Baby Boomers are retiring every day and that is having quite the impact on society. The only problem is that many of this generation are simply not able to retire like they would prefer. Some are even having to put off retirement because they just can’t afford it at the moment.

Nearly half of all American workers, including Baby Boomers, have less than $10,000 saved for retirement. 29% of Americans have less than $1,000 saved.

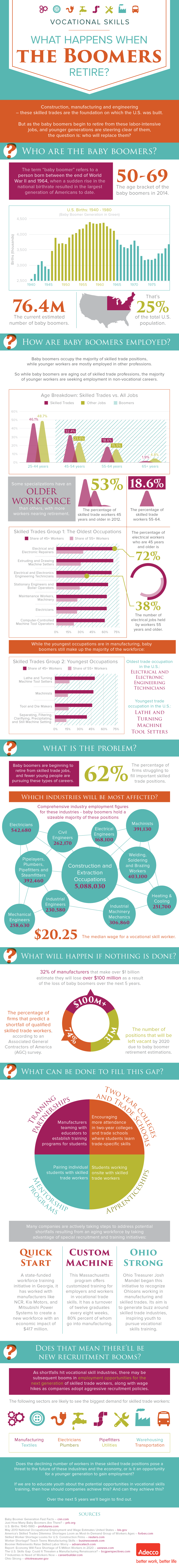

Baby Boomers

This means that Baby Boomers are working into their later ages more than any other generation. It allows for more experience in certain jobs, but it also creates a trickle-down movement where jobs that would normally be free are no longer available. Why? Because Baby Boomers, just like all the other generations, haven’t been able to save for some reason.

What Is Going On With Retirement?

- By 2050, there is expected to be nearly 90 million people who are senior citizens in the United States. Right now there are almost 40 million.

- American workers are $6.6 trillion short of what is needed to retire comfortably.

- 1 out of every 6 Baby Boomers in the United States is living below the federal poverty right now.

- At this very moment, 10,000 Baby Boomers are retiring every day. This is a trend that is expected to last for the next two decades.

- Health care costs are expected to rise by 5% every year, making it even more difficult for a Baby Boomer to retire.

- From 1991-2007, the number of Americans who were 65 or older that filed for bankruptcy rose by 178%.

- Only 1 in 4 Baby Boomers plans to retire by the age of 65.

- 3 out of 4 Baby Boomers expects to be working at least part-time after they officially retire to make ends meet.

There’s no easy answer when it comes to the retirement solution for Baby Boomers. People who have done it right, saved much, and invested smartly are still coming up short for retirement at 65 because of health costs, emergencies, and other money drainers that exist in society today. Is it any wonder that people are just spending money instead of saving it for later? What’s the point of saving money if you’re just going to end up having to work into your 70’s because all of your health care costs are astronomical? That doesn’t excuse not saving, however, and the fact that almost 30% of households don’t really have any retirement account means that this trend of working to an older age is most certainly going to continue.

What Can Be Expected With Retirement?

- Another Baby Boomer turns 60 every 8 seconds in the United States.

- The average annual income for a household with a Baby Boomer: $53,000.

- 70% of the wealth that is controlled in the United States is held by the Baby Boomer generation.

- 45% of US companies have special positions that are designed to be filled by the Baby Boomer population.

- Two thirds of Baby Boomers expect to use their retirement to spend more time with friends, family, and to stay fit.

- The average Baby Boomer is expected to live to the age of 83.

- Right now, a 65 year old man has a 25% chance to live to the age of 92. For a 65 year old woman, the same chance exists to live to the age of 94.

Social Security has become the topic of conversation these days because it isn’t expected to be funded for the next generation. Here’s something that’s shocking to think about: when the program was first established in 1935, the retirement age was set at 65. The average life expectancy at that time was just 61. The program was established the way it was because a majority of people weren’t expected to even need the program. If they did need it, then it would be there. If they didn’t need it, then it would provide help for others who did. Now let’s put those ages into modern context. If the average age of the Baby Boomer is 83, then a comparative Social Security age would be 87. Imagine tell your kids that they can’t retire from their job until they’re almost 90 – how great would that conversation be? The only problem is that is the issue facing Baby Boomers right now.

Where are The Baby Boomers Going To Go?

- 3 out of 4 Baby Boomers want to live somewhere that offers age diversity instead of retiring to a specialized community just for them.

- Nearly 20% of this generation intends to relocate to Arizona when they retire.

- 3 out 5 Baby Boomers plan to move to a new community after they retire, while another 24% plan to move before they officially retire.

- Another 26% of retirees intend to move after enjoying their current home for awhile after they retire.

- The percentage of Baby Boomers who won’t relocate at all after retiring at some point: 1%.

- Only 8% of Baby Boomers have placed an emphasis on personal finances as a priority after they retire.

Retirement ages are getting older because they can be. People are working longer because they want to try something new or provide for themselves to make their retirement funds last longer. In a recent survey, 70% of Baby Boomers said that they felt retirement offered them the chance to do something new, or to open a new chapter in their lives. Only 28% of this generation saw retirement as the chance to take things easy. Even fewer saw retirement as an extended vacation. Then there’s the fact that retirees who are fully engaged socially, in government, and in local economics will generally live longer than those who don’t – it all adds up to what amounts to a retirement emergency for this country.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.