The Australian lamb industry provides one of the best dining experiences that is in-demand around the world today. Lambs in Australia are grass-fed and kept active in pastures by most industry professionals. The result is a mild-flavored lamb that is lean, tender, and free of hormones, growth promotion substances, and artificial additives.

Australian lamb products are reported through the country’s sheepmeat industry. Many of the facts and figures that are reported included live lamb and sheep figures, along with mutton products.

One of the advantages that Australian lamb provides is a combination of maximum yield and minimum waste. Most of the lamb that is produced by the industry has a shelf life of 12 weeks. Each product is traceable to its point of origin as well, creating a superior eating-quality grade which offers a level of consistency that meets global standards of quality.

Important Australian Lamb Industry Statistics

#1. The approximate value of the sheepmeat industry in Australia in 2016-2017 was an estimated $5.23 billion. That is a 3% increase in value from the year before. (Meat and Livestock Australia)

#2. Australia features over 31,000 businesses that are involved in the sheepmeat industry, including lambs. (Meat and Livestock Australia)

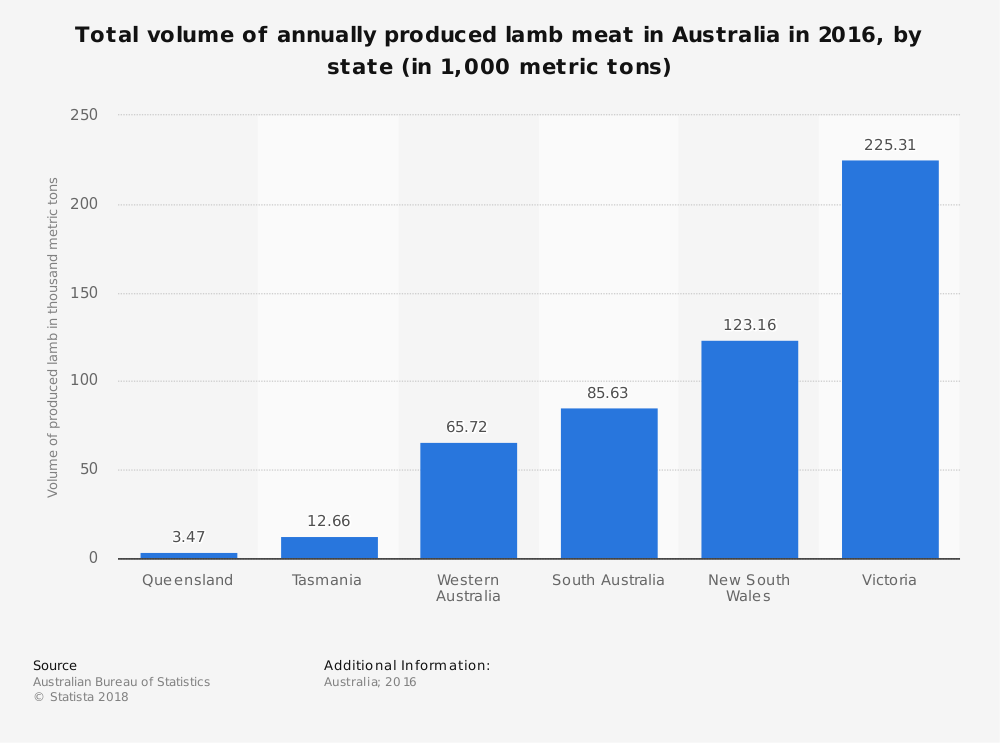

#3. The total headcount for sheep in Australia as of June 2016 was 67.5 million head. NSW is the national leader in headcount, with a total population of 26 million. WA follows with 13.9 million, then Victoria with 13.1 million. (Meat and Livestock Australia)

