An electronic wallet, sometimes called a “digital wallet” or “e-wallet,” is an electronic version of a payment card which is authorized to conduct transactions on your behalf. These wallets are usually on a mobile device, such as a smartphone, though desktops and laptops can hold an electronic as well.

Electronic wallets must be linked to specific debit or credit cards to operate properly. There may be a requirement to link the e-wallet to a bank account as well. Then, through the use of information and software, consumers can use their electronic wallet to pay for items instead of carrying a physical wallet to pay with a card.

There are several advantages and disadvantages of electronic wallets to examine if you’re thinking about embracing this technology.

List of the Advantages of Electronic Wallets

1. It offers more convenience for many consumers.

When you’re carrying an electronic wallet, you get to limit the number of cards you carry when you travel. You no longer have the requirement to carry a lot of cash with you either. All you need to do is tap your device to the payment receptacle, or have your mobile device scanned, to pay for the items you are purchasing. That means you’re no longer carrying a pocketful of items wherever you go.

2. It provides access to other types of cards.

Electronic wallets typically store credit cards and debit cards. They can be used for a wide variety of cards, however, if the provider is compatible with the wallet you are using. That means you can store rewards cards, loyalty cards, and even coupons within your digital wallet, allowing you to enjoy more of a paperless lifestyle.

3. It offers more security.

If you have a wad of cash in your pocket that gets lost, you have zero options available to you to recover your funds. Losing your credit cards means you must contact each lender to cancel each card, then have a new one issues. With an electronic wallet, the information is stored through a third-party provider. It’s locked behind your password or biometrics. Even if you lose your device, you’ll still have access to your e-wallet once you get a new device.

4. It can be used at most retailers and online stores.

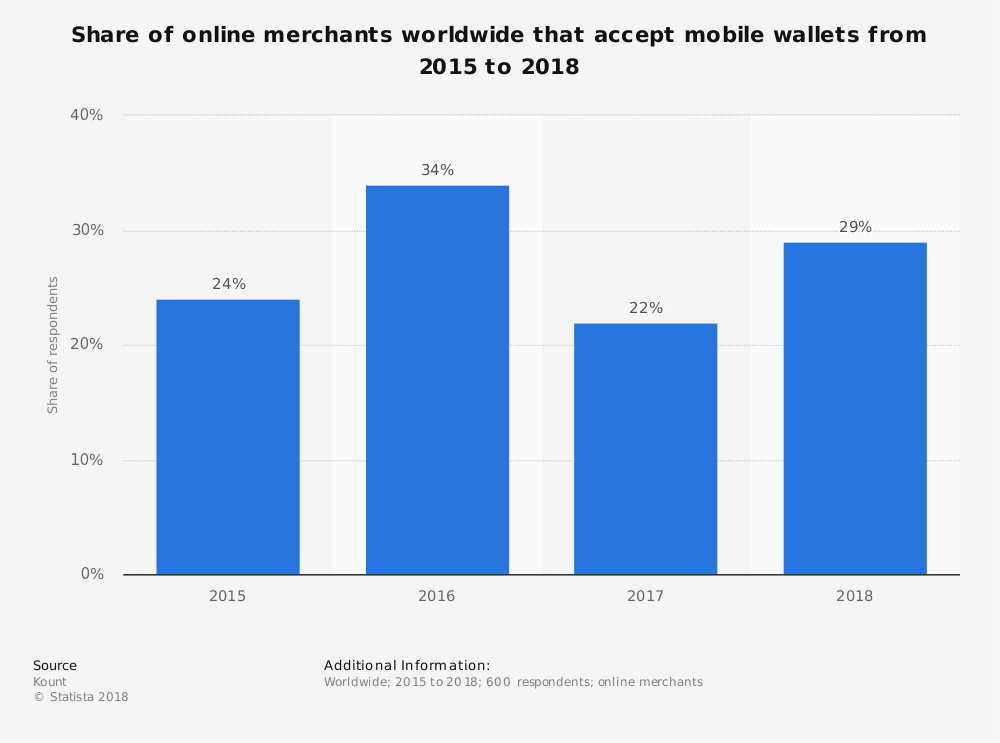

Electronic wallets have become widely accepted within the past few years. Most locations that accept cards as a payment option will allow you to pay with your electronic wallet. Although there are still some locations that are using older processing technologies, which does limit some product or service access, the number of retailers who provide payment access in this manner continues to increase each year.

5. It requires users to authorize every transaction.

Electronic wallets function like a debit card when initiating a transaction. They require you to input your PIN to authorize payment. For devices with biometrics, a payment would require your fingerprint to authorize it. That gives you another layer of security against unauthorized purchases or the financial risks associated with identity theft.

6. It may offer access to new rewards.

Many electronic wallets offer incentives to encourage consumers to use them instead of traditional payment methods. You may find discounts apply to certain purchases, such as fuel, food, or travel. Some businesses may work with your e-wallet provide to offer specific discounts as well. That means you have the potential to save money without changing your spending habits. You’re just changing how you pay for those items.

