Mining has been a historically important driver of economic activity in Chile throughout modern history. Since the early 16th century, the Chilean mining industry has been active. Chile is a key global player in the production of metallic minerals and the world’s largest copper mine producer. Chile has competitive advantages in the production of several non-metallic minerals in high demand such as lithium, iodine and potassium compounds.

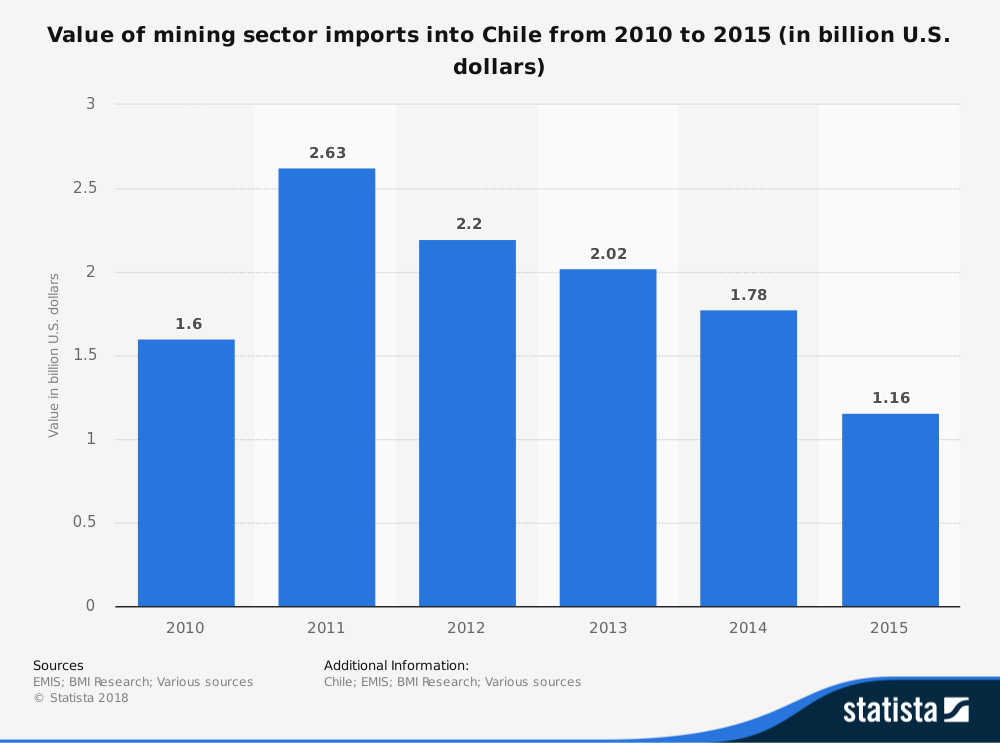

In 2015, mining exports accounted for USD 34.2 billion and 84.9% of domestic production. Coal accounted for USD $752 million or a 64.9% share, the bulk of imports. Chile is heavily dependent on coal for energy production, accounting for 40% of all electric power generated in the country.

Many of today’s active mining projects are based on exploration efforts that occurred in 1997, if not before. Because of the size of the deposits found, however, the industry has continued to thrive and even be a top producer in some products.

Important Chilean Mining Industry Statistics

#1. Chile is the top producer of copper in the world, partially due to large infrastructure supports. More than 5.5 million tons of copper were produced in 2016 by the Chilean mining industry, representing 30% of total copper production in the world. (International Trade Administration)

#2. The total market size for the Chilean mining industry in 2016 was $1.209 billion. That represented a decrease of almost $400 million in market size from the year before. As of January 2018, estimates show continued reductions for the industry. (International Trade Administration)

#3. The mining sector plays a large role in the economy for Chile. It accounts for nearly 10% of its GDP and makes up nearly 50% of the country’s total exports. (International Trade Administration)

#4. In 2016, the average price for copper fell from $2.49 per pound to $2.21 per pound. In 2017, the price of copper is expected to rise 20% to match 2015 figures. In 2018, estimates suggest that the price of copper could reach $2.65 per pound. (International Trade Administration)