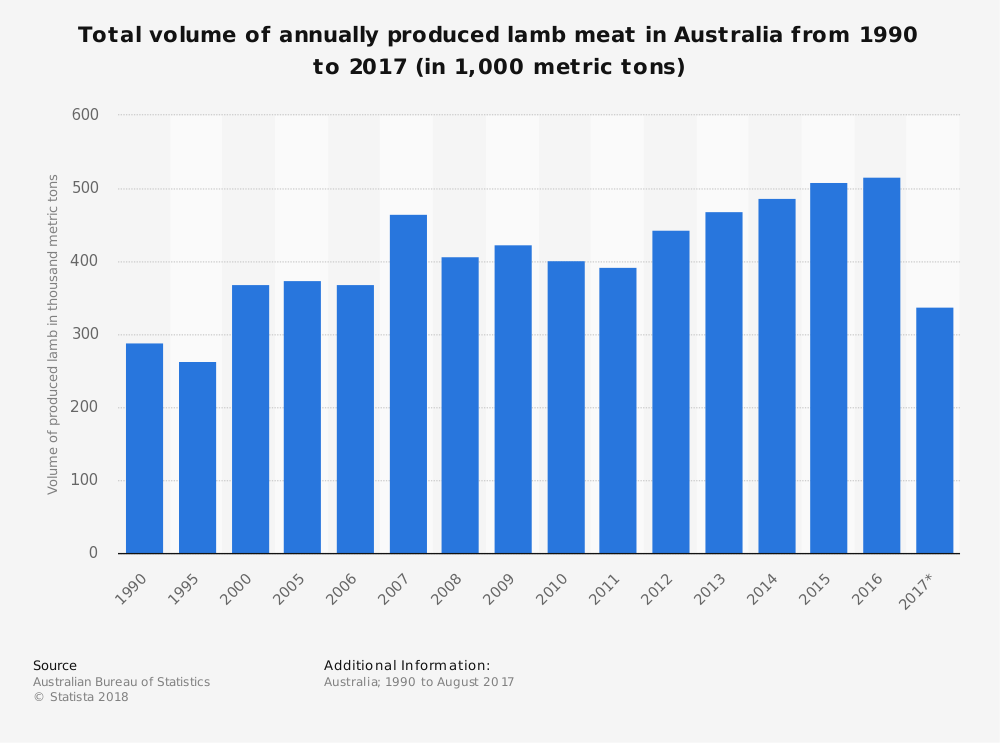

#4. Lamb production in 2016-2017 for the sheepmeat industry was over 506,000 tons cwt. Victoria was responsible for most of the production, accounting for 45.4% of the Australian lamb industry. NSW followed with a 23.6% market share, then SA with a 16.3% market share. (Meat and Livestock Australia)

#5. Australia produces three times more lamb in the sheepmeat industry compared to mutton. In 2016-2017, about 160,000 tons cwt of mutton were produced. (Meat and Livestock Australia)

#6. Lamb and mutton production from the sheepmeat industry in Australia contributes about 6% to the overall farm value of A$62.8 billion that was registered in the 2016-2017 year. (Meat and Livestock Australia)

#7. In Australia, about A$2.3 billion was spent domestically on lamb in 2016-2017. Another A$88 million was spent domestically on mutton products. (Meat and Livestock Australia)

#8. Lamb had the third-highest share of meat-based retail sales in Australia in 2016-2017, accounting for 13% of all fresh meat sales. (Meat and Livestock Australia)

#9. Australia exported 57% of their total lamb production in 2016-2017, along with 92% of the total mutton production. More than 240,000 tons cwt were exported. (Meat and Livestock Australia)

