How You Can Spot a Fake Check Right Now

Writing bad checks is something that is becoming more uncommon as people migrate toward electronic forms of payment, but some retailers still routinely accept checks as payment. Rather than accept an invalid check and let that person get away with stealing from your employer or your business, use these tips today to spot a fake check immediately so you can stop the purchase before it is completed and that revenue walks out the door on you.

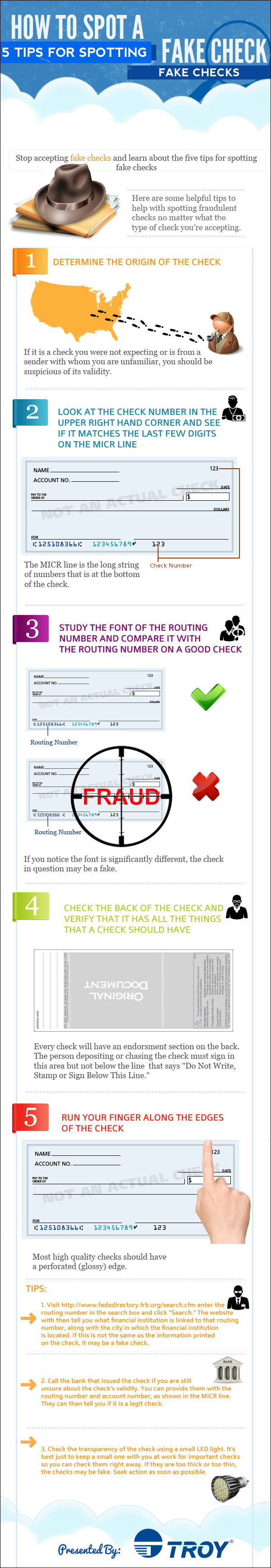

Where is the check from?

Many retailers today only accept checks from what they would consider local customers. That means from the specific town or region where the store is located. If your store doesn’t have this policy, then if you get a check written by someone with a Washington address, but they have a Colorado driver’s license, you could be dealing with a fake check.

Do the check numbers match?

It’s pretty easy to print out fake checks today on even the cheapest of computers and printers. One of the things that is often overlooked by these quick check printouts is that the check number is actually printed on the check twice instead of just once. Look to see if the check number in the upper right hand corner is the same as the number that is next to the account number of the check holder. If they don’t match, you’ve likely got a fake. If there isn’t a second check number, you probably have a fake as well.

Do all the fonts on the check match?

A vast majority of checks are printed with just one font on them. This means the font that is used for the name and address of the account holder will be the same as the banking information, the routing information, and any other printed information on the check. In addition, many banks will specifically print their logo on the check if they originated the order. If the fonts don’t match and the bank’s logo isn’t on the check, then chances are you’ve got a fake check on your hands.

Does the back of the check have everything it needs?

From the endorsement section to the security protocols, every check has similar features printed on the back of it. If it is missing anything or just doesn’t look right, don’t accept it as a form of payment.

Are the edges of the check smooth?

Everyone can struggle to get a check out of a checkbook now and then. Temporary checks are notorious for being perforated. Yet even temporary checks have smooth, crisp edges where they weren’t attached to the initial printer. Fake checks, on the other hand, often feel like a heavy piece of parchment paper that’s been in the oven for awhile. If you feel a roughness around the edges of the check, there’s a good chance that it’s a fake too.

Use these tips today to check on the checks that are coming into your establishment. That way every customer is given the opportunity to pay their fair share and you have reduced the risks of theft dramatically.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.