The first freight forwarding agencies began to appear in the early 19th century in Europe, developing networks of steamships and railroad transports to move goods throughout the continent or over to North America.

Numerous methods of freight forwarding exist. Railroads, trucking, airplanes, and ships are all common transportation methods for goods. When extensive forwarding requirements are necessary, it is possible for a freight forwarder to use all four of these transportation methods to move goods to their final destination point.

Interesting Freight Forwarding Industry Statistics

#1. World trade growth averaged 3% in 2015 from the year before. Just 5 years in the past 5 decades have experienced a 2% or lower increase in global trade. (KPMG)

#2. In 2010, sea freight forwarding companies reported revenues of EUR 1.3 billion. (Statista)

#3. The total value of imported goods to the United States was $192.2 billion in 2016. (Statista)

#4. In 2016, the total value of new private-sector warehouse construction in the United States to support the freight forwarding industry was valued at $19.6 billion. (Statista)

#5. The export value of monthly freight flows in North America, directly attributed to NAFTA, was valued at $2.1 billion in August 2017. (Statista)

#6. Rail freight volumes in the United States reached 2.3 trillion ton-miles in 2016. By 2040, the overall U.S. ton-miles of freight is expected to reach 8 trillion. (Statista)

#7. The market size for third-party logistics in the United States is valued at just under $200 billion annually. (Statista)

#8. Parcel transportation costs in the United States total about $99 billion annually. UPS (United Parcel Service) currently controls about 22% of the global market share of the freight forwarding industry. (Statista)

#9. The U.S. Postal Service currently handles over 149 billion pieces of mail each year as part of the freight forwarding industry. (Statista)

#10. About 296,000 Class 3 trucks are sold in the United States each year to support the work of the freight forwarding industry. (Statista)

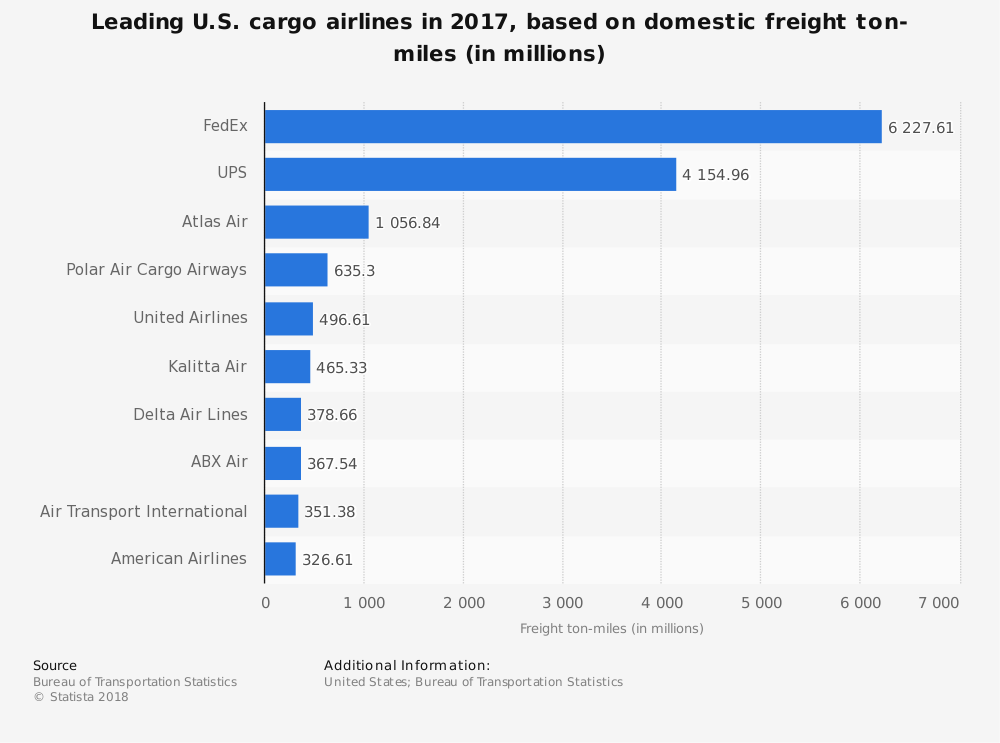

#11. Air carriers that are based in the United States support the industry by providing 15.8 billion ton-miles each year. Over 7,100 air carriers are part of the current commercial fleet in the United States. (Statista)

