In the United States, trucks are categorized into specific classifications based on their weight limits. Most trucks that are driven for personal purposes are classified as a light-duty truck. Examples of this classification would include the Dodge Dakota, the Toyota Tacoma, or the Ram 1500 and 3500. Classes 1-3 are all light-duty trucks.

Medium-duty trucks are found in classes 4-6. They have a weight limit between 14,001-26,000 pounds. These vehicles can still be used for personal purposes, while being strong enough for some commercial or industrial purposes.

Heavy-duty trucks begin at Class 7. Drivers are required to hold a commercial driver’s license (CDL) to operate these vehicles. Class 8 trucks are the heaviest of all, with a weight limit above 33,001 pounds. Class 9 trucks are sometimes called “super heavy-duty,” although most are usually just a Class 8 vehicle with special characteristics.

It is the heavy-duty truck industry which paves the way for goods to be transported throughout the U.S. and the rest of the world.

Important Heavy-Duty Truck Industry Statistics

#1. Sales of trucks in the Class 8 weigh segment improved by 59% in 2017, with a total of more than 296,000 vehicles sold in North America. (ACT Research)

#2. The spot freight rate for vans reaches $1.81 per mile in December 2017, which is up almost 21% from the year before. (DAT Solutions)

#3. In December 2017, there were about 9 loads available for every truck that was operating within the spot freight market. That average is a record for the heavy-duty truck industry. (DAT Solutions)

#4. Heavy-duty truck manufacturers added 196,000 jobs to the economy in 2017, which was a 1.6% increase over the year before. (Bureau of Labor Statistics)

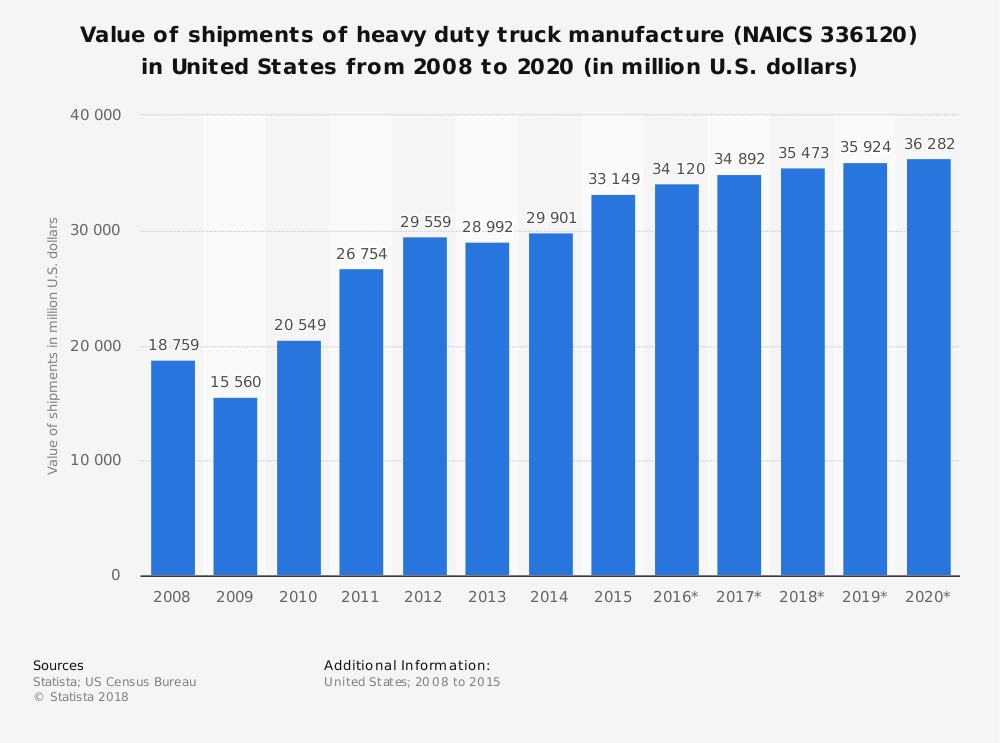

#5. Global heavy-duty truck manufacturing is an industry valued at $369 billion. Although segments of the industry are growing, the global industry saw an average contraction of 0.2% per year from 2012-2017. (IBIS World)

