Understanding Your Finances Creates Financial Security

Are you concerned about your current financial estate? Are you more apprehensive about your financial future? Let’s explore a few staggering statistics that may leave you in an utter state of disbelief.

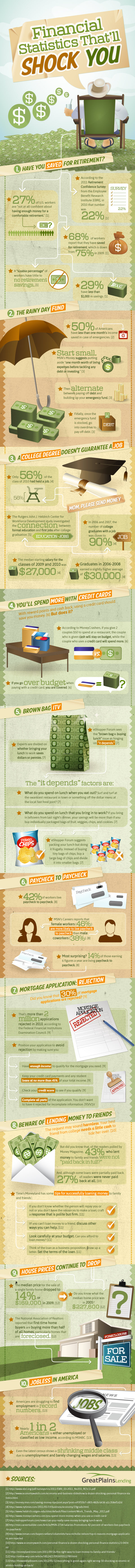

While growing up you may have learned about the importance of obtaining a college degree. Although you learned about the significance of a college degree, do you realize that a college degree doesn’t mean that you’re guaranteed a job within you field of study. The average American gross household income is $71,258. The average American household with debt owes $132,529.

Finances Following College

Why is it becoming so difficult for college educated graduates to obtain jobs within their field? Studies conducted by the Rutgers John. J. Heldrich Center for Workforce Development examined the relationship between college educated people and their ability to obtain their first job following graduation.

In 2006 and 2007, 90% of individuals with college degrees actually received a job making a little more than $30,000 a year. A few years later, in 2009 and 2010, it was revealed that the average salary of college graduates was $27,000. The average salary decreased over the past three to four years by $3,000 dollars. In addition, 56% of 2010 college graduates received a job which is down by 34% from 2006 and 2007 statistics.

As more and more Americans receive college degrees the emphasis placed on a college degrees change. So many people have associate and bachelor degrees that they are not set apart from other graduates with the same degrees. In order to set themselves apart from the rest, they have to pursue higher education and obtain masters and doctorate degrees. However, even these college degrees won’t guarantee you a job.

Credit Cards and Your Financial Future

What other sources contribute to your financial estate? Although credit cards are intended to help you, they drastically harm your financial well-being. You tend to spend a lot more money using credit cards because you don’t have to necessarily stay on budget when paying with a credit card.

Living Week to Week

Are you living paycheck to paycheck in today’s economy? You are part of the 42% of Americans who actually live paycheck to paycheck. Females are 46% more likely to live from one paycheck to another than 38% of their male counterparts.

If finances are part of your everyday worries you may want to consider brown bagging it. If you usually go to a nearby diner or restaurant during your lunch break it will be very beneficial for you to bring leftovers from last night’s dinner. When bringing in your own lunch you should avoid buying individually wrapped bags of chips or cookies and should invest in larger bags which can be distributed into smaller bags. This will save you money which can be used on other things.

The Risk of Loans

You should also beware of loaning money to co-workers, friends, or family members. Although some loans are partially paid back, 43% of people were not paid in full and 27% of people were never paid back at all.

Since your finances are of grave significance, it is essential that you understand and manage your finances accordingly. Proper management of your financial information enables you to budget and save which allows you to be more financially secure in the future.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.