Cost of ownership. It’s the biggest factor that is facing the equine industry today. When looking at the trends this industry is experiencing, the stress of costs are one of the biggest influences on breed transfers and membership trends right now.

According to the US Departments of Agriculture, Commerce, and Energy, there has been an over 200% increase in stress factors related to the price of corn fed to their animals.

Just a decade ago, there were virtually no stress factors related to equine ownership. Since then, every cost associated within the equine industry has seen stress factors related to cost rise above 50% for at least a 2 year period in every major category. This is what is leading to fewer active equine owners in the United States.

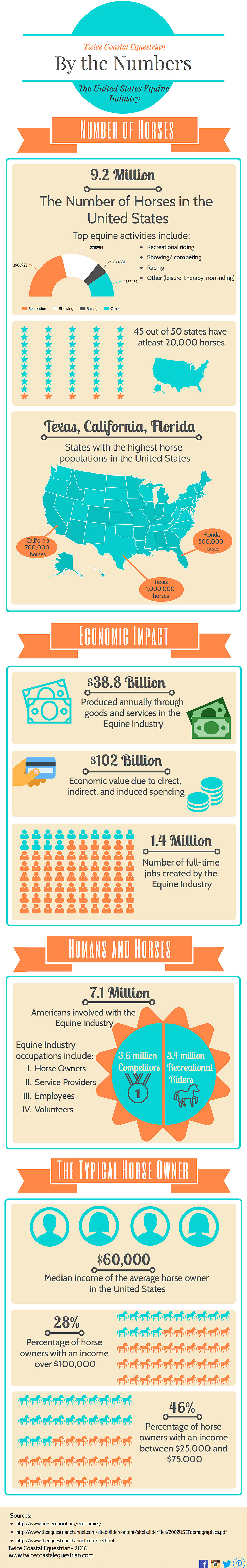

Where Horse Ownership is Popular in the United States

- Texas has the largest horse population in the United States. It’s the only state with more than 1 million horses.

- California has the second largest horse population at 700,000.

- Florida comes in third, with 500,000 horses registered.

- Oklahoma, Kentucky, and Ohio all have more than 300,000 horses respectively registered within their borders.

- Missouri, North Carolina, Colorado, and Pennsylvania round out the top 10 of states with largest horse populations, with each one having more than 250,000 horses.

- It is estimated that there are currently 1.8 million horse owners in the United States.

- Women above the age of 45, married, and employed full-time are the most likely to own at least one horse.

- Horse owners generally have an HHI above $50,000.

- 85% say that they are recreational riders of their horses. Only 30% participate in competitive events.

- 7% of horse owners report that that they are professional trainers.

1 in 4 horse owners believe that the equine industry is improving. That’s the same number which believes that the equine industry is getting worse. Horse ownership still has pockets of popularity, but with pending legislation, an increased number of training techniques deemed to be unacceptable, and a greater public awareness of horse welfare, the costs of owning a horse are getting higher. This is placing a great strain on the industry right now.

How Cost Stress Factors Affect Ownership

- In 2010, cost factors of unemployment rose to their highest ever level at just under 150%. Only corn costs had higher stress factors.

- After peaking in 2008, gasoline cost factors are once again rising to a nearly 100% rate.

- Hay costs are below 50% for the first time since 2006, but have risen in the past year.

- The only cost factor that has seen a lower overall stress factor for the equine industry is related to alfalfa.

- This has resulted in a decline of breed transfers in every common category. From 2000-2011, quarter horse transfers have gone done from over 200,000 per year to fewer than 150,000 per year.

- Breed membership trends are also at their lowest levels in a decade for every common equine breed in the United States.

With so many cost factors involved, the equine industry is struggling to maintain its current ownership. Under that kind of pressure, it is difficult for the industry to begin recruiting new owners, even if people want to get involved with a specific horse breed. Until the economy can truly recover, many who may have money to spend are avoiding this industry because it is seen as more of a luxury than a need. This means for the next 5-10 years, the declines seen in the last decade could be a continuing trend.

Here is How Steep the Declines Have Been

- For quarter horses, the decrease in breed transfers from 2012-2013 was 11.8%. The percentage decrease from 2006-2013 was 55.1%.

- For paints, they are the only breed to have seen a year over year increase, with a gain in transfers of 4.6% from 2012-2013. From 2006-2013, however, they experienced a percentage decrease of 65.9%.

