Canada is a unique nation with regions and provinces that are fused with many different culinary traditions. For the Canadian restaurant industry, its survival depends upon the stories that are behind the food, not just having access to high-quality ingredients.

The Canadian restaurant industry has a distinctive personality. It has a widespread presence in every province and territory. It is also poised to rebound from regional recessions that have kept more diners at home in recent years.

Informative Canadian Restaurant Industry Statistics

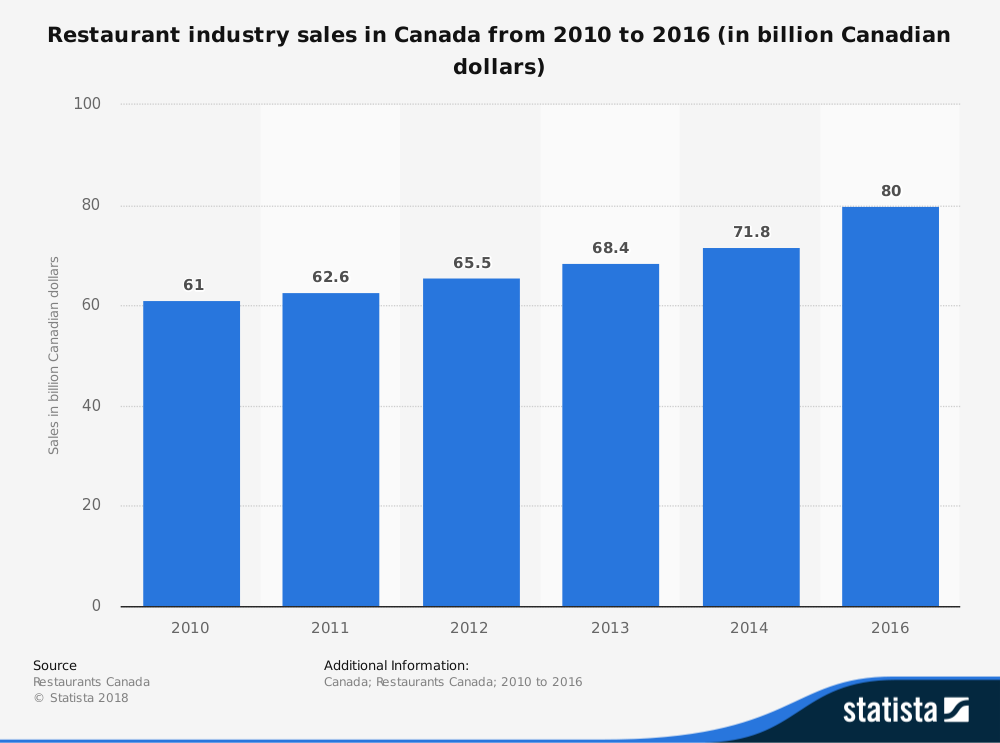

#1. In 2017, commercial foodservice sales are estimated to have grown by 4.9%. This is in comparison to the 2.6% GDP growth that Canada was able to achieve over the same period. (Restaurants Canada)

#2. When the Canadian restaurant industry combines commercial and non-commercial food services, it is expected to surpass $84 billion for the first time in 2017. (Restaurants Canada)

#3. Full-service restaurants led all segments in terms of growth in overall sales, seeing a 5.5% increase in 2017 thanks to extensive growth in Ontario, Quebec, and British Columbia. (Restaurants Canada)

#4. Quick-service restaurant sales are also expected to see large increases, with a 5.3% growth rate achieved in 2017. The QSR segment has been one of the most consistent and robust areas of the Canadian restaurant industry for more than a decade. (Restaurants Canada)

#5. Revenues for caterers are one of the few bleak sports for the industry as remote camps are offering less spending for this segment. The final 2017 figures are forecast to show a contraction in revenues of 0.9%. (Restaurants Canada)

