Sugary drinks were very popular in the past. Today, however, there is a trend of falling sales within the soft drink industry that has been caused by a fundamental shift in consumer thinking. Focusing on carbonated sugary beverages cannot sustain the industry any more.

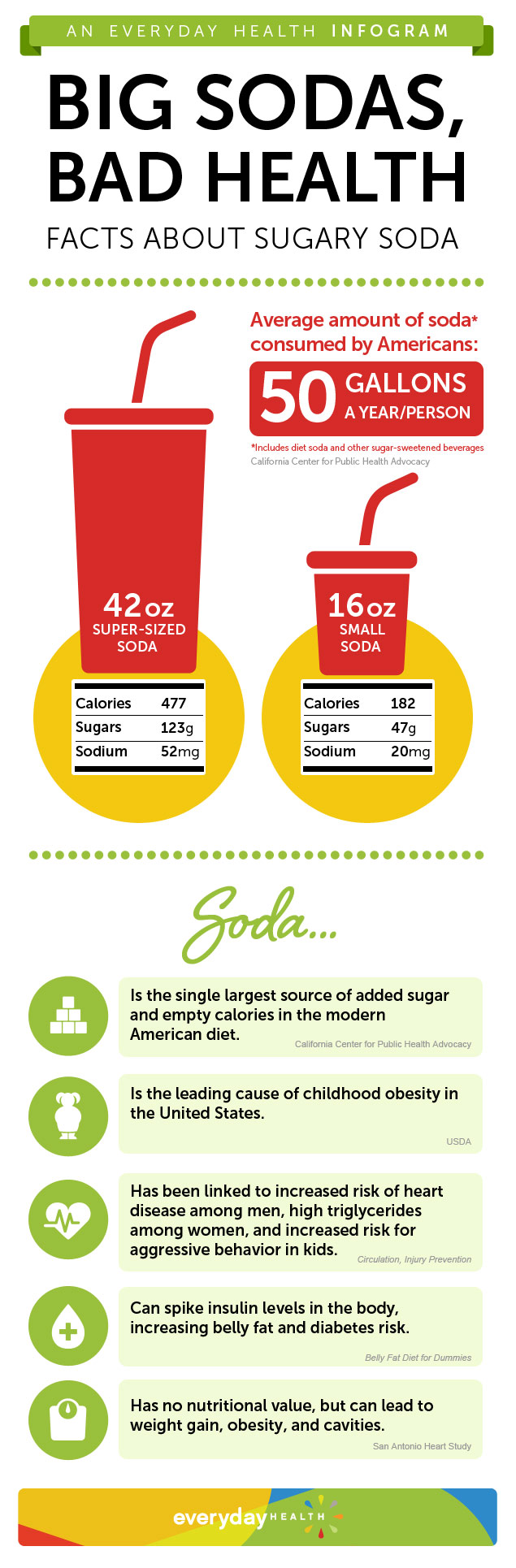

According to the CDC, sugar drinks like soft drinks have been linked to poor diet quality, weight gain, obesity, and, in adults, type 2 diabetes.

This means the soft drink industry must begin evolving their product lines beyond flavor choices. Consumers are paying attention to ingredients with greater detail. They are concerned about the levels of sugar and HFCS they consume since 2 out of 3 Americans are overweight or obese. The old brands are out. The new brands being developed are being perceived as healthier, single-serve options that are completely different from the carbonated soft drinks of the past.

Who is Still Consuming Soft Drinks?

- According to the CDC, men consume an average of 178 kcal from sugar drinks on any given day, while women consume 103 kcal.

- Consumption of sugar drinks increases until ages 12–19 years and then decreases with age.

- 70% of boys in the 2-19 age demographic consume at least one beverage like a soft drink on any given day. 40% of adult women, on the other hand, consume one beverage per day.

- 8.5% of kcal consumption in African-American/Black children comes from soft drinks, compared to 7.4% in Hispanic/Latino children and 5.3% in Caucasian/White children.

- There is a direct correlation in the lower amount of household income a family has and a higher amount of soft drink consumption.

- 92% of soft drinks that are consumed at home are purchased at a local store. 35% of soft drinks consumed away from home are purchased at a restaurant or fast food location.

Soft drinks are often described as being the “new tobacco” for consumers, but it may be more accurate to call it “liquid fast food.” People consume soft drinks because they are convenient. It’s something they can consume when they’re out and about. It’s also something they can consume when they are busy at home because it takes almost no effort to open a can or bottle when thirsty. A majority of people, however, are actively avoiding soft drink consumption today even if they are not always successful at it. This is the challenge the soft drink industry faces today. The trend is going away from carbonated sugary drinks and the industry must be able to adapt.

How Innovation is Changing the Soft Drink Industry

- PepsiCo is launching new products that focus on the health perspectives of their consumers, including an organic Gatorade, flavored waters in their Aquafina brand, and healthy vending machine choices.

