Although the trucking industry has a global presence, it is the heartbeat of the economy in the United States. Without truck drivers hauling loads back and forth on American roadways, the economy would literally grind to a halt.

Every year, 9.2 billion tons of freight are moved across the United States thanks to nearly 3 million heavy-duty Class 8 trucks and their drivers.

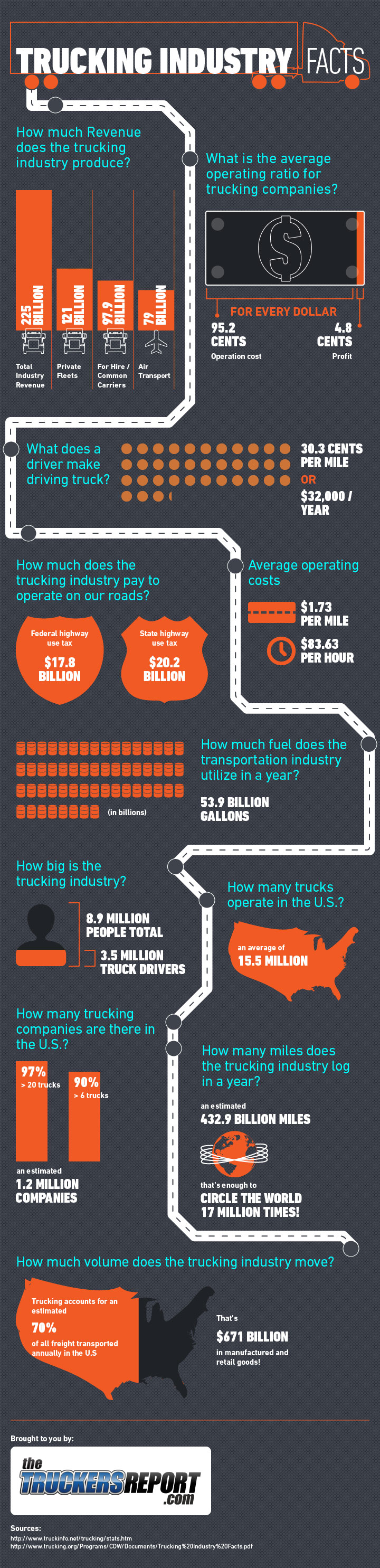

This is why 70% of the oil that is consumed in the US goes to transportation needs. It takes over 37 billion gallons of fuel to power the trucking industry every year. This is why if this industry stops, the United States also comes to a halt. Here are the things you’ll want to watch for in the months and years to come with this industry.

The Influence of the US Trucking Industry

- 83.7% of the revenues generated from the transportation industry comes from the trucking sector.

- The trucking industry collects over $650 billion in revenues every year, which is about 5% of the US GDP.

- Over the next decade, the trucking industry is expected to see 21% growth.

- The value of shipped goods handled by the trucking industry has an annual value of $139 billion, or a per second value of $4,422.

- Home furniture and miscellaneous manufactured goods make up the largest percentage of the freight the trucking industry handles at 15%. Agricultural items come in second at 14% and wood and textiles/base metals account for 13% each respectively.

- A long haul truck can carry up to 300 gallons of diesel fuel, but only gets 8 miles per gallon.

The trucking industry in the US really is the backbone of the economy. The influence is different than in Europe or other parts of the world because of the taxation structure. Instead of heavy fueling taxes in place to pay for social programs and a transportation network, the US taxes fuel to maintain the network of infrastructure only. This is partly why there is a need to replace roadways and bridges throughout the country. As the trucking industry becomes more fuel efficient, there is less money available to keep the transportation infrastructure properly maintained.

The Ongoing Problem of Turnover

- Driver turnover at large truckload fleets hit an annual rate of 103% in Q2 2014. It was 87% in Q2 2015. Predictions for consistent turnover rates of 150% or more in the near future continue to hover around the industry.

- The For-Hire Tonnage Index was 144 in February 2016, up 7.2% from the month before, and the all-time high for the index.

- Part of the reason for high turnover rates is that younger workers prefer jobs that are local and suited to their personal interests, which means for many, being a truck driver is out of the question.

- Regulation changes make it more difficult for truck drivers to meet the demands of their clients, which further increases the turnover rate with large truckload fleets.

- Acceleration of U.S. growth for several quarters would push freight growth up enough to push capacity utilization above 100% for 6-9 months.

- This also means rate increases of between 8% and 10% would be expected, which would then increase consumer prices.

- The average truck today drives about 2,150 miles per week. Before regulatory oversight, the average truck could clear 2,900 miles per week.

