How to Handle an IRS Audit

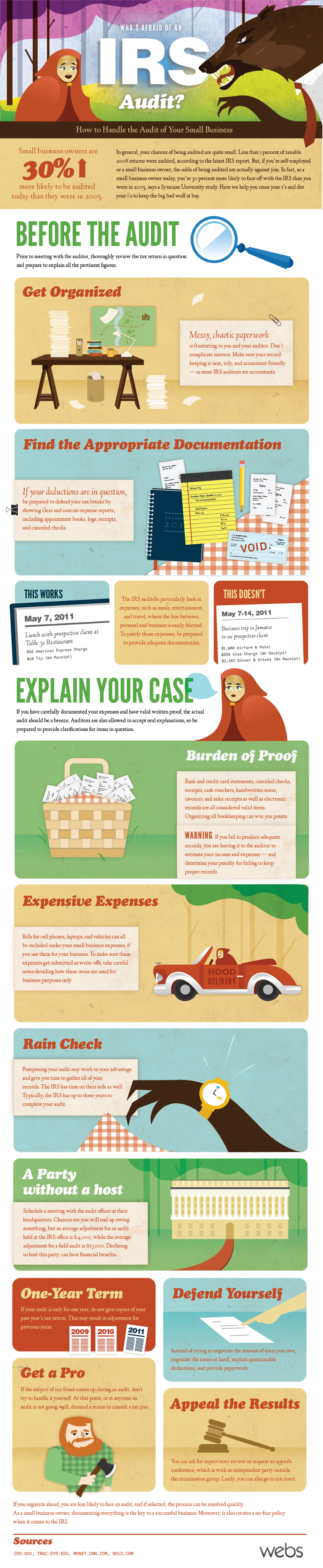

Have you just received that dreaded envelope in the mail, the one marked “audit?” Stay calm, don’t panic. Getting an audit from the IRS is actually very common, especially if you are self-employed or run a small business. In face, the chances of a small business receiving an audit increased by 30% since 2005, according to a study by Syracuse University.

So if you get an audit, remember that it is a very common occurrence. Here is a simple guide to help you navigate the audit process and come out on top.

Before the Audit

Before you meet with the IRS auditor, you will need to make sure your knowledge of your tax returns is rock-solid. Review every figure and prepare an explanation so that you are prepared to answer any questions. Also, gather together physical evidence, such as invoices and earnings reports, in order to back our explanations up. This is particularly important if you are going to be defending your deductions.

Explaining Your Case

Once you have carefully compiled all of the necessary information, everything should sort itself out rather quickly. You should have all of your bookkeeping in order, including invoices, canceled checks, handwritten notes, receipts, and electronic records. If you don’t, then the auditor will be forced to estimate your income, and thereby determine your penalty. If you can provide as much information as humanly possibly, you stand a better chance of avoiding a penalty, or at least getting off with one that you can pay easily.

One area where auditors often investigate is in business expenses, such as lunches with clients and business trips. These areas are often gray, and you should make sure to provide proper documentation and show that they were used for business purposes only.

When to Postpone

Sometimes, it’s in your interest to ask the auditor if you can postpone the meeting. This will enable you to get your materials together and build a stronger case. Having the proper documentation is much more important than rushing to prepare for a meeting, so if you can, ask for an extension. This will no doubt help you use the extra time and prepare a better defense.

If you can explain all of the details, then you have nothing to fear from an IRS audit. It is simply a procedure to make sure you aren’t cutting any corners in terms of taxes.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.