- Coca-Cola is offering consumers more sparkling juice options and sparkling Smartwater.

- All soft drink manufacturers are using research and development to find ways to lower calorie counts, reduce sugar intake, and limit the amount of sodium that is available per serving.

- Calorie counts on the labels of soft drinks will continue to be emphasized, with additional labeling available for per serving counts when a bottle or can may contain multiple servings.

- Core brands within the soft drink industry will continue to reformulate their recipes to add new products and brands that have lower calories.

- Resistant to this reformulation process is Coca-Cola, however, who still receives negative feedback from their New Coke experiment nearly 30 years ago.

- Smaller cans and bottles will also become more readily available to consumers. When soft drinks were first introduced to the US market, they came in 6.5 ounce cans. Now 12 ounce cans are a standard serving, as are 20 ounce bottles, which makes it difficult for consumers to focus on moderation.

- As reported by Business Insider, in 2014, the American Beverage Association pledged to cut calories by 20% by 2025. By serving smaller cans and bottles, can do just that, without necessarily cutting sugar from the recipe.

You’re finding a lot of nostalgia is making its way into the soft drink industry. PepsiCo is taking advantage of this with brands like 1893 and Caleb’s Kola to work on reversing the downward industry trends. Coca-Cola has seen successes with label personalization, encouraging consumers to purchase bottles or cans with their names on them. In 2016, this is expanding to song lyrics and other meaningful phrases, with the option for consumers to purchase a customized label direct from the company if they wish. Innovation must happen for the soft drink industry to survive, but it must be an authentic innovation for it to work.

Finding New Paths to Profitability in the Soft Drink Industry

- Reformulations are taking place across the industry based on consumer preferences. For example: Diet Pepsi is being reformulated so that it will no longer contain aspartame.

- PepsiCo is also launching a line of Tropicana brand products that will be labeled as non-GMO to take advantage of the preference for products that aren’t genetically modified.

- Coca-Cola has received a lot of negative feedback from consumers regarding the paths they’re trying to find as they were discovered to be funding nutritionists and research groups which supported their own internal opinions.

- Others are looking outside of the soft drink industry to the craft beverage industry to sustain themselves. Constellation, for example, recently purchased Ballast Point Brewing and Spirits for $1 billion.

- Soda taxes have become a popular method of generating new revenues for local jurisdictions. According to the New York Times, soft drink industry lobbyists have made several campaign contributions to local politicians and staged rallies to defeat tax proposals in Philadelphia, San Francisco, and New York State.

- Sales of bottled water have risen dramatically and are on pace to overtake soft drinks as the largest beverage category by 2018.

- From US government data, from 2004 to 2012, American children consumed 79 fewer sugar-sweetened beverage calories a day. This represented a 4% cut in total caloric intake and obesity rates in school-age children have begun to level off.

- Many school districts have chosen to forbid the sale of sugary beverages within their schools and in public vending machines on their properties. Cities like Philadelphia have also provided financial incentives to convenience stores to highlight healthy food and beverage options.

Why are new paths needed for the soft drink industry to survive? Because over the last 20 years, the sales of full-calorie sodas in the United States have dropped by more than 25%. Soda consumption is seeing a sustained decline with a majority of consumers limiting themselves to 1 soft drink or none on any given day. Americans are actively avoiding these products. This is why the industry is looking at new products as aggressively as they are. Yet even with a focus on innovation, the industry is still struggling to cope with the evolving attitudes toward their products by the general public.

Is Customization the Wave of the Future?

- Coca-Cola has nearly doubled the number of individual products it offers, with 700+ available today compared to the 400 available in 2004.

- When people focus on their health and wellness, they tend to transition from regular soda to diet soda and then to an “other” product, such as sparkling juice or water.

- Yet turning away from soda doesn’t always mean that consumers are making a healthy choice. Many fruit drinks are sweetened with as much HCFS as a soft drink contains.

- Single serving water brands offer the same margins as soft drinks do for sales, but consumers have less brand loyalty to bottled water today as they did to soft drink brands in the past.

- Low-margin companies which specialize in water or “other” products that consumers want are able to out-price even major companies like PepsiCo and Coca-Cola.

- Historically beverage preferences have been set during childhood, which is where the sharpest declines in consumption are being seen. Without brand loyalty established for water or juice products, customization is the only outreach method left to manufacturers to establish a relationship with consumers.

- Even with these efforts, 2015 saw the tenth consecutive year of overall declines for the soft drink industry.

Coca-Cola was recently able to post a 1% gain in revenues thanks to their label customization efforts. This has caused many other brands to look at other aspects of customization to attract consumers, from flavor profiles to hybrid products that also contain tea, juice, or even energy drink ingredients. By focusing one brand on a specific niche, the soft drink industry is hopeful that it can find a product for the future. They’ll need one, because full-calorie soft drinks are becoming a product of America’s past.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.