Accountants and managers are responsible for recording day-to-day transactions and use both single and multiple entries to record and prepare financial statements. Journal entries are used to create sub-ledgers, general ledgers, quarterly or annual reports, and other reports and statements.

A compound journal entry in accounting is any entry which has more than one credit or debit, or more than one of both credits and debits.

If there are multiple accounts affected by the transaction, it is more effective to report the transaction as a compound journal entry rather than a series of single journal entries.

Compound journal entries essentially are combined single journal entries that are used to keep the entire transaction under one main entry, simplify record keeping, and provide a sufficient level of detail regarding the transaction, the services or products purchased, and the accounts used for the purchase or sale.

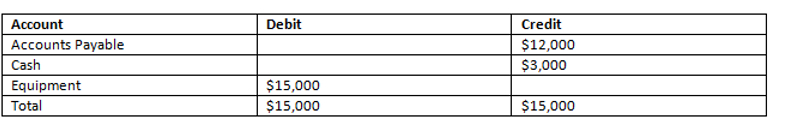

Compound Journal Entry Example 1:

In this example, a plumbing company purchases a van with a combination of a $3,000 down payment, $12,000 in financing.

The $3,000 down payment would be recorded as a $3,000 credit to the cash account, $12,000 credit to accounts payable, and a $13,000 debit to the equipment account.

Here is how the compound entry would look:

The cash account is credited with the $3,000 that was used to purchase the vehicle (in order to record a decrease in cash you credit the cash account), while the remaining $12,000 is credited to the accounts payable. To record the increase in expense for the equipment account (the purchase of the van) you debit it. As a result the totals are even and the compound entry covers every transaction that occurred.

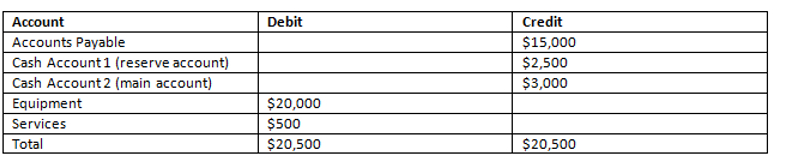

Compound Journal Entry Example 2:

In this example, XYZ Electrical has purchased wiring installation equipment for $20,000 and there is a down payment of $2,000 and $3,000 used from two different cash accounts: the company’s reserve cash account and main cash account. A $15,000 loan was also taken out for the purchase from a bank, and there was a service fee of $500 for the loan from the bank that was paid upfront with the cash reserve account.

In this example accounts payable is credited $15,000 for the loan, and the service payment of $500 was added to the down payment of $2,000 to combine for a $2,500 cash payment. The main account had a $3,000 withdrawal. These withdrawals are both documented as a $2,500 and a $3,000 credit to cash.

On the debit side this compound journal entry shows what was purchased – $500 worth of services from the bank and $20,000 worth of equipment, so a $500 debit is entered on the services account and a $20,000 debit is entered on the equipment account.

This compound journal entry is useful because it provides more detailed information on what asset was purchased, the accounts used to purchase the asset, the amount that was financed, and services charges that were due upfront. A simple entry that does not differentiate the accounts that were used, or show a service charge would not be as useful and would also not abide by GAAP principles.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.