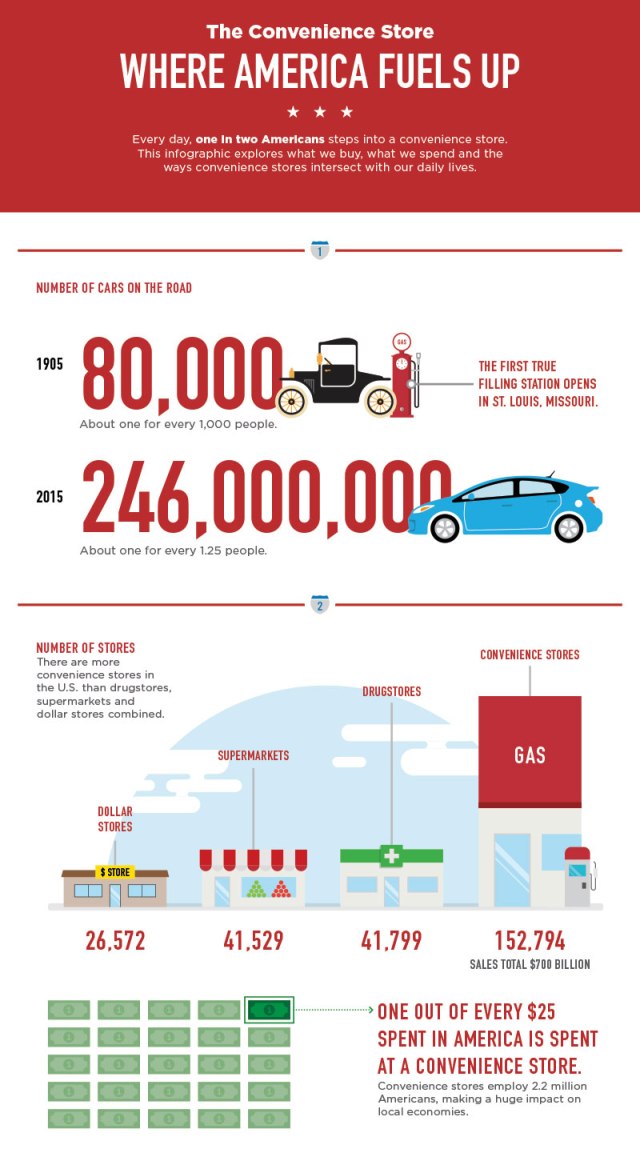

In the United States, there are over 150,000 convenience stores that create over $575 billion in sales every year. They are popular with consumers because they offer the ability to provide high speed services for needed items when time is of the essence.

In the past 12 months, the NACS reports a 0.9% increase in the number of convenience stores providing services.

Consumers like convenience stores because they offer one-stop shopping. Many offer grab-and-go food services, a variety of merchandise, and quick transactions. A vast majority will also sell fuel, especially when based in the US, accounting for 80% of gasoline purchases – but not every convenience store does so. These convenience store industry trends will help each store, new and old, to be able to keep bringing in the customers they need on a repetitive basis.

The Problem of Credit and Debit Card Fees

- In 2015, data collected by NACS shows that the convenience store industry shelled out a total of $10 billion in credit card fees. Although that seems like a lot, it’s actually a 12.3% decrease from the $11.4 billion that was paid in fees the year before that. This is the second-largest expense the industry faces behind labor costs.

- For those convenience stores that sell fuel, credit card costs equated to $0.07 of every gallon purchased by a customer.

- Credit card fees cost a typical convenience store 2% of the transaction, which is made up of several components, some of which can be costlier for convenience stores than other channels.

- Many convenience stores are charged higher interchange rates set by the card associations whose members are card-issuing banks. Each type of card carries different fees that reflect factors like fraud rates, risk factors, transaction volume and processing path.

- Credit card companies have increased their acquiring fees, such as authorization, capture and settlement fees, charged to retailers over the past few years, even though the per-unit processing costs have declined.

- There is a considerable difference between the fees charged for a PIN-based debit transaction and a credit transaction. Watch for convenience stores to encourage consumers to pay via a PIN transaction to limit fees or begin adding payment processing fees to transactions to start limiting costs.

- Paying by cash will also be encouraged more often as credit and debit card fees continue to increase. Some convenience stores are already publishing two purchasing rates: one for cash and one for credit/debit cards, to encourage using an “old-fashioned” form of payment.