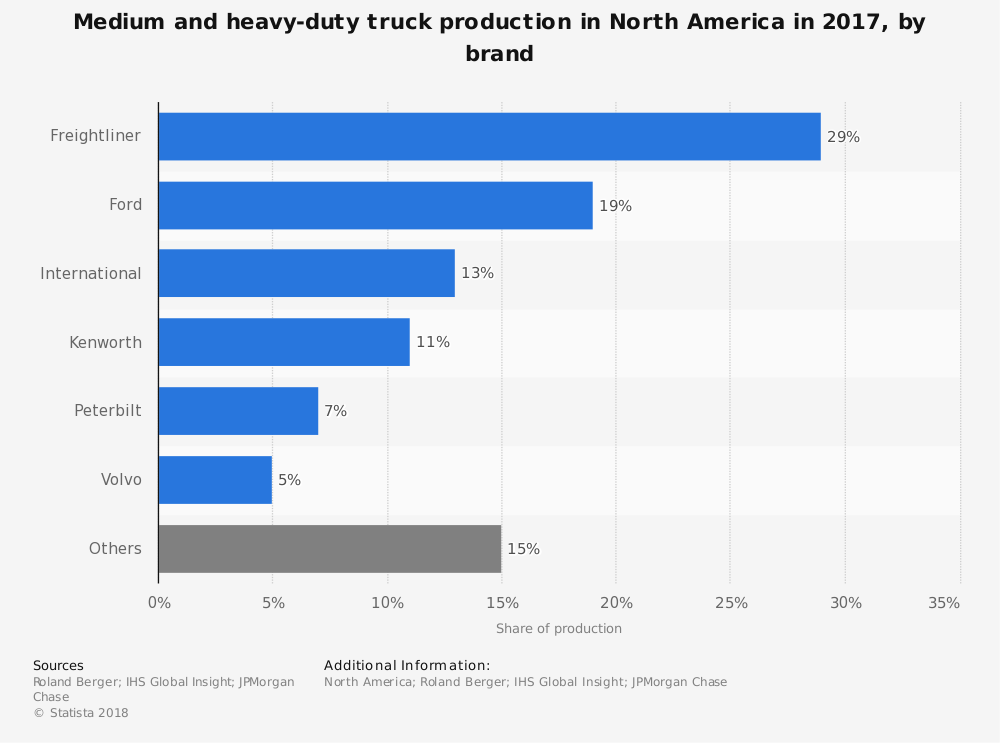

#6. There are about 1,000 firms currently operating in the heavy-duty truck manufacturing industry, employing a total of 284,000 people around the world right now. Daimler, Volvo, and PACCAR are currently leading the industry in total market share. (IBIS World)

#7. Daimler generated $42.59 billion in the manufacturing of trucks in FY 2015. Volvo generated $26.3 billion in revenues, while PACCAR generated $14.78 billion. (Statista)

#8. About 6% of the jobs available in the United States are directly tied to the heavy-duty trucking industry in some way. 80% of the cargo that is transported in the U.S. is handled by the trucking industry. (U.S. Department of Transportation)

#9. Heavy-duty truck drivers in the U.S. log more than 432 billion miles each year. They make that happen on 54 billion gallons of fuel, at an annual expense of $143 billion. (U.S. Department of Transportation)

#10. The occupation of “truck driver” is the most common job opportunity in 29 states within the U.S. A long-haul truck driver will log more than 100,000 miles each year. (U.S. Department of Transportation)

#11. 10% of the cargo transported by heavy-duty trucks involves machinery. 8% involves electronics. Another 8% involves shipping other motorized vehicles. (U.S. Department of Transportation)

#12. The current demands of the U.S. economy require 3.6 million heavy-duty trucks to haul more than 10 billion tons of freight each year. That means there are over 3.5 million truck driving employment opportunities available. (American Trucking Associations)

#13. The for-hire trucking industry is facing a severe shortage of drivers. In 2016, there were more then 35,000 open positions which needed to be filled. Although the shortage has been decreasing thanks to low unemployment levels, the tonnage indexes keep rising, which means more employment opportunities. (American Trucking Associations)

#14. The cost of fuel for the heavy-duty trucking industry can be as much as 20% of the overall operating costs. (American Trucking Associations)

#15. In 2016, there were over $738 billion on gross freight revenues handled by the heavy-duty tricking industry, which represented over 81% of the total freight bill in the United States. (American Trucking Associations)

#16. More than $41 billion was paid by commercial trucks in state and national highway user taxes in 2015. (American Trucking Associations)

#17. Commercial trucks are about 13% of all registered vehicles in the United States. (American Trucking Associations)

#18. 24% of all trucks registered, a total of 33.8 million trucks, are used for business purposes outside of farming and government work. (American Trucking Associations)

#19. Private carriers represent more than 700,000 of the for-hire carriers that are currently registered with the federal government. Interstate motor carriers represent 80,000 opportunities. (American Trucking Associations)

#20. Excluding self-employment, direct and indirect employment opportunities generated by the heavy-duty trucking industry, when all activities are considered, total 7.4 million. (American Trucking Associations)

#21. About 5 million heavy trucks are sold globally each year. About 450,00 medium- to heavy-duty trucks are produced in Europe each year, with 80% of them classified as heavy-duty. (Transport and Environment)

#22. There are 13 million heavy-duty vehicles on European roads as of 2015. Just 5 companies account for 90% of the sales generated by the industry each year. (Transport and Environment)

#23. Because of higher fuel costs in Europe, it may represent up to 33% of the operating costs that are associated with each truck. (Transport and Environment)

#24. Daimler and Volvo share 46% of the market in the United States within the heavy-duty segment. They also have a 40% share of the heavy-duty market in Europe. (Transport and Environment)

Heavy-Duty Truck Industry Trends and Analysis

There are plenty of opportunities present within the heavy-duty trucking industry at the moment. When new rules came into effect that limited drivers to a 14-hour working day, with 11 hours maximum behind the wheel, many chose to leave the industry rather than comply. That caused orders to dip for the industry over the past few years, but increased demand, along with higher wages, is bringing drivers back.

When there are more drivers and cargo available, there is a need for more heavy-duty trucks. That bodes well for the industry. Through May 2018, the industry has averaged more than 40,000 units sold each month. Class 8 orders continue to exceed expectations. Growing freight demands place a total order level in North America for the year at 386,000 units.

The danger here is that once the tight capacities have been relieved, there will be an over-abundance of heavy-duty trucks and fewer opportunities. That would plunge the industry into a steep decline, similar to what was experienced in 2008.

With U.S. spending on logistics rising, to a tune of $1.5 trillion in 2017, the next 5 years look to continue the impressive performances in 2018 so far. It is going to the 10-year forecast where uncertainty looms.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.