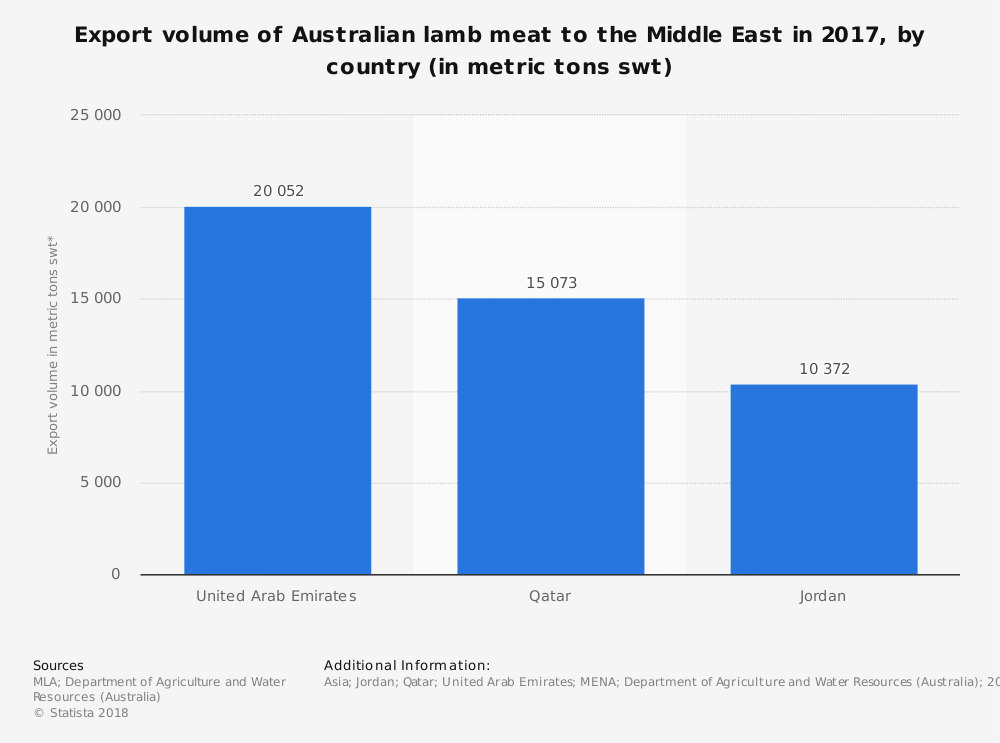

#10. The Middle East received the greatest share of lamb exports from Australian in 2016-2017, accounting for 24.5% of total volume. The United States followed in second, with 22% of the total exports. China finished in third, with 19.3% of the market. (Meat and Livestock Australia)

#11. The total value of the lamb exports in 2016-2017 was A$1.94 billion. Mutton added another A$720 million to the sheepmeat industry for Australia. (DAWR)

#12. Live sheep exports also contributed to revenues for the sheepmeat industry, with A$234 million generated in 2016-2017. (Meat and Livestock Australia)

#13. In total, Australia produces about 8% of the world’s total amount of lamb and mutton, according to 2014 figures. Australia is the largest exporter of sheepmeat in the world and the world’s third-largest live sheep exporter. (FAO)

#14. Only two other nations export more than 100,000 tons cwt of lamb and mutton products annually. New Zealand comes in second, with just under 400,000 tons cwt, while the United Kingdom is third at just over 100,000 tons cwt. (FAO)

#15. About 1.8 million head were exported from Australia’s sheepmeat industry in 2016-2017 as live sheep exports. Kuwait received the greatest share of these exports, accounting for 35.5% of the market. Qatar was second, with a 33.8% share of the exports. (DAWR)

#16. Just 3.6% of live sheep exports from Australia are destined to locations outside of the Middle East. (DAWR)

#17. The sheepmeat industry in Australia is the country’s third-largest agricultural industry by value. The gross value of production in 2012-2013 was about $1.5 billion. Two-thirds of the revenues come from meat production, while the other third comes from wool production. (Agriculture Victoria)

#18. Since the 1990s, sheepmeat production in Victoria has increased by nearly 60%. Victoria now produces over 40% of the total sheepmeat for Australia and is one of the world’s largest suppliers of lamb and mutton globally. In 2013-2014, the total value of production was nearly $900 million. (Agriculture Victoria)

#19. In 2018, the national sheep flock is expected to grow by 2.5% thanks to stock retention and improvements in marking rates. (Meat and Livestock Australia)

#20. Actual slaughter rates in the sheepmeat industry are forecast to decline in 2018 to 22.5 million head of lamb and 7.2 million head of sheep. Despite the slaughter declines, an increase in body weight is expected to keep the overall harvest at a static rate. (Meat and Livestock Australia)

#21. About 241,000 tons swt of lamb exports are expected from the industry in 2018. (Meat and Livestock Australia)

#22. Consumer demand for sheepmeat from Australia is expected to increase, with mutton exports up 11% despite flat domestic consumption rates. (Meat and Livestock Australia)

#23. Increases in wool pricing, if it continues as it did in 2017, may cause a further reduction in available lamb meat in the next 5 years. Producers are retaining more of their lambs to have them available for wool production instead of red meat production. (Meat and Livestock Australia)

Australian Lamb Industry trends and Analysis

The Australian lamb industry does face some challenges. The industry accepts that there will be a 25% failure rate over each lambing season. That means about 1 in 4 lambs will die, usually from exposure, within a few days of being born. That means about 15 million lambs die every year without contributing to the industry.

Technologies introduced to the Australian lamb industry is encouraging mothers to have more multiple births as well. Up to 6 lambs can occur from each birth.

That combination may help the industry, or it may hurt it in future years. The stresses of multiple births may limit breeding stock and maintain current numbers instead of increasing them.

At the same time, however, the industry is the strongest of its type in the world. Even with certain challenges present, the Australian lamb industry is expected to dominate the global market for at least the next decade.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here. Brandon is currently the CEO of Aided.