The retail foods sector in Singapore is one of its most mature market segments. It is diverse, competitive, and highly dynamic, with several highly-developed market segments. The industry is also highly dependent upon imported products to ensure customers have access to the various produce, snack foods, and beverages that are currently in-demand.

With a population of 5.6 million people, Singapore is a country which is best described as being urban and wealthy. Its position, within key trading movements between Asia, Europe, Australia, and the United States, has helped it to develop one of the world’s most open economies. That allows the Singapore supermarket industry to take advantage of what is available on the import market.

There are no excise taxes or imports on food or beverages because of the unique structure of Singapore. There is virtually no domestic agricultural production, which means almost all retails foods are imported.

Interesting Singapore Supermarket Industry Statistics

#1. Singapore imported $11 billion in fish, forestry, and agricultural products in 2016. The United States with the 4th-largest supplier of these goods, with an 8% market share valued at $872 million. (U.S. Department of Agriculture)

#2. The total value of consumer-oriented foods in 2016 to the Singapore supermarket industry was valued at $6.22 billion. For fish and seafood products, Singapore imported $1.07 billion worth of food products. (U.S. Department of Agriculture)

#3. There are three key firms active in the Singapore supermarket industry: NTUC FairPrice Coop, Dairy Farm International Holdings, and Sheng Siong Supermarket. In addition, online grocery retailer Redmart is expected to help online grocery retailing to become 10% of all internet retail sales in Singapore in the next fiscal year. (U.S. Department of Agriculture)

#4. In March 2018, the sale of food and beverage services in Singapore declined by 1.3% from the previous month when rates are seasonally adjusted. From the same period the year before, however, food and beverage services increased by 3.6%. (Department of Statistics – Singapore)

#5. The total sales value of the food and beverage services in Singapore in March 2018 was an estimated $716 million. That is $25 million higher than the sales achieved in the year before. (Department of Statistics – Singapore)

#6. In a year-by-year comparison conducted in March 2018, the Singapore supermarket industry experienced a 0.3% increase at current prices, but a contraction of 1.1% at constant prices. (Department of Statistics – Singapore)

