The global oleochemicals market size was valued at $20.2 billion in 2016, according to Grand View Research. The APAC region is the largest consumer and producer of oleochemicals. It accounts for more than half of global production with its increasing demand in local markets being the primary driving force behind the region’s development. Here are the oleochemical industry statistics that demonstrate the health of the industry as a whole.

Important Oleochemical Industry Statistics

#1. The global oleochemicals industry had a market size of $19.07 billion in 2015, led by a higher demand for biodegradable products and a desire to decrease dependencies on petrochemicals. (Grand View Research, Inc.)

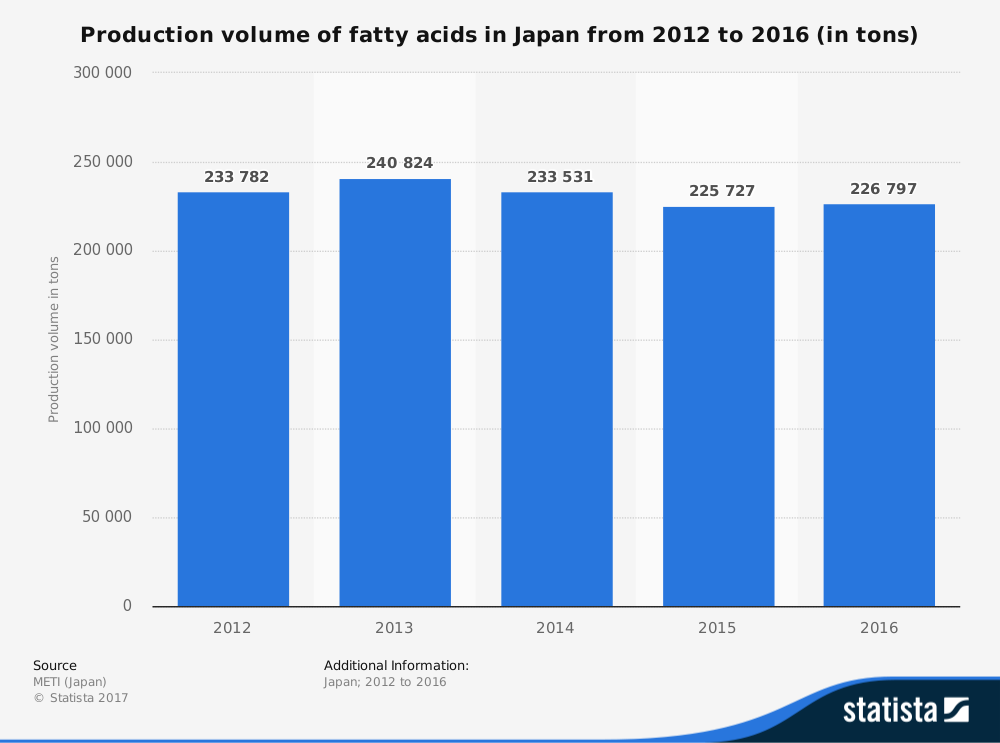

#2. Fatty acid production typically dominates the market revenues produced by the oleochemical industry. In 2014, they accounted for nearly $1.5 billion of market revenues. Fatty alcohol was the next popular product produced and it did not manage to generate $1 billion in market revenues. (Grand View Research, Inc.)

#3. By 2024, the fatty acid production offered by the oleochemical industry is expected to reach about $2 billion in market revenues. (Grand View Research, Inc.)

#4. The APAC fatty acid market for detergents and soaps is expected to grow at a CAGR of 4.9% through 2024. (Grand View Research, Inc.)

#5. Although it is not one of the top market revenue earners, glycerol is expected to see the highest levels of growth in coming years. This is due to its growing importance in several foods, beverages, and personal care products. In Europe, the anticipated CAGR through 2024 is 5.3%. (Grand View Research, Inc.)

