Statistics related to the Usage of Credit Cards in United States

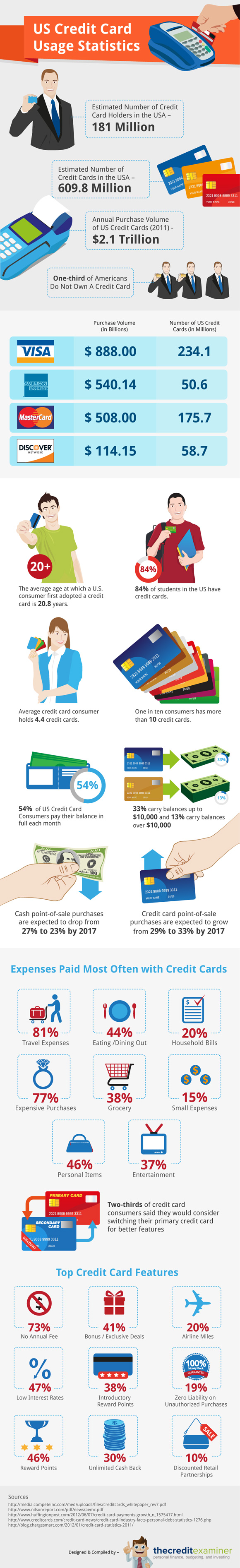

The use of credit cards in United States serves as another form of cash advance to some American citizens who are experiencing financial problems. Its rate of usage continually increases as time goes by. Based on researches conducted about the usage statistics of credit cards in United States, only one-third of the American citizens living in United States are not using or possessing credit cards coming from the lending companies and banks in their states. As the number of the credit card users in United States continue to increase, the number of credit cards available in different parts of US also increases.

Who Has Credit Cards?

Almost one hundred eighty-one people from the American citizen living in United States of America are already possessing and using credits cards at the present time. This data was just a proof that many people in America are already suffering from financial problems caused by limited income and unemployment. The high number of credit card users in this place was used by the group of banks and lending companies as reason to produce more credits cards for their future clients. As of now, the estimated number of available credit cards in United States of America at the present time is already 609.8 million which is five times higher to the number of its users.

Average Purchasing Statistics

The yearly purchase volume of credit cards in United States reached its highest rate in the period of 2011 up to the present year. After three years of continual releasing of credit cards in this place, banks and credit companies have collected almost $2.1 trillion from all of their clients. The statistics was based on the records of four famous credits cards in America which are the VISA, American Express, MasterCard and Discover Network.

The annual purchase volume for US credit cards which is $2.1 trillion was actually the sum of all the purchase volumes of these four different examples of credit cards in United States of America. Almost $888.0 billion was the purchase volume of VISA for 2011 to 2013. $540.14 billion was purchase volume of American Express. $508.00 billion was the purchase volume recorded from Master Card. And $114.15 billion was the purchase volume of Discover Network. The total of these set of information is equivalent to $2.1 trillion which means that the users of credit cards in United States are many and will still continue to increase when poverty and unemployment are not controlled.

Managing Credit Cards

With the use of credit cards, American citizens living in United States of America can already pay all their bills in online shops and groceries where their primary needs are available. The latest statistics about the usage of credit cards in United States have recorded that almost 81 percent of the people in United States use credit cards in paying their travel expenses. While 44 percent of credit card users consume their cash advances in eating. Almost 77 percent of credit card users in US use their balances in cash advances in purchasing expensive items. However, the use of credit cards in this place is not limited to those options, some American citizens uses their credit cards in paying their expenses for house bills, groceries, personal items and entertainment.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.