How To Use Crowdfunding For Your Next Business Venture

The origin and evolution of crowdfunding can be traced back to Ireland in the 1700s, when Jonathan swift realized that the poor people of Dublin who had no experience with credit and little in the way of assets could still be considered good credit risks.

Mohammad Yunus

Nobel laureate, economist, and banker Mohammad Yunus from Bangladesh is considered the founder of modern microlending. Microlending went on-line in 2006 with Kiva.org, based in San Francisco, California. Starting with just seven loans totaling $3,500 Kiva has distributed nearly 480 million dollars in loans as of October, 2013 and enjoys a better the 99% repayment rate.

Prosper.com

Prosper.com launched the first person to person lending platform in 2006. Borrowers can apply for loans ranging from $2,000 to $35,000. They submit their story and their credit risk and investors can browse requests to find one they would like to invest in. To date Prosper has invested $600 million.

Kickstarter

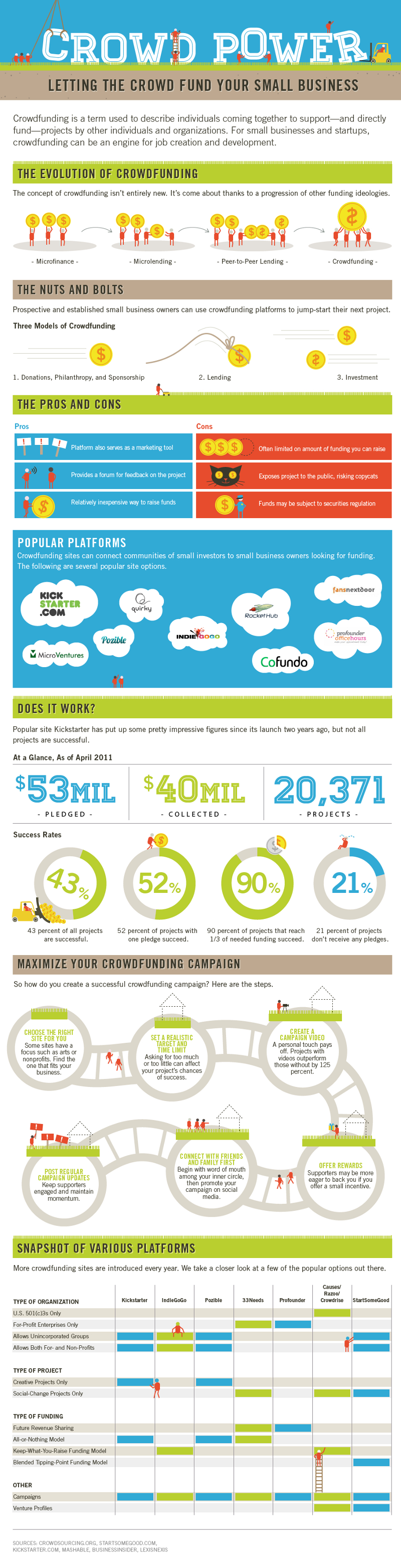

In 2009 Kickstarter.com was launched as a new way to fund creative ventures in art, design, and publishing. The success of Kickstarter has led to a wide understanding and growing popularity of crowdfunding. As of October, 2013 Kickstarter had provided more than $812 million in funding toward 49,000 creative projects.

Locate Crowdfunding Niche Markets

Many other crowdfunding sites have joined Kickstarter to fill various niche markets. Sites like Fundable.com and Crowdfunder.com are aimed at funding small businesses and entrepreneurs. Their programs use various models but are generally grouped as sponsorship, lending, or investment.

Fundable requires companies or individual entrepreneurs to create a profile that outlines their business plans and funding goals. For small projects, typically under $50,000, fundraising campaigns typically offer investors rewards like pre-release copies of music or books, or copies of the product they are developing. Companies using the site for larger ventures, usually between $50,000 and $10 million may offer shares of company stock to accredited investors and may include debt funding as well.

Using crowdfunding for your small business or venture opens up a whole new avenue to build and develop your brand as well as raising funds. Because the process is so public the entire buildup to the launch or completion of your project creates the kind of marketing buzz that can make your project a success. Great ideas can also attract input and even direct participation from experts in a given field or market. Feedback from investors or donors can also help you fine tune your product, your pitch, and even build your team.

There are many examples of well designed business ventures far exceeding their original target. Experienced crowdfunding entrepreneurs have learned that when you create your plan you need the basic plan, the big plan, and the rule the world plan. When it comes to ambitious ideas you don’t want your crowd to find you wanting.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.