#6. Over 25% of fatty alcohol capacities are currently owned by the raw material suppliers for the global oleochemical industry. (Grand View Research, Inc.)

#7. About 60% of the industry’s fatty acid capacities are also owned by raw material suppliers, which has allowed for an increase in the profit margins for the industry and being able to meet growing economies of scale. (Grand View Research, Inc.)

#8. Soybeans dominate the oleochemical industry in terms of harvested areas for the oil seeds that are used. About 44% of the total harvested area is dedicated to soybeans. (Oilworld)

#9. Rapeseed (12.8%) and cottonseed (12.2%) are the other two major harvested areas of oil seeds that are currently harvested. (Oilworld)

#10. Although oil palm receives just 6.3% of the harvested area for oil seed production, it accounts for more than 30% of the total oils that are produced for the oleochemical industry. Soybeans account for about 24% of the total oils that are produced. (Oilworld)

#11. In 2015, nearly 83 million tons of oils were exported by the oleochemical industry. Palm oil is the most exported oleochemical product that is harvested from oil seeds in the world. It accounts for 57.6% of total exports. (Oilworld)

#12. Palm oil is also the most-consumed product that is used by the oleochemical industry. When all possible products are considered, palm oil accounts for 30% of all consumption in the industry. Soybeans account for about 24% of total consumption. (Oilworld)

#13. In the APAC region, there are two major exporters of palm oil to the oleochemical industry. Indonesia accounts for 51% of total exports, while Malaysia accounts for 39% of total exports. (Oilworld)

#14. The APAC region is the largest consumer of oleochemicals in the world today. The Asia-Pacific region accounts for 68% of the total market share. Europe accounts for another 18% of the market. All other regions, including the United States, make up the remaining 14%. (Specialty Chemicals Magazine)

#15. One of the newest areas of the oleochemical industry involves biopolymers. In 2013, the market was considered to be in its infancy, with just 1.3 million tons of product produced. The annual rate of growth for this new area of the industry is expected to average 40% per year. (Specialty Chemicals Magazine)

#16. Palm oil is the primary export for all possible oil palm products. It accounts for 69% of total exports. (Malaysian Palm Oil Board)

#17. The oleochemical industry receives just 12% of all exports for oil palm products in 2016 from Malaysia. (Malaysian Palm Oil Board)

#18. Just 2% of exported oil palm products are exported as a finished product. Palm kernel cakes or oils are exported more often than finished products. (Malaysian Palm Oil Board)

#19. In Europe, the oleochemical industry experiences a turnover of 4 billion euros per year, with an added value of 1.5 billion euros. (APAG)

#20. The oleochemical industry in Europe employs over 10,000 people and may help to support, directly or indirectly, an additional 30,000 jobs. (APAG)

#21. Compared to biodiesel, the European oleochemical industry offers three times more processed biomass per ton. (APAG)

#22. The total market share for the oleochemical industry is expected to reach more than $25 billion globally by the year 2024. Some estimates place the total impact of the industry at $34 billion. (Grand View Research, Inc./Research and Markets)

#23. Agricultural circumstances have driven the oleochemical sector in Europe and the APAC region, accounting for their higher market shares. In 2000, for example, Europe experienced an outbreak of “mad cow disease.” This caused personal care products to shift to using vegetable-based oleic fatty acids, such as coconut oil or palm kernel oil. (PTT Green Energy Pte. Ltd.)

Oleochemical Industry Trends and Analysis

The future of the oleochemical industry appears to be quite secure. Populations in the developed world are shifting away from petrochemicals, even if crude oil prices are competitive, because there is a desire to use products that are degradable. Various industries are looking at how they can expand the use of the items produced by the industry, which is why there are high CAGR estimates through 2024 for most sectors.

At the same time, household consumption of oleochemical industry products is expected to increase as well. Although many household products come from this industry today, soaps and detergents have been the traditional mainstays. Look for more households to look for biodegradable cleaners and additional options in the coming decade.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.