Ginseng is a root that comes from plants that only belong to the Panax genus. There are several varieties available within this botanical genus, though the two most popular products come from Korean and Chinese ginseng. It grows in climates that are cooler, with versions found in Russia, Canada, and the United States as well. There are a few ginseng varieties that have adapted to warmer climates, such as P. notoginseng, which grows in Southwest China.

The use of ginseng has been documented since the end of the 2nd century for traditional medicine and treatments. Data suggests that human populations may have been using ginseng products for over 4,500 years. American ginseng was first discovered in 1716. Since its discovery, it has had access to the Asia-Pacific market. It is often used as an opposite ginseng product with Asian ginseng varieties, often described as a “yin yang” experience.

There has not been any high-level clinical research conducted on the possible medical benefits of ginseng. It may help with a person’s insulin response, improve memory, and reduce fatigue. There are, however, no formal health effects tied to ginseng within the medical community.

Interesting Ginseng Industry Statistics

#1. Ginseng products are currently distributed to at least 35 different countries. (National Institutes of Health)

#2. Four countries are responsible for 99% of the world’s total production of fresh ginseng: South Korea, China, Canada, and the United States. Combined, they produce 79,700 tons of the 80,000 tons that are used around the world. (National Institutes of Health)

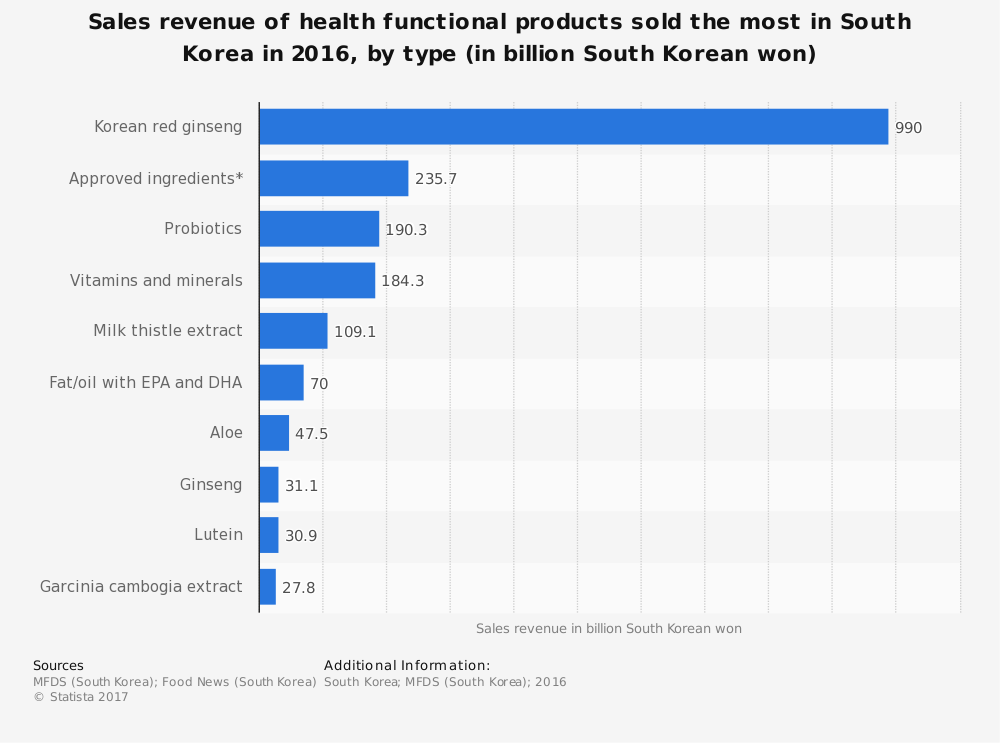

#3. Including ginseng root products, supplements, and other processed products, the total value of the ginseng industry in 2013 was estimated to be $2.08 billion. The Korean market for ginseng products is responsible for about half of the industry’s global annual revenues each year. During the same year, the Korean market share was $1.11 billion. (National Institutes of Health)

#4. China is the world’s largest producer of ginseng, responsible for more than 44,000 tons annually. That means China, on its own, is responsible for more than half of the global ginseng supply. (National Institutes of Health)

#5. For ginseng products to be mature enough to reach the market, there must be a minimum of 3 years’ cultivation on the product. Canada and the United States usually feature products within this minimum timeframe. Ginseng root from China and South Korea are cultivated for 4-6 years. (National Institutes of Health)

#6. Out of the 35 countries that are involved with the ginseng industry, 19 of them import and export ginseng products. North Korea is the only country that exports ginseng but does not import any. (National Institutes of Health)