#6. High levels of household debt hold the Canadian restaurant industry back from achieving its full potential. In the next 5-year forecast period, debt is expected to increase sales by 3.9% and actual sales to just 1.2% annually, matching overall population movement. (Restaurants Canada)

#7. By 2021, the commercial sector of the restaurant industry in Canada is forecast to reach sales of $78 billion. Ontario, Quebec, and British Columbia are expected to continue leading with the strongest sales level in this category. (Restaurants Canada)

#8. Alberta is coming out of a recession and their segment of the industry is expected to see some recovery in 2017 and 2018. Growth rates of 2.9% are anticipated within the province. (Restaurants Canada)

#9. Menu prices for Canadian restaurants average an increase of 2.5% annually. In the past, this was due to unpredictable food prices. Beginning in 2017, the increases are now attributed to higher labor costs. (Restaurants Canada)

#10. In 2018, menu prices in Ontario are expected to rise by nearly 4% due to minimum wage requirements that may reach up to $15 per hour. (Restaurants Canada)

#11. Newfoundland and Labrador are expected to continue struggling, with a total annual nominal change in sales of just 1.5%. (Restaurants Canada)

#12. Canadians cook about 80% of their meals at home. Mobile ordering could change this percentage in future years, but it is expected to remain steady through at least the end of 2018. (The NPD Group)

#13. Since 2008, the full-service restaurant industry has been able to achieve an operating profit margin above 3% consistently. For limited-service restaurants, the operating profit margin has been consistently above 5%. The special food services segment, however, has seen high levels of variation, ranging from 2.7% to 4.3%. (Statistics Canada)

#14. In December 2017, food services and drinking places saw a monthly contraction of 0.2%, bringing in $5.5 billion. This offset gains from November. Sales at limited-services establishments were down 1.1% the same month, while sales at drinking places were down 3.8%. (Statistics Canada)

