How Many FICO Credit Score Do You Have?

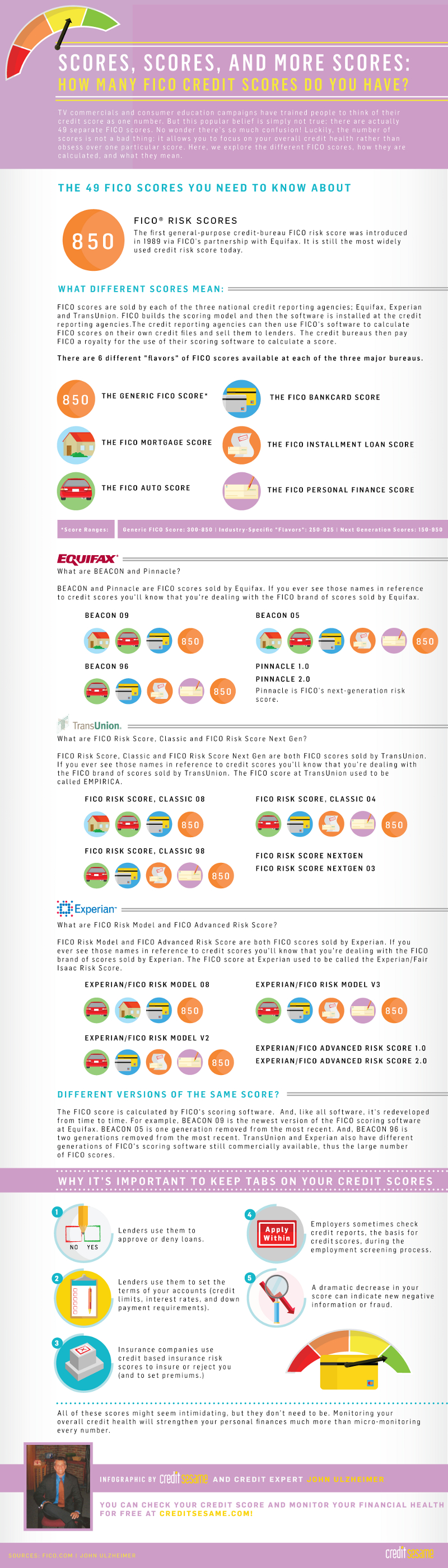

People have been taught to think of their credit score as one number, this is not a complete perspective. There are actually 49 separate FICO scores. Interestingly, these scores allows you to focus on your overall credit health instead of brooding over a particular score. This article explores the various FICO scores, how they are calculated and what they actually mean.

The 49 FICO Scores You Need to Know

In 1989, the first general purpose credit bureau FICO risk score was introduced in collaboration with Equifax. Till date, it is the most widely used credit score.

The Meaning of Different Scores

Equifax, Experian and TransUnion are the three national credit agencies that sells credit scores. The scoring model is built by ICO, installing the software in the reporting agency. The agency then uses the software in the determination of FICO scores, selling them to lenders. FICO earns royalty from credit bureaus for making use of the scoring software.

Here are six different types of FICO scores that are available at each of these agencies.

1. The Generic FICO score.

2. The FICO mortgage score.

3. The FICO auto score.

4. The FICO bankcard score.

5. The FICO instalment loan score.

6. The FICO personal finance score.

There are different score ranges, here they are:

1. Generic FICO Score – 300 – 850

2. Industry Specific Flavors – 250 – 925

3. Next Generation Scores – 150 – 950

Equifax

What are BEACON and Pinnacle? These are FICO scores sold by Equifax. Those names signifies that the FICO brands are involved in the transaction.

BEACON 09

The Generic FICO score

The FICO auto score

The FICO bankcard score

The FICO mortgage score

BEACON 96

The FICO bankcard score

The FICO auto score

The FICO instalment loan score

The FICO personal finance score

The Generic FICO score

BEACON 05

The FICO mortgage score

The FICO auto score

The FICO bankcard score

The FICO instalment loan score

The FICO personal finance score

The Generic FICO score

PINNACLE 1.0 and PINNACLE 2.0. The next generation risk score is pinnacle.

TransUnion

What is meant by FICO Risk Score, Classic and FICO Risk Score Next Generation? These are FICO scores sold by TransUnion. When these names appear along with credit scores, it indicates that FICO brands associated with TransUnion are being sold. FICO scores at TransUnion used to be called Empirica.

FICO RISK SCORE, CLASSIC 08

The FICO mortgage score

The FICO auto score

The FICO bankcard score

The Generic FICO score

FICO RISK SCORE, CLASSIC 98

The FICO auto score

The FICO bankcard score

The FICO instalment loan score

The FICO personal finance score

The Generic FICO score

FICO RISK SCORE, CLASSIC 04

The FICO auto score

The FICO bankcard score

The FICO instalment loan score

The FICO personal finance score

The Generic FICO score

FICO risk score next gen and FICO risk score next gen 03

Experian

What is referred to as the FICO risk model and FICO advanced Risk score? These are both FICO models sold by Experian. These names implies you are dealing with FICO brands of score sold by Experian. It used to go by the name Experian/Fair Isaac Risk Score.

Experian/FICO Risk Model 08

The FICO auto score

The FICO mortgage score

The FICO bankcard score

The Generic FICO score

Experian/FICO Risk Model V2

The FICO auto score

The FICO bankcard score

The FICO instalment loan score

The FICO personal finance score

The FICO auto score

Experian/FICO Risk Model V3

The FICO auto score

The FICO bankcard score

The FICO instalment loan score

The FICO personal finance score

The FICO auto score

Experian/FICO advance risk score 1.0, Experian/FICO advance risk score 2.0

Different Versions of the Same Score

With the use of FICO calculator, the FICO score is calculated, it is also updated frequently. The Beacon 09 is the latest version of FICO scoring software at Equifax. BEACON 05 is one generation less than the present version while Beacon 96 was launched before Beacon 05.

Importance of Keeping Notes of Credit Scores

• Lenders makes use of them in deciding whether to approve or deny a loan.

• It is made use of by lenders to set the features of your account such as rates, interest and down payments.

• It is also made use of by insurance companies in the execution of their businesses.

• Employers make use of it as a base for accessing candidates during screening.

• If there is a decrease in your score, it can be a pointer to the fact that there is an anomaly somewhere.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.