7. It could help you with your budget.

Many electronic wallets can help you track your spending habits. Some may generate reports that show you specific categories of spending. You can also assign fixed budgets to specific cost categories to ensure that you’re not spending more than you should on certain items. If you have a big-ticket item to purchase, however, you can disable this feature to make sure there’s enough money available to make the payment.

List of the Disadvantages of Electronic Wallets

1. It is not fully available worldwide.

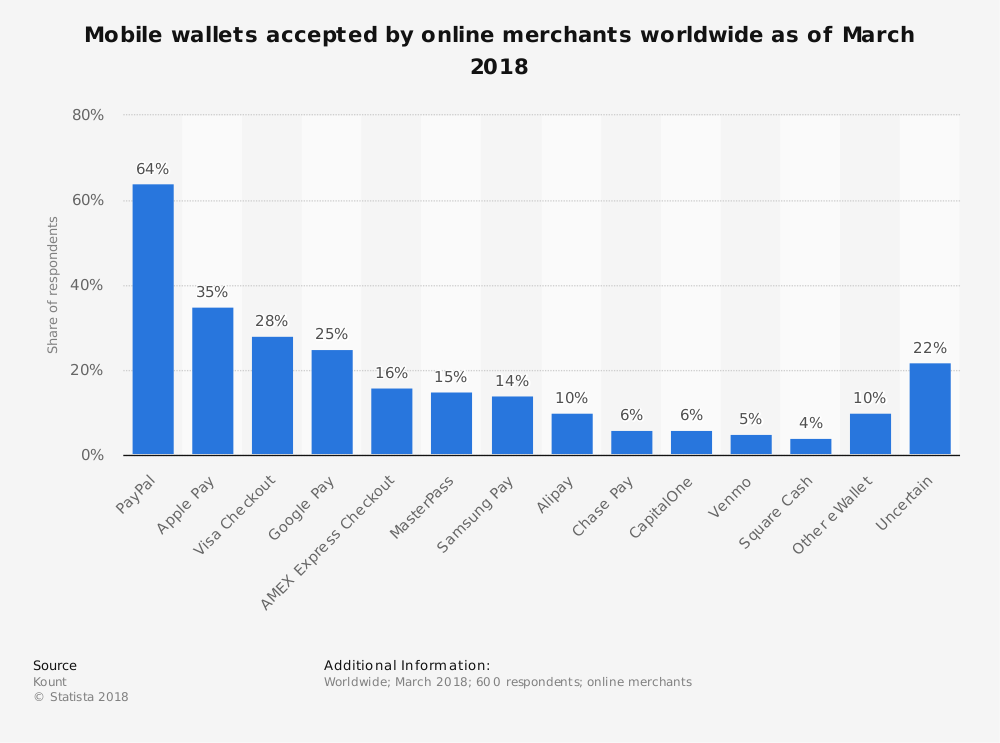

The number of retailers which accept payments from an electronic wallet depends on the actual wallet you choose. In December 2016, just 36% of retailers accepted Apple Pay. 34% of retailers accepted PayPal as a form of payment. Just 25% of retailers accepted MasterPass. About 2 million retailers in North America currently provide access to some form of mobile payment through an electronic wallet.

2. It still requires you to carry something.

Although an electronic wallet offers more convenience for many consumers, it doesn’t fully eliminate the requirement of carrying something with you. If you don’t have your mobile device on your person, then you have no way to complete a transaction. Because these wallets don’t store your identification and other needed items, you’re still forced to carry a traditional wallet or purse with you as well.

3. It requires your device to have a charge.

There’s also the disadvantage that an electronic wallet requires you to have a charged device to have it operate. If you’re carrying a traditional wallet, you won’t need to worry about how much battery life is left on your phone.

4. It doesn’t eliminate your security risks.

The security of your smartphone or mobile device is dependent on the settings you use. If you don’t have your device protected with some type of password, then someone could steal your device and potentially access the funds in your bank account or credit cards. There are definite security advantages to consider which make an e-wallet a beneficial technology, though it requires responsible management of it to maximize them.

5. It may charge you more to process payments.

Many of the electronic wallets which offer a rewards program will charge you a fee to transfer those rewards. You may be required to process payments in a specific way to access these benefits as well. When using the PayPal debit program, for example, consumers receive 1% cash back when their transaction is a standard signature credit transaction. Using a PIN through a digital wallet eliminates this benefit because you’re changing how the point-of-sale treats the transaction. If you spend $900 per month, you’d be losing over $100 each year for the convenience of this payment method.

6. It could encourage reckless spending.

When money is electronically-based instead of a physical item, some people struggle with their spending habits. The money doesn’t feel real, so proper budgeting doesn’t take place. If you are already struggling to maintain a budget with a traditional wallet, then an electronic wallet might make that issue even worse.

These electronic wallet advantages and disadvantages show that this technology makes it faster and easier to complete a transaction. Although there are some accessibility issues to consider, for the most part, the use of a digital wallet is a convenient option for many people.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here. Brandon is currently the CEO of Aided.