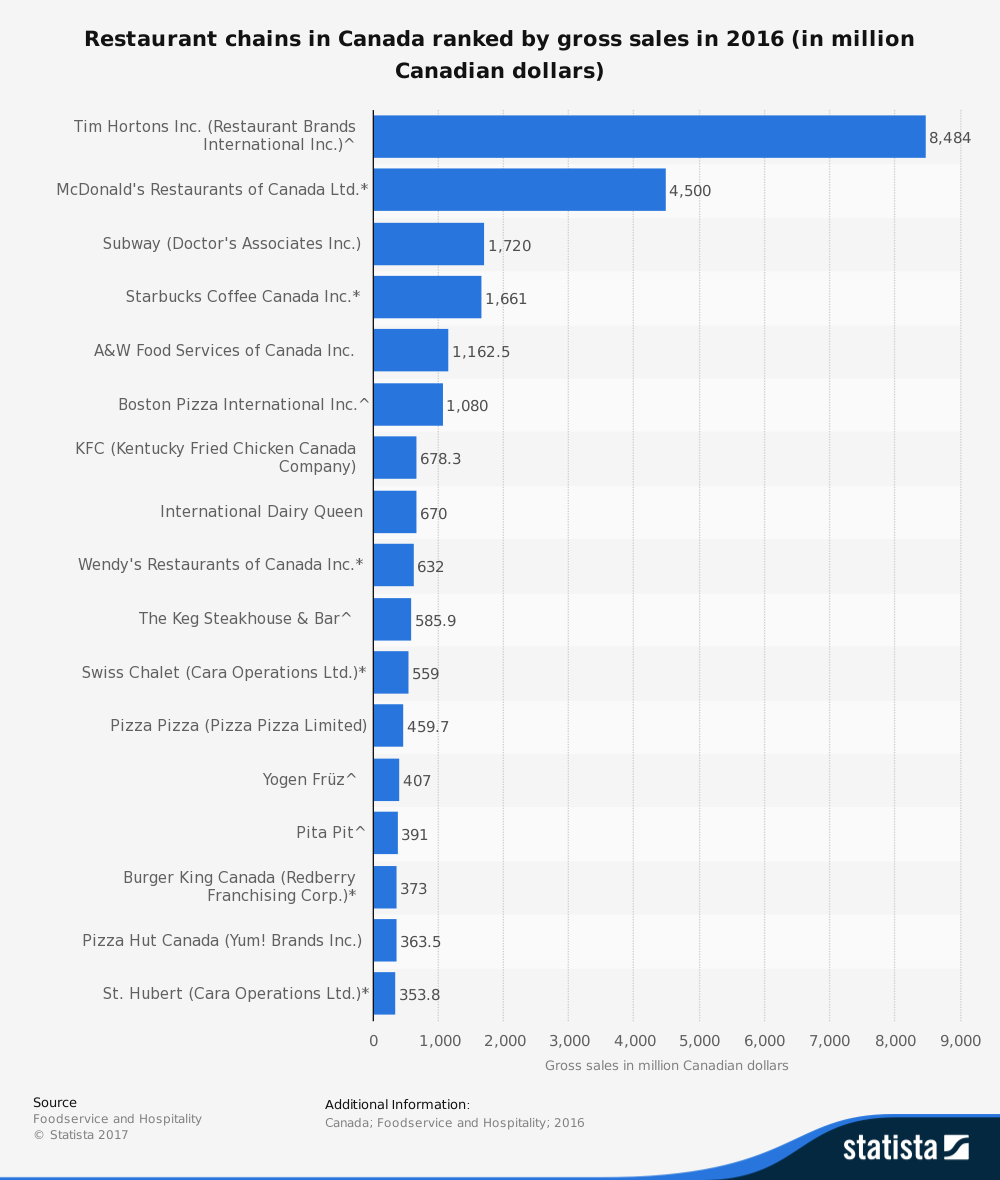

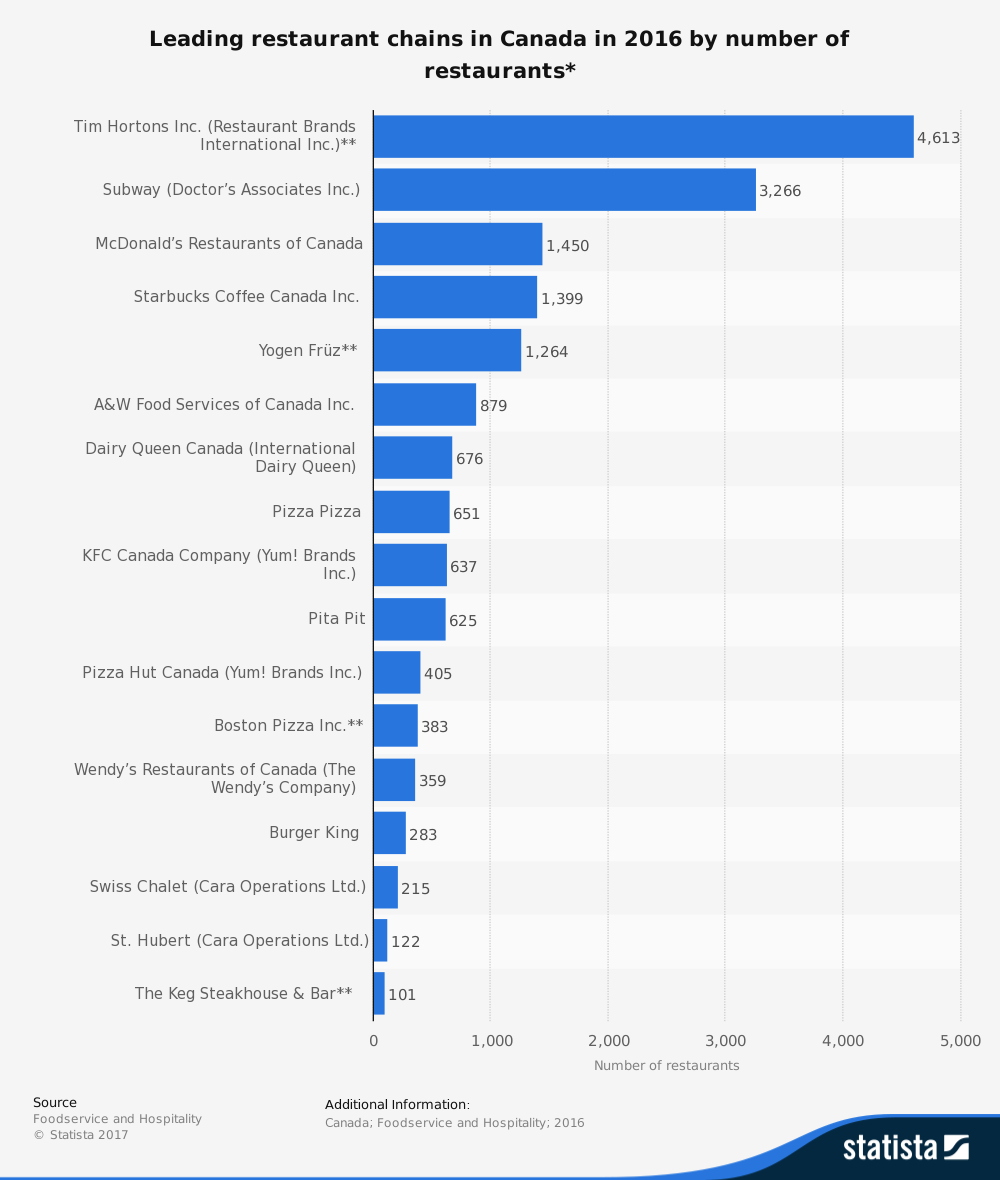

#15. In 2016, annual sales of food services and drinking places experienced a confirmed increase of 6.3% when compared to 2015 figures. That was the largest rate of annual growth experienced by the Canadian restaurant industry since 2000. (Statistics Canada)

#16. The rate of sales in the food services industry typically increases at a much higher rate than the population. In the post-war boom for the industry, growth at restaurants rose by 245% while the population levels rose by 21.8%. From 2006-2016, total sales have increased within the industry by 50%, while population levels rose by 11.4%. (Statistics Canada)

#17. There are an estimated 94,415 establishments that were operating within the Canadian restaurant industry in 2016. 98.7% of those businesses employed 99 people or fewer over the course of the year. (Statistics Canada)

#18. Based on financial data submitted by industry professionals in 2015, the average revenue generated by each establishment in the Canadian restaurant industry was $626,000. More than two-thirds of active establishments are currently profitable. (Statistics Canada)

#19. Drinking places have a slightly higher average revenue in their segment, achieving $646,500 on average in 2015. Slightly fewer of these establishments, at 66.8%, were considered to be profitable. (Statistics Canada)

#20. Only 5,200 establishments are considered to be part of the drinking places segment of the Canadian restaurant industry. Just 0.5% of these establishments employ 100 people or more throughout the year. (Statistics Canada)

#21. The segment with the highest levels of business profitability is the special food services category. This includes caterers, mobile food services, and food service contractors. Nearly 80% of businesses are profitable in this category on an average revenue of $268,100 per establishment. There are currently 10,000 businesses operating within this specific segment in Canada right now. (Statistics Canada)

Canadian Restaurant Industry Trends and Analysis

The Canadian restaurant industry is responsible for many firsts that have taken the global industry by storm. Everything from the iconic California Roll to Yukon Gold potatoes have roots in Canada.

The industry must continue to adapt to changing consumer preferences to continue seeing consistent patterns of growth. That means offering classic staples like poutine, while offering new services, such as app ordering, to appeal to the stay-at-home market.

Record revenues are forecast in the next 5-year period. Although the restaurant industry in any country is somewhat unpredictable, the Canadian restaurant industry looks to be about as sure of a bet as one can find.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here. Brandon is currently the CEO of Aided.