#12. Cargo growth at U.S. airports is growing at an annualized average rate of 1.6%. (Statista)

#13. 68% of the firms that are active in the freight forwarding industry specialize in the arrangement and shipping of merchandise on behalf of shippers. Another 26% of firms are consultants, facilitators, or add value to the process in some other way. (Logistics Trends and Insights)

#14. 44% of customers who use freight forwarding services say that they value the trade expertise of the provider or the low rates they are given. Another 18% prefer the ease and time-savings that exist when booking freight within the industry. (Logistics Trends and Insights)

#15. 46% of the freight forwarding opportunities which currently exist are located in North America. 42% of the opportunities are found in the Asia-Pacific region. Europe is responsible for just 8% of industry opportunities. (Logistics Trends and Insights)

#16. 46% of providers within the freight forwarding industry say that e-commerce platforms are their most promising opportunity. That is followed by high-tech industries (14%), retail (12%), and healthcare (12%). (Logistics Trends and Insights)

#17. 40% of online freight marketplaces are perceived as an opportunity for the industry. Just 13% of the platforms are perceived as a threat to the industry. (Logistics Trends and Insights)

#18. 86% of industry professionals say that digitization is either “extremely important” or “important” to their overall business strategy. (Logistics Trends and Insights)

#19. 30% of companies say that they plan to build their own digitization assets in the future, compared to 28% of firms which say they will be using an off-the-shelf solution. (Logistics Trends and Insights)

#20. 34% of freight forwarders say that custom brokerage opportunities provide them with the greatest opportunity for cross-selling. That is followed by contract logistics (28%), order fulfillment (22%), and final mile delivery services (16%). (Logistics Trends and Insights)

#21. 54% of industry professionals say that shipper insourcing is their biggest threat to their financial security in the future. (Logistics Trends and Insights)

#22. Clothing and shoes represent more than 440,000 TEUs (twenty-foot equivalent units) in current volumes for the freight forwarding industry. Computers and office equivalent average 195,000 TEUs, while toys average 163,000 TEUs. (Shipwire)

#23. The shipping port in Los Angeles handles an average of 4 million containers each year in support of the freight forwarding industry. (Shipwire)

#24. Spending within the transportation and logistics industries, supporting freight forwarding, totaled $1.48 trillion in 2015. In the United States, that represents 8% of the GDP. (Select USA)

#25. Air and express delivery services represent an industry that is valued at $82 billion in the United States. (Select USA)

#26. There are more than 140,000 miles of railroad tracks that support the freight forwarding industry, transporting an average of 5 million tons of goods each day. (Select USA)

#27. Freight rail in the United States moves about 5.2 million carloads of coal, representing 70% of the total supply in the country. The freight forwarding industry is also responsible for 58% of raw metals, 13.7 million containers, and 1.6 million carloads of agricultural products. (Select USA)

#28. In 2016, trucking revenues were more than $676 billion, with trucks moving over 10 billion tons of freight. (American Trucking Associations)

Freight Forwarding Industry Trends and Analysis

The freight forwarding industry has experienced a surge in volume in recent years as businesses and homeowners have looked to the convenience of product deliveries. Instead of shopping in person, more people are shopping online, satisfied to wait for their items. To support these shoppers, businesses like Amazon and Walmart have created 2-day shipping options, which is then fulfilled by this industry.

Expect the total value of the global freight forwarding industry to continue rising through 2028, even if a period of economic recession should occur. Shoppers today are concerned with value, which means they are more likely to make their purchases online than in-person when budgets are tight.

Local freight forwarding trends will begin to emerge as well. Look for companies to begin offering delivery services for orders placed within the community to expand convenience options. Internal freight forwarding will be developed to support this infrastructure.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.