.