- Swift Transportation agreed to pay $4.4 million to settle a federal class action lawsuit, alleging that it violated the Fair Credit Reporting Act for several years by not informing driver applicants they had a right to obtain a free copy of background check reports used by Swift and could then dispute the information that was found those reports.

The labor shortages that are being faced by the trucking industry are very real. This is why Daimler has introduced the idea of using trucks that don’t require direct driver oversight. If the truck can maintain its lane and distance from other vehicles and even change lanes on its own, then this might attract younger workers who want more of a laid-back lifestyle. Even then, however, there are still issues that must be faced. Could a driverless truck be hacked? Hijacked? And what would this do to the fuel costs of a fleet? Right now fleets are buying new vehicles in an attempt to lower turnover rates. It may require new technologies instead.

Detention in the Trucking Industry

- Trucks and drivers held for more than 2 hours at a receiver qualify for detention fees, but in the US this is an additional charge that is typically billed.

- Receivers who do not pay detention issues cause time delays for drivers because they are still on the clock.

- Receivers who require a first come, first served load are not necessarily subjected to detention fees.

- In Australia, however, turnover rates in their local trucking industry are somewhat better because receivers and shippers who hold trucks for more than 2 hours are automatically fined.

When a truck sits, no one is making money. This is one of the biggest issues facing the trucking industry today. It’s difficult to play hardball with a shipper or receiver and say after 2 hours, you’re just pulling the truck out of the dock when you’ve already invested fuel costs, potential toll costs, and other costs associated with driving a truck to the location. Yet detention on both ends of a delivery route can also have costs add up, especially for owner-operators. Then there are broker fees on top of that. Is it any wonder why truck driver turnover rates are so high in the US? This is why a growing call for more regulation over this issue is happening.

The Global Economy and the Trucking Industry

- 15.5 million trucks operate in the United States, with 2 million of them being semi-trailers.

- 1 in 9 truck drivers works as an independent owner-operator for the 1.2 million trucking companies that currently operate in the United States.

- In 2006, the last year from which data is available, the trucking industry logged 432.9 billion miles. Class 8 trucks accounted for 139.3 billion of those miles.

- The average truck will put on 69,000 miles in a given year.

- The average driver earns about 30 cents per mile, which translates into an average salary of about $33,000 per year.

- Commercial trucks make up 12.5% of all registered vehicles, but pay 36.5% of total highway-user taxes.

- Falling oil prices create the potential for recessions in Russia and Canada, which can directly affect the US trucking industry.

- Many fleet managers are looking to build trucks below the 26,000 GVWR threshold that requires a CDL, especially since vans and smaller vehicles offer better fuel economies.

As the rest of the world goes, so does the trucking industry in many aspects from a financial perspective. Although the US and China are somewhat independent of the influential debt factors that the rest of the world faces, they are not completely immune. If Russia, for example, struggles with low oil prices and this drags down their economy, then this affects the Chinese economy. If the Chinese economy is affected, then the US economy will be as well. This is why the debt bubble threat is very real to the trucking industry, even if other industries aren’t paying much attention to it.

The Dangers Faced by the Trucking Industry

- Commercial trucks are involved in 2.4% of all car accidents, but represent 3.9% of all vehicles on the road. The total cost of motor vehicle accidents in the US? $450 billion.

- The good news is that commercial trucks are 3x less likely to be in an accident, but one person is still injured or killed in a truck accident every 16 minutes.

- The US Department of Transportation estimates that 500,000 trucks are involved in at least one accident every year.

- 75% of truck driving accidents are due to the driver of the passenger vehicle.

- Just 16% of truck driving accidents are found to be the fault of the truck driver, with the other 9% of accidents having mechanical or environmental causes.

- 98% of those who are killed in truck vs. car accidents are the drivers of the passenger car.

- 68% of truck accidents occur in rural areas and 78% of accidents occur on the weekends.

- By 2025, there will be more than 33 million people over the age of 70 in the US with the potential of being on the road. This is the age demographic which has the highest number of rear-end and turn-left accidents.

Truck drivers may encounter up to 3 near accidents in any given month, but the average driver experiences an accident once every 5-8 years. Yet if you speak with a truck driver, you’ll often hear some variation of this phrase: “If it hasn’t happened to you yet, then it’s going to happen at some point.” Being out on the road can be dangerous, but the economic need for the trucking industry is very real. It’s not just personal safety that is a danger the industry faces either. The US railroad industry is very adamant about truckers not being able to increase their market share of freight transportation.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.