Many challenges have impacted the South African clothing and textile industry since the transition to democracy occurred in the 1990s. Higher wages and lower demand have caused a steady decline in employment opportunities. The industry has averaged a job loss of about 4,000 people per year.

Cheap imports have also made it difficult for industry professionals to be competitive. Import increases from China, in particular, have been devastating. Some years saw import growth of more than 700%.

The last year for reliable data comes from the period ending with FY 2014.

Important South African Clothing and Textile Industry Statistics

#1. The South African clothing and textile industry, which includes footwear and leather, is responsible for approximately 14% of the total manufacturing employment in the country. (Business Partners Limited)

#2. About 80,000 people are employed at any given time by the industry. During peak times of production, employment levels can reach up to 120,000. Most of the jobs are centered around KwaZulu-Natal and the Western Cape. (Business Partners Limited)

#3. On the average year, the clothing and textile industry contributes about 1% of South Africa’s GDP. (Business Partners Limited)

#4. About 30% of the goods that are manufactured by the industry are sold domestically. (Business Partners Limited)

#5. South Africans spend about 5% of the total monthly income on products generated by the clothing and textile industry. That comes to the equivalent of about $48 per month. (Flanders Investment and Trade)

#6. Before South Africa transitioned to a democratic government structure, the clothing and textile industry employed more than 250,000 people. (The Journalist)

#7. Local manufacturing industry sales were R50 billion in 2015, which was a 21% increase over figures from 2010. From 2005-2010, local industry sales actually contracted by 6%. (The Journalist)

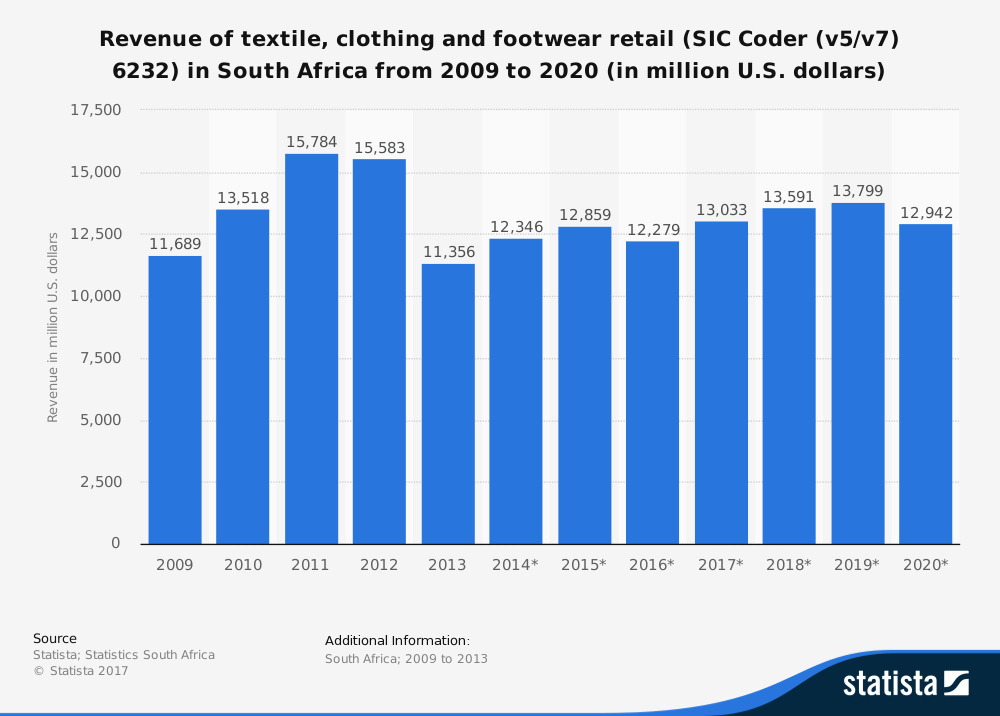

#8. In 2014, the South African apparel retail industry say total revenues of $7.4 billion. 21% of those sales came from the textiles, footwear, and clothing industry. (Flanders Investment and Trade)

#9. Yarn manufacturer Sans Fibres contributes 80% of the sewing thread that is used in the world’s sewing operations from their facilities in South Africa. (Fibre Processing and Manufacturing Sector Education and Training Authority)

#10. Since 2010, the South African government’s Clothing and Textile Competitiveness Program (CTCP) is believed to have saved 63,000 jobs and added up to 8,000 new employment opportunities. (Fibre Processing and Manufacturing Sector Education and Training Authority)

#11. More than 360 companies receive government support through the CTCP, with nearly 700 transactions approved to the tune of R2.4 billion. (Fibre Processing and Manufacturing Sector Education and Training Authority)

#12. Gelvenor Textiles supplies about half of the world’s need for parachute fabrics from their South Africa location. (Fibre Processing and Manufacturing Sector Education and Training Authority)

#13. More than 1 million suits have been delivered from House of Monatic to the United Kingdom. (Fibre Processing and Manufacturing Sector Education and Training Authority)

#14. Import taxes on certain fabrics that are used by the South African clothing and textile industry are up to 22%. It is the single largest input cost that the industry faces. (Fibre Processing and Manufacturing Sector Education and Training Authority)