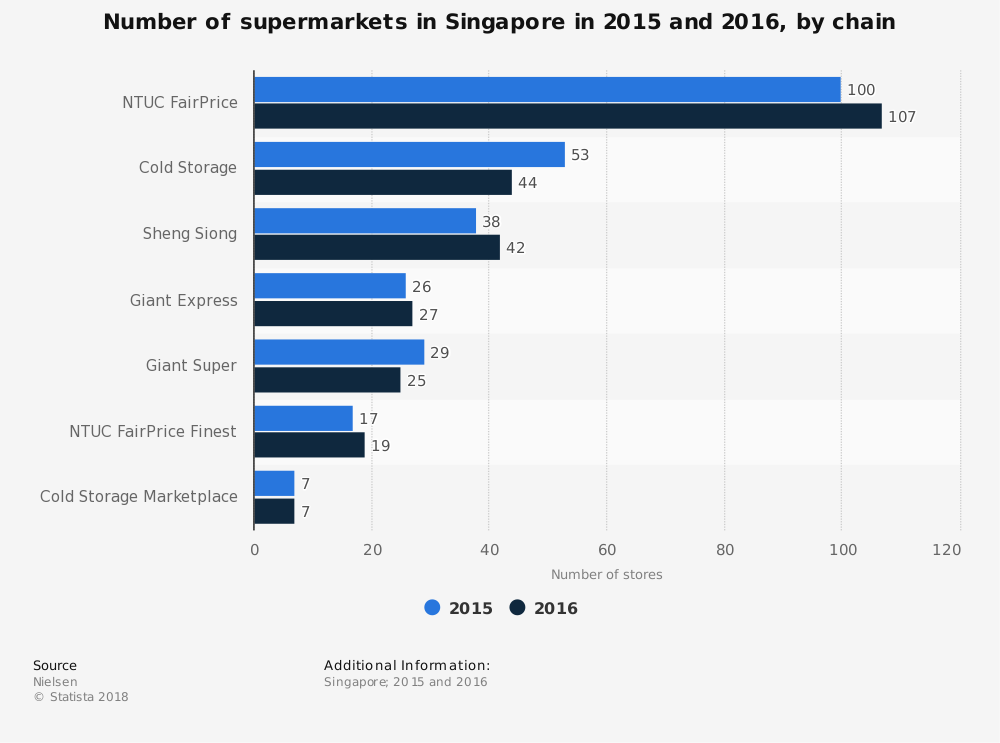

#7. NTUC FairPrice offers the most grocery stores in Singapore for consumers, with a total of 17 locations. Cold Storage comes in second, with 44 locations, while Sheng Siong has 42 locations. NTUC offers 19 “Finest” locations, while Cold Storage offers 7 “marketplaces” as well. (Statista)

#8. New Zealand provides the most dairy products to the Singapore supermarket industry, accounting for 29% of goods sold. Australia comes in second (21%), with Thailand (8%), France (6%), and the United States (4%) all providing shares as well. (U.S. Department of Agriculture)

#9. Malaysia is the largest supplier of breakfast cereals to Singapore, supplying 26% of the market. The United States comes in second (22%), followed by Thailand (10%), and Australia (6%). (U.S. Department of Agriculture)

#10. Beef is primarily supplied by Brazil to the Singapore supermarket industry, with one-third of the market coming from this South American Nation. Australia provides 32% of the beef for Singapore as well. (U.S. Department of Agriculture)

#11. Brazil and Australia are also a top provider of pork to Singapore, together accounting for 50% of the market. (U.S. Department of Agriculture)

#12. 76% of the poultry that is available through the Singapore supermarket industry is imported from Brazil. The United States takes the second-largest share, providing 12% of the products sold. (U.S. Department of Agriculture)

#13. 88% of the eggs sold in Singapore are imported from Malaysia, thanks to its close proximity and low transportation costs. Just three local farms produce eggs for the supermarket industry. (U.S. Department of Agriculture)

#14. In the fresh fruit category, the United States has the largest share, with a 16% market share. Oranges, grapes, apples, and strawberries are the primary fresh fruits that are imported to Singapore. (U.S. Department of Agriculture)

#15. More than one-third of the fresh vegetables available in the Singapore supermarket industry come from Malaysia. Another 28% of the market is provided by Chinese imports. (U.S. Department of Agriculture)

#16. The United States also leads in the dried fruits category, providing 48% of the total products available in Singapore supermarkets. (U.S. Department of Agriculture)

#17. In 2016, over 333,000 metric tons of dairy products were imported for sale through the Singapore supermarket industry. Over the past 5 years, there has been a 6% decline in the number of dairy products sold. (U.S. Department of Agriculture)

#18. Over 443,000 metric tons of fresh fruit were imported by Singapre in 2016, with a 5-year average annual import growth of 5%. (U.S. Department of Agriculture)

#19. Despite over $1.07 billion in imports of fish and seafood, accounting for over 193,000 metric tons, the average growth in this category has contracted by 0.3% over the past 5 years. For the average resident of Singapore, fish and meat account for 40% of the diet. (U.S. Department of Agriculture)

#20. More than 538,000 metric tons of fresh vegetables were imported by Singapore in 2016. There is a solid level of demand for produce grown in the United States. Consumers pay extra to have fresh produce flown in from the U.S. to local supermarkets. (U.S. Department of Agriculture)

#21. Snack foods is a growing category for the Singapore supermarket industry. The 5-year growth average has been 2%, with just 65,000 metric tons of product imported. The total value of the product, however, is almost $382 million. There is a strong demand for high-quality U.S.-based snacks within the industry.

Singapore Supermarket Trends and Analysis

Singapore is one of only a handful of nations where virtually the entire population lives within an urban center. That provides a unique challenge to the supermarket industry in the country, as their success is dependent upon the success of the import market each year.

Because of the industry’s key location within multiple trading pathways, Singapore is given a unique opportunity. The supermarkets are able to stock a vast array of goods, providing unique choices at various price points for consumers to enjoy.

There are some risks associated with such a complete dependence on imports to supply food through the supermarket industry. If key suppliers are unable to meet demands, there is no domestic backup in place to provide food resources. Pricing is also highly variable, as import prices may rise and fall based on the performance of the foreign economies supplying food to the country.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.