How Much Do Americans Save

They say a penny served is a penny earned but exactly how many Americans live by this advice? Saving money is extremely important because it’s impossible to tell when an emergency will arise. Putting money away for unforeseen emergency seems like it would be a common practice but many people don’t realize it.

US Household Statistics

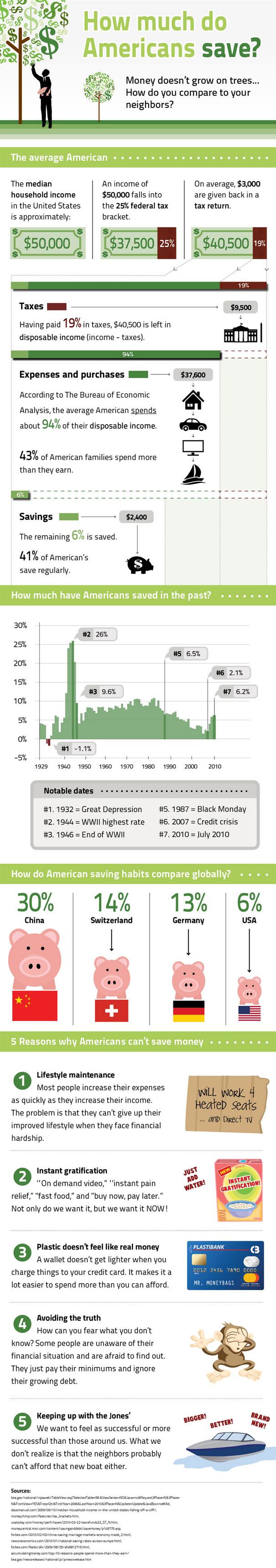

The average American household brings in approximately $50,000 annually. Unfortunately, a fourth of that will be taken away by taxes but $3,000 of that will be given back in tax return. That leaves the average American household with a net income of $40,000 a year.

Average Spending

The Bureau of Economic Analysis has reported that the average American household spends 94% of their net income on rent or mortgage, transportation, entertainment and miscellaneous items. 41% of Americans save regularly and keep the other 6% for an annual savings of $2,400. Unfortunately, 43% of American families spend more than they earn for an average annual savings of 0%.

Trends

In the forties, Americans saved an average of 26% of their income. This was largely due WWII when the averaged spiked up from about 5%. The average dropped to about 2% after the credit crisis of 2007 and it has rebounded to the 6% rate of today.

6% may seem like a decent amount of annual net income to save but other countries such as Germany and Switzerland save 13% and 14% respectively. Meanwhile, people in China save an amazing 30% of their annual income. The reason why Americans can’t save money may be a lack of discipline. Eating out and buying too many gadgets and toys is a big part of the problem. People also want to outspend their friends and family, buying bigger cars and expensive jewelry simply to show off.

Sadly, many people don’t know how much debt they’re really in. They rely on credit cards to make the vast majority of their purchases and make the minimum payments while more interest accrues. Some people use credit cards like they’re free money and they end up paying a lot more for items after all the interest is added on.

Current Generation

For some reason, this generation seems unconcerned with saving money and retirement. Instead, they seem content to put away the bare minimum if anything at all. This is a dangerous practice which forces them to use a credit card when a financial emergency arises and then their problems become overwhelming. Credit cards are supposed to be for emergencies only and the balance should be paid off as soon as possible to prevent the interest from growing out of control. It may seem difficult initially but the money saved on interest can be put towards retirement or the college fund of a child.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.