People always want fewer taxes. This at least is true in the United States. But is the same sentiment shared in other countries? Are there places where people are happy with how much they are taxed? When considering this question, two important considerations come to mind, individual tax rates and corporate tax rates.

Lets Make A Guess, Those With Fewer Taxes Are Happier and Healthier Economies

It is often thought in the United States that if taxes on individuals and corporations were reduced, then people would be happier and live more efficient and productive lives. As a result, decreasing the taxes is seen as a priority that far outstrips re-vamping the tax law or even social services. To see if this guess is right or not, lets look at countries and compare their tax rates.

The United States and Other Developed Nations

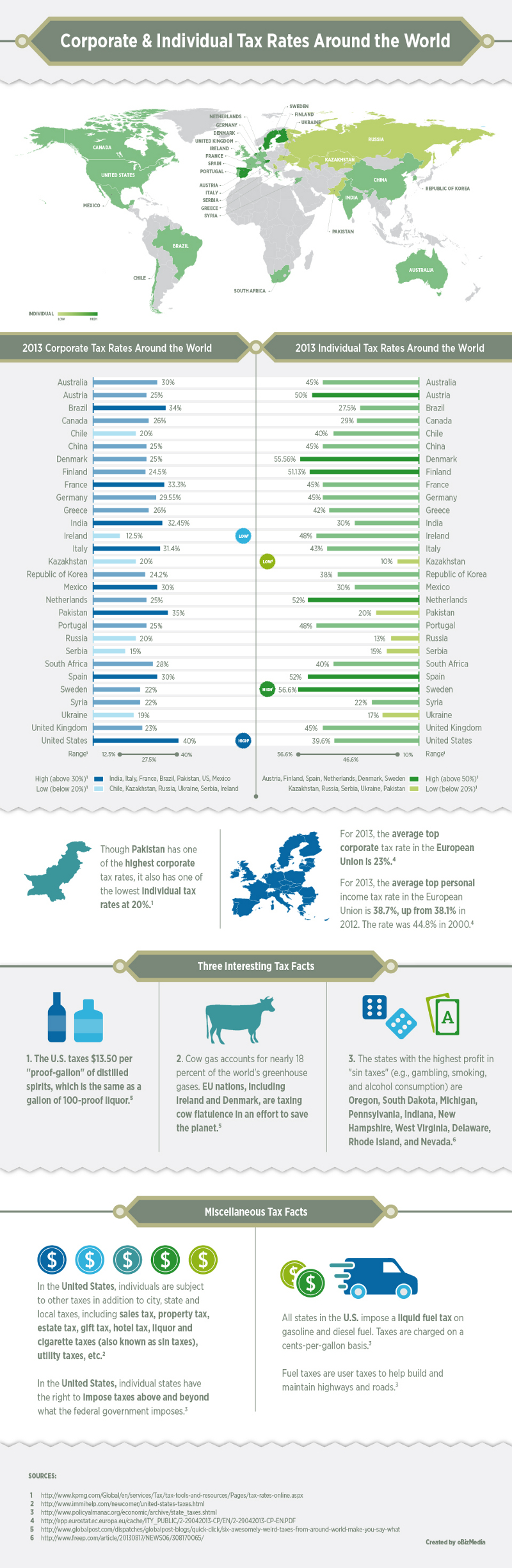

The vast majority of developed nations have higher then average tax rates. The United States has a corporate tax rate of 40%, and an average individual tax rate of 39.6%. How does this compare to the average? Well, if you are considering the entire world, US Corporations pay 12.5% more taxes then other countries, and a little more then other developed nations. Individual tax rates on the other hand are widely different. Whereas the world average is 46.6% and the majority of developed countries are paying in the low 40’s, the United States is 39.6%.

How The United States Compares to Developing Countries

Compared to developing countries, both our corporate and individual tax are on the average higher. This makes sense; give the kinds of services we provide. It should also not be understated how little corruption and bribing is required within the United States and most of Europe. Whereas we take this for a given, things like daily bribes dramatically decreases the efficiency of an economy and takes much more out of people’s pocket then a few percentage points worth of tax.

A Final Look at These Numbers

The last thing to consider is how efficient our tax code is. One reason why taxes are so high in the United States at least is because of the incredible number of exemptions that exist for companies and people in the tax code. While this makes sense for people, it makes less sense for companies and results in some of the biggest companies paying well below 40%.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.