In 2011, the Federal Reserve was anticipated to draft debit transaction rules that would limit the fees collected to just $0.12 per transaction. Instead, in the final rules that were released in June of that year, the fee cap became $0.21 per transaction, plus 0.05% of the transaction, plus another 1% per transaction fee to pay for card security compliance. This helped the industry save about $500 million in total costs, but was nowhere near the $1.3 billion in annual savings that was expected. The amount of fees being paid are in decline, but this is because the industry is encouraging other forms of payment. Look for this to continue, along with the potential of adding other transactions, like low-cost ACH transfers, to the list of accepted payments.

Funding Holds and a Frustrated Customer

- Both Visa and MasterCard require that retailers place “preauthorizations” of $1 on signature debit, check card, and credit card gas purchases. Many of these small holds are not even noticed and they disappear once the “hold transaction” expires.

- Other industries also place a hold on these transactions to ensure a consumer has enough money to pay for the transaction at the end of the day.

- The issue is for consumers with low levels of credit or a low balance in a checking account. Most holds today for a fuel transaction cover the cost of a fill-up, so they may be $50-$100. In the past, $35 was the most common amount held.

- Under all normal circumstances, it’s not the retailer who is responsible for continuing the hold, since credit/debit card network rules make it impossible for the retailer to extend the hold. Consumers do not always realize this, however, and may not even realize that a hold is going to take place. Holds may take 48-72 hours to be removed, depending on the speed of the bank settlement process.

- Depending on the hold process, a fuel transaction could be denied because a consumer can’t meet the hold requirement. If a hold is $50 and a customer wants to purchase $27 worth of items and has $35 in their account, the transaction will often be disallowed by the card provider.

- This is why PIN transactions are being encouraged by the convenience store industry. Holds only take minutes instead of hours or days, won’t take up credit space, and will allow consumers with tight budgets to make a purchasing choice that is best for them.

The convenience store industry faces an issue that, for the most part, is out of their control – yet can very quickly cause potential growth to be completely eliminated. Debit holds can be especially devastating for consumers that are on a tight budget for any reason. To counter this issue, some stores have started installing outside PIN payment opportunities to eliminate holding issues, but only about 3 out of 5 locations currently have this technology. Until this becomes more of an industry standard, there will always be a revenue gap, albeit a small one, that could affect local stores in a very negative way.

The Evolution of In-Store Food and Merchandise

- Nearly 80% of convenience stores sell beer, accounting for more than 30% of all beer purchased in the United States. This means compliance issues for alcohol sales are a major point of consideration for those who work and/or own convenience stores. NACS reports that convenience store clerks check 3x the amount of identification then TSA agents every day.

- Average sales of beer per store rose 3.5% in 2014 to $185,259 from $179,001 in 2013, with average gross profit dollars up 5.6% to $35,326. The category ranks sixth for in-store gross margin contribution at 4.39%.

- This creates local growth challenges because of laws that are in place. In Colorado, for example, a convenience store can only sell beer with a maximum 3.2% alcohol level. There are also several hundred dry counties in the US where alcohol sales are forbidden, which means stores outside of those areas benefit from higher sales levels at the cost of others.

- Blue laws, which mean beer and alcohol can’t be sold on Sunday, may also affect local convenience stores.

- Time-sensitive consumers are also looking at convenience stores as a way to pick up a morning beverage or snack. For coffee drinkers, their local convenience store has become a preferred destination when a cup of hot coffee is wanted in a hurry.

- Fresh food products are also becoming a top preference for shoppers in convenience stores. Although these products have been offered for about a decade with regularity within the industry, many stores are discovering that they need to transition away from preserved snacks to fresh snacks to maintain their customer base.

- For convenience stores that sell fuel, the attitude as evolved into become a food retailer that happens to sell fuel instead.

- Lottery sales will continue to be an important part of the convenience store experience. Nearly 50% of all lottery tickets that are sold in the United States are through transactions at convenience stores.

- Watch for more food products to be prepared on-site at convenience stores to attract customers. This may include pizza, hamburgers, salads, and sandwiches that are easy enough to eat while driving.

- To avoid a higher cost of labor to take these additional orders, watch for the industry to look for ways to automate the ordering process as much as possible. Kiosks at fuel pumps have been in place to do this for some time. Watch for an expansion into fresh food orders to continue the automation.

- About 71% of all convenience stores offer frozen dispensed beverages, even though the category itself makes up a small portion of an average convenience store’s overall sales. As more fresh food options are requested, this percentage may decline in the coming years.

It didn’t take long for the convenience store industry to figure out that their goal should be to get their customers into a store because they had to stop for fuel. In the past, you’ve seen advertisements at fuel pumps that promote internal products. Consumers have often stopped for cold beverages, like soda or tea, when driving, but other products and merchandise haven’t always sold well. The preference of Millennials is for prepared fresh products, so in the coming years, look for local stores to develop contracts with local food providers to continue encouraging a visit to the store for more than fuel.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.