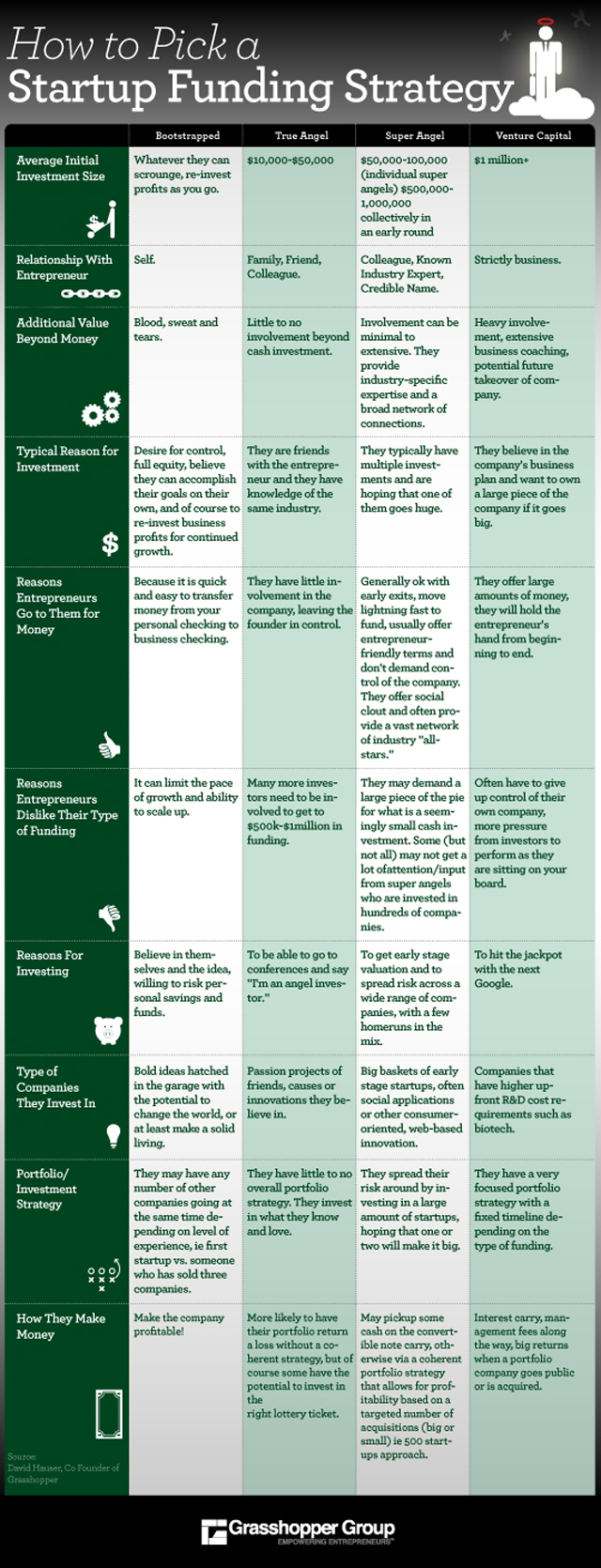

How to pick the Right Startup Funding Strategy

Starting a new business venture will require funding to some degree. Choosing the correct funding strategy will improve the chances of success. Getting the right amount and type of funding will allow you to gain a foothold in the market and give you room to grow and expand the business well into the future.

Read on to learn about the main funding options that you should consider.

Bootstrapping

A bootstrapped venture means going it alone, without any real outside funding. You will have to scrounge up as much as you can, and simply re-invest the profits as you move the business forward.

It will be your own money being invested, which also means you will have 100 % control in the decision making. Not having to give away any equity or control is one of the main reasons that startups go with this option. Another advantage is that it is very quick to transfer money from your personal account to your business account, so there is no down time waiting for the funding to be transferred.

However there are some big limitations with this strategy. The rate of growth and ability to scale up the business can be restricted. But those who have a strong belief in their idea will be willing to take the risk and invest in themselves.

True Angel

Initially, angel investors put $10,000 to $50,000 into a startup they are funding. True angels often have a pre-existing relationship with the entrepreneur such as family members, friends or colleagues.

They usually have little other involvement in running the business other than their cash investment. Reasons an angel would invest in a startup include having some knowledge of the particular industry or simply being friends with the founder. A typical true angel has no overall portfolio strategy, but simply invests in what they are passionate about.

For larger scale ventures which requires more funding, many more investors would be needed. This can overcomplicate the situation for an entrepreneur and is often the reason to not go with this kind of funding.

Super Angel

Early round funding from an individual super angel is usually in the range of $50,000 to $100,000. For a group of super angel investors this could be as much as $500,000 to a $1,000,000. Super angels will be well established and known within their industry and be viewed as experts in the field.

Additional involvement can be minimal or extensive depending on the arrangements made. Super angel can bring a lot of value beyond the initial cash, as they have plenty of industry knowledge and expertise to share. The typical super angel has multiple investments and has the hopes that one of them will become a massive hit.

There are some reasons that may dissuade entrappers from this option. A super angel will usually demand a larger chunk of the company, for comparatively little cash. Also super angels who have invested in hundreds of startups won’t have much time to dedicate to an individual company.

Venture Capital

When you need a very large amount of cash to get the business off the ground, you can turn to venture capitalists. This type of funding is usually for over $1 million. The relationship between a venture capitalist and an entrepreneur is business only.

Venture capital will mean heavy involvement and coaching from the investors. This can be a blessing and a curse. The entrepreneur will receive more help to make their business a success, but will also be restricted in the control of the company and the decisions they can make. There will be increased pressure from investors to meet performance.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.