#15. 26% of the workers that are employed by the industry speak IsiZulu as their home language. Another 20% speak Afrikaans. English comes in third, reflecting 18% of the employment population. (Fibre Processing and Manufacturing Sector Education and Training Authority)

#16. 72% of the workers employed by the clothing and textile industry are women. 38% of workers are between the ages of 21-25. Another 27% of workers are under the age of 20. (Fibre Processing and Manufacturing Sector Education and Training Authority)

#17. Men are more likely to be involved in the textiles segment of the industry, accounting for 40% of total employment. (Fibre Processing and Manufacturing Sector Education and Training Authority)

#18. Textiles are one of the few categories where a third place of manufacturing emphasis, Gauteng, is available to the industry. (Fibre Processing and Manufacturing Sector Education and Training Authority)

#19. Over 70% of those employed in the footwear sector of the industry are 25 years old or younger. Just 1% of employees are above the age of 40. (Fibre Processing and Manufacturing Sector Education and Training Authority)

#20. The leather component of the clothing and textile industry is fully centered in Gauteng. Equity distribution is 100% black for this segment of the industry. (Fibre Processing and Manufacturing Sector Education and Training Authority)

#21. Of the total clothing and textile output achieved by the industry, about 18% of textiles and 9% of clothing sales were exported. (Friedrich-Ebert-Stiftung)

#22. The top apparel retailers in South Africa are responsible for 70% of formal domestic clothing sales that are achieved by the industry. (Friedrich-Ebert-Stiftung)

#23. There are about 2,000 active clothing, textile, footwear, and leather companies that are registered with the government’s education and training authority. About 4 out of every 5 companies focuses on clothing and textiles only. (Friedrich-Ebert-Stiftung)

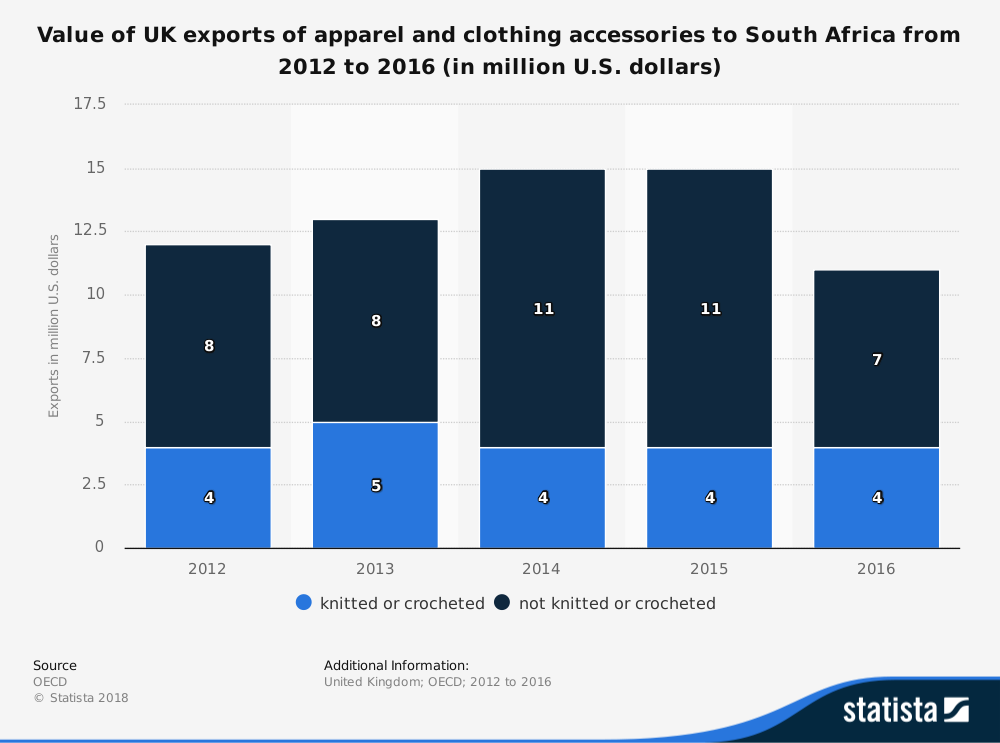

#24. Textile imports grew by 60% from 1995-2002, but then declined by over 35% from 2003-2004. The U.S. is the largest importer of South African clothing, representing more than 55% of the total figure. The UK comes in second, with 21% of total imports. (Friedrich-Ebert-Stiftung)

South African Clothing and Textile Industry Trends and Analysis

The number of households in South Africa that will include an ultra-high net worth is forecast to grow by 59% by the year 2024. Two cities in South Africa, Cape Town and Johannesburg, are rated in the Global Top 40 in importance in this area.

When this is combined with the maturity and sophistication of the clothing and textile industry in the country, there is a foundation for strong and continued growth already built. Tax structures are reasonable, business cultures are positive, and wages are competitive.

South Africa does face certain challenges in the coming days that may affect the success of this industry. Cape Town is facing an uncertain and unprecedented water shortage, rationing water to just 6.6 gallons per person. Since it can take almost 3,000 gallons of water to produce a single t-shirt, these challenges are not going to go away.

The industry must focus on using recycled water and examine enzymatic techniques to reduce water. Over time, this may create added profitability for the industry, but could be a large capital investment for some.

Until these issues are fully resolved, there will always be tension and unease present for investors in the South African clothing and textile industry.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here. Brandon is currently the CEO of Aided.