#5. The record high for copper pricing for the Chilean mining industry came in 2011, when copper was consistently near $4 per pound. (International Trade Administration)

#6. The estimated value of the Chilean mining industry through the year 2024 may be as high as $30 billion. That is because potassium nitrate, sodium, iodine, and lithium are all major components of the industry. Chile is also a major global supplier of sliver, gold, and molybdenum. (International Trade Administration)

#7. The Chilean mining industry is currently the second-largest producer of lithium in the world. It currently holds a 36% share of the global market and holds the largest-known extractable lithium reserves in the world today at Salar de Atacama. (International Trade Administration)

#8. There are only two companies that are currently active in the Chilean mining industry, though salt production is being developed and extraction rates have been approved to be tripled in recent years. (International Trade Administration)

#9. The United States is the largest supplier of equipment and parts to the Chilean mining industry. The U.S. currently holds a 22% share of these supplies. (International Trade Administration)

#10. The Chilean mining industry achieved a 1.2% CAGR through 2010-2015, producing 5.76 million tons of copper while supporting nearly 240, 000 employees. Copper mine production is expected to have a 1.5% CAGR through 2020. (EMIS)

#11. More than $553 million in foreign direct investment has been achieved through the Chilean mining industry since 2010. This has helped the industry to be able to create a $33 billion mining trade surplus for the country. (EMIS)

#12. 2.9% of the total employment achieved in Chile is through the Chilean mining industry. (EMIS)

#13. About 80% of copper production in Chile comes from porphyry copper deposits. Because of this, mines produce several byproducts of value as well, including gold and silver. Most of the deposits that offer the richest potential can be found in the northern reaches of the country. (Cochilco)

#14. The Chilean mining industry is believed to have 30% of the world’s current copper reserves, estimated to be at 210mt. (EY Chile)

#15. Since 2007, the Chilean mining industry has accounted for about 60% of the total revenues that are achieved through exports. (EY Chile)

#16. Chile is home to 70% of the largest copper-producing mines in the world today. About 47% of the reserves are located in Antofagasta. (EY Chile)

#17. In 2016, the government of Chile produced an annual exploration budget of just $5.9 million. Major mining companies, on the other hand, invested over $358 million in new exploration efforts. Even junior mining companies invested $34.7 million into exploration efforts. (EY Chile)

#18. Through 2025, the projected investment into the Chilean mining industry is about $9.2 billion. In 2020, $4.6 billion in investments is anticipated. (EY Chile)

#19. Since 2006, copper grades produced by the Chilean mining industry have gone consistently lower. In 2006, the copper grade was 0.94. In 2015, the copper grade was 0.61. This may be partially due to the aging mines within the industry. In one mine, located in Chuquicamata, trucks are required to travel 11km to reach the surface from the bottom of the pit. (EY Chile)

#20. From 2010-2013, the cost per ton to move materials increased an average of 14% per year for the Chilean mining industry. In comparison, the U.S. saw an average annual increase of 4% during the same time and Australia saw an average of 10%. (EY Chile)

#21. The wages offered by the Chilean mining industry are some of the highest that are found in South America. Many miners earn wages that are close to the average of what U.S.-based miners currently earn. (EY Chile)

#22. The cost of copper mining for the industry has increased since 2003 quite dramatically, partially due to the competitive wages being paid. In 2003, the unit costs were just over $0.50 per pound. In 2015, the mining costs were $2.16 per pound. (EY Chile)

Chilean Mining Industry Trends and Analysis

With several large deposits being mined, providing the world with a diversified set of resources, the Chilean mining industry looks to have a secure future. Although the overall revenues being generated may continue to decline over the next handful of years, it won’t take much to change that trend. Stepping up the mining on existing deposits, changes to commodity pricing, or investments into new exploration could make the industry even more dominant than it currently happens to be.

The Chilean mining industry seems to have grown comfortable with its status. That makes it consistently profitable and an economic generator, but it can limit growth. Assuming that comfort can be replaced with confidence, this industry looks to be ready to continue on for several more generations.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.