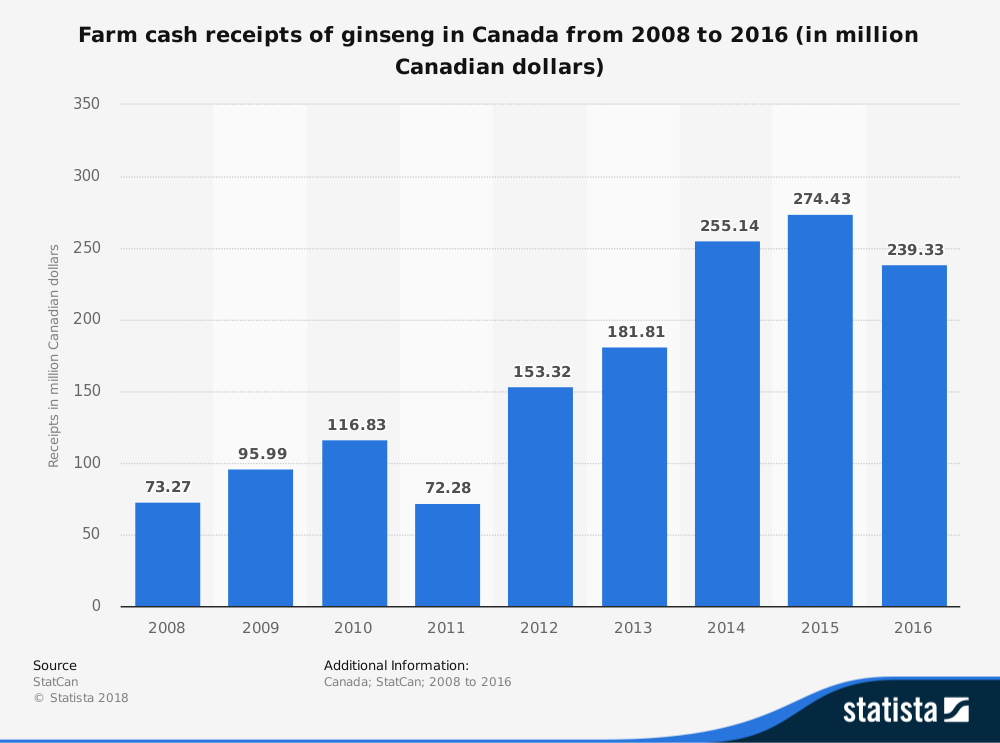

#7. Canada is the largest exporter of ginseng in the world today, with their 2009 market value for the product reaching $66 million. Hong Kong is the largest importer of ginseng products in the world, averaging more than $100 million per year. (National Institutes of Health)

#8. About 95% of white ginseng products are consumed as root. In comparison, about two-thirds of red ginseng products are processed before consumption. (National Institutes of Health)

#9. 90% of the ginseng products that are consumed in South Korea are consumed within the health foods category. (National Institutes of Health)

#10. American ginseng has the largest potential for growth within the ginseng industry today. In a study commissioned in 2007, the retail value of American ginseng was expected to have a CAGR of 35.9% annual growth through 2016. At the same time, volumes were only expected to increase by 5.9%. (HKEXnews)

#11. The current total global demand for ginseng products, by the end of 2016, was an estimated 5.2 million kilograms. (HKEXnews)

#12. Hang Fat Ginseng has been one of the largest buyers of American ginseng in the past 20 years. In some years, they would purchase up to 70% of the market share for import. About $480 million is brought into Ontario every year through ginseng growth. Over one-third of Canadian growers sold their entire crop to Hang Fat and have yet to receive any money from the transaction. (Bloomberg)

#13. Ginseng shops in North America sell small cellophane bags of the root for about $300 each. It can then be used for food, tea, supplements, or put into gum, candy, and even hair-care products. (Bloomberg)

#14. Since 2013, the average price of ginseng originating from Canada has risen by over 60%. (Bloomberg)

#15. When combined with an overall medicinal herb growing industry, the total revenues generated through ginseng sales total $25 billion in China. For the 5-year forecast period ending in 2017, the industry achieved an annual growth rate average of 15.9%. (IBIS World)

#16. There are currently 2.6 million businesses in the United States that offer Chinese medicinal herbs in some way to their customers in China. In total, these companies employ a total of 16.6 million people. (IBIS World)

#17. Chinese medicinal herbs, including ginseng, are forecast to grow by 11.6% annually through 2022. At the same time, China’s GDP is forecast to grow an average of 6.5%. (IBIS World)

#18. 94% of all ginseng exports that original from Canada eventually make it to China. About 74% of the total production of American ginseng, which includes acreage in Wisconsin as well, is traded through Hong Kong markets before it reaches its final destination. (Imperial Ginseng)

#19. More than 5 million pounds of American ginseng products are consumed in the Asia-Pacific region every year. That accounts for 90% of the American ginseng market. (Imperial Ginseng)

#20. Wild ginseng is still a small part of the market as well. The average size of a wild ginseng is just 6 grams. In 2017, a 260-gram wild ginseng root was auctioned at $1.38 million in China. (People’s Daily Online)

Ginseng Industry Trends and Forecast

Through 2025, the global dietary supplements market is expected to achieve a CAGR of 7.4%. As an important component of this market, the ginseng industry is expected to remain strong. Trends within the industry will continue to grow specific segments, namely personal care, oral care, and food products.

If high-level clinical research is completed during this forecast period showing that there are potential medical benefits for ginseng, then the medical segment for this industry will likely see explosive growth. Because there are high levels of uncertainty within this segment, however, it is difficult to predict any growth or contraction for medical use within the forecast period.

Ginseng has also been recently seen as an energy booster. Demands for capsules will likely continue to increase, as will easy-to-consume products, such as ready-made teas, energy drinks, and weight loss products.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.