- Thoroughbreds saw a 2.1% decrease in breed transfers from 2012-2013. From 2006-2013, the percentage decrease was 44%.

- Arabians saw breed transfer rates decline 10.2% from 2012-2013 and 53.3% from 2006-2013.

- Appaloosas had a percentage decrease of breed transfers in 2012-2013 of 11.9%. In the 2006-2013 period, the percentage decrease was 60.7%.

- Pintos also saw a percentage decrease in 2012-2013 of 4.8%. From 2006-2013, this decrease was 60%.

- For the 2014 equine membership figures, every breed lost members. The quarter horse breed saw the biggest drop in total membership with 7,185 fewer members.

- The steepest percentage declines were seen with the Tennessee Walking breed [22.75%] and the miniature breed [16.88%].

- Paints were the most stable breed in terms of membership, losing just 1,082 members for a percentage decrease of 2.1%.

Having a decrease of a few percentage points is something that every industry experiences from time to time. The equine industry, however, is seeing double digit percentage decreases on an annual basis in some breeds. This has led to a steep drop in overall membership, less overall activity within the industry, and has forced many to either retire, leave the industry prematurely, or consider consolidation. These are currently the strongest equine industry trends and there isn’t anything to indicate that this is changing any time soon. Paints are the only breed that is seeing stability.

How Stallion Breeding Reports Predicted This

- In 1990, the American Quarter Horse Association reported more than 6,000 race stallion breeding reports. Those reports decreased every year through 2013, which saw fewer than 1,000 race stallion breeding reports.

- Show stallions showed stability from 1990-2002, with between 17,000-18,000 breeding reports registered annually. In 2003, those figures dropped below 17,000 for the first time. By 2013, just 4,000 reports were registered.

- In 2013, other activity stallions showed the same level of breeding reports as they did in 1990. Between these two years, there was a large increase in activity from 2002-2007, when over 25,000 reports were filed. Since the recession years of 2008-2009, steep decreases have been seen in these areas.

- In 2014, there was a rise in quarter horse registrations for the first time since 2006. Total registrations, however, are still below levels recorded in 1975.

- Even with steady membership and breed transfer rates, the number of Paint registrations is less than half of the 60,000 per year seen in 2000-2002.

- Outside of Quarter Horses [12.19%], only Arabians [6.3%], Anglo/Half Arabians [3.57%], and Paso Fino [27.4%] registrations were up in 2014 compared to 2013 figures.

- The average price for a broodmare in 2013 rose above $80,000 for the first time in history.

- The average price for yearlings also reached a record average price of $60,000 in 2013.

There have been some encouraging signs within the equine industry, especially within the Quarter Horse ranks. Yet the breeding situation has shown that there has been a long-term decline in the industry for quite some time. This doesn’t necessarily mean that there are fewer events being held or lower purses being offered. It just means that there are fewer members and fewer horses getting involved in the large events on an overall basis. It may also mean that some owners may be not registering their horses as they did in the past.

Encouraging Trends in the Equine Industry

- The United States Equestrian Federation [USEF] has seen a 2-3% rise in membership and a 20% increase in the number of show entries.

- Arabians as a breed have seen a 15% increase in small show entries. There has also been a rise in embryo transfers and exports for the breed.

- The Therapeutic Riding Association has experienced a recent growth of 7%, with about 6,000 horses in total as part of their membership.

- The National Cutting Horse Association [NCHA] has reported a rise in the number of events held and the amount of purses offered.

- The Professional Rodeo Cowboys Association has reported a 6.4% rise in the number of entries received.

- The American Quarter Horse Association [AQHA] also reports a 15% increase in the number of show entries, although the number of horses registered is actually down.

- There are 2.72 million showing horses in the United States right now. Another 840,000 are registered as racing horses.

- 1 in 3 horses registered in the United States is an American Quarter Horse. Thoroughbreds account for another 1.29 million registrations.

These trends are encouraging for the equine industry because it shows that people are willing to stay involved. In some ways, this data is also discouraging because it indicates that horses are being worked harder than in the past. With entries up, but the number of horses down, it means owners/members are asking their horses to work more entries in attempt to gain the higher purses. With over 9 million horses in the US and the average price of a broodmare more than double what it was in 2003, the future could be bright for the equine industry if the trends mentioned here can stabilize. That will only happen if the economy is able to stabilize.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.