There are many things to learn from Warren Buffet. A man who made billions despite having an IQ below 160 by his own admission and who has survived numerous hurricanes at the stock market, Warren Buffet is a living legend and such legends only come by once in a century.

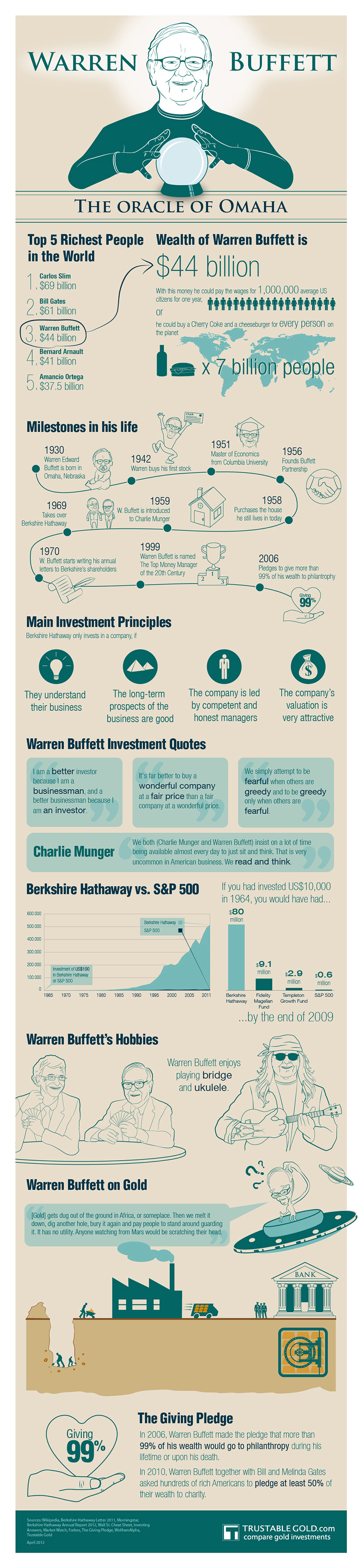

A review of the economics and timeline around Warren Buffet’s life and success, outlining his investment principles and inspirational quotes.

A lot has been said and published about this pioneering investor. People are urged by business coaches to be intuitive like Buffet. His simple lifestyle, considerably humble home for one of the richest men on earth and his approach towards life has all been well documented. While millions of people may aspire to be Warren Buffet and only a few might get close, there are some lesser known lessons to be learnt from the life and times of this great man.

In the slideshow, The 3 Most Important Things To Learn From Warren Buffet, you would be introduced to three principles that this man stands by. These three lessons are not only important for people who invest in the stock markets but also for people who are working in different companies with myriad profiles.

Buffet has been hailed as an accurate predictor of how the market would behave in the near and distant future. For someone who can make profits consistently in a market that often makes and destroys people by the hour, it would come as a surprise to you that Warrant Buffet doesn’t get swayed by market conditions. It is a paradoxical reality actually. Someone who correctly predicts the markets does not judge the market by its conditions or its swaying. This is particularly true and well understood when you consider the investing principles of Buffet.

He doesn’t invest in a company because it has a certain ticker on Wall Street. He invests in a company that he believes in, a company that seems to have the right values and the right plans. Buffet is not a know-all genius who can steer a spaceship and tweak a dynamo at the same time but he has the ability to understand if a company is on the right path and if its vision is going to reap the desired rewards. Thus, Buffet doesn’t allow the market to cloud his judgment or to influence his opinion. Besides, he looks for much more beyond the price. He is also an incredibly patient man. Patience is key to success, be it in the stock market or in personal lives.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.