Cement is a core component of many construction products. The first cements were produced in the early 19th century. Since then, it has become a global industry wherever large deposits of limestone or similar materials are contained. Ghana has become an important part of the African market for cement in recent years.

Important Ghana Cement Industry Statistics

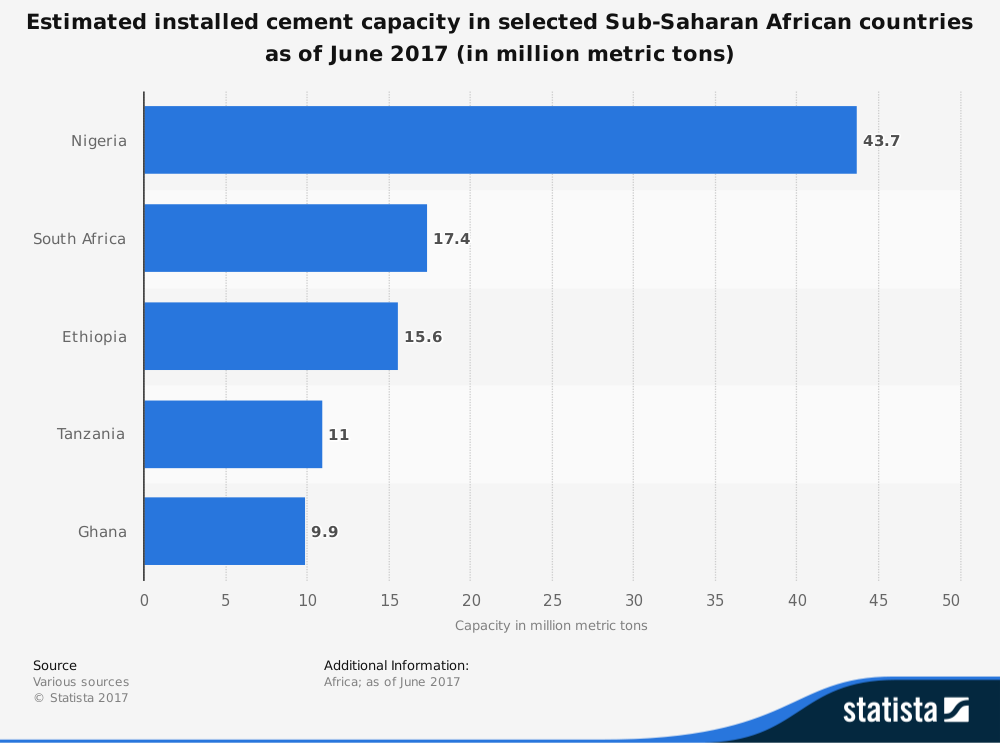

#1. Local cement manufacturers in Ghana have an installed capacity to produce about 7.4 million tons of product every year. That is above the annual consumption of cement in Ghana, which is estimated to be 5 million tons per year. (Ghana Trade)

#2. About 500,000 tons of bagged cement are imported into Ghana every year, jeopardizing the local industry. Some cement importers have made declarations that their cost and freight from China was as low as $25 per ton. (Ghana Trade)

#3. Chinese cement imports may cost the Ghana cement industry more than $13 million per year. (Global Cement)

#4. There are currently 8 total plants that are part of the Ghana cement industry. All but one of them are located along the coast. (International Cement Review)

#5. The leading cement employer in Ghana, Dangote Cement Ghana, is responsive for a manufacturing workforce of 2,000 people. Another 2,400 drivers’ mates are employed, and an additional 20,000 people receive indirect employment benefits because of this company’s presence in the local economy. It began operations on February 10, 2010. (Business Ghana)

#6. More than $100 million has been dedicated by Dangote toward an expansion program that has funded a new grinding plant in Takoradi, which was expected to be completed by the end of the year in 2017. (Business Ghana)

#7. Dangote recently purchased 1,000 new trucks, at a cost of $82 million, to aid customers with a free delivery option throughout all of Ghana. (Business Ghana)

#8. Cement manufacturing represents just 3% of the total weight of manufacturing production in Ghana. The latest figures reported, from 2004, indicate that only cutlery, paper products, and electrical equipment represent a lower overall manufacturing weight. (Stats Ghana)

#9. The capacity utilization for the Ghana cement industry hovers around 46%. That is still higher than other nations in the region, such as Nigeria, where capacity utilization hovers around 22%. (World Bank)

#10. Cement consumption in Ghana and the surrounding region is the lowest in the world. China leads the world, at 750kg per capita. The global average for consumption is about 340kg per capita. In Ghana, it is about 70kg per capita. (World Bank)

#11. Despite the high levels of installed production, from 2001-2007, Ghana was a net importer of cement, which helped to depress the local cement industry. (World Bank)

#12. The overall mineral sector within Ghana is estimated to contribute about 10% of the country’s GDP. It also accounts for just over 14% of the total government revenues that are achieved. Cement is a very small component of this sector, however, as gold and crude petroleum account for 64% of the industry. (U.S. Geological Survey)

#13. Since 2009, cement production levels have continually increased. From 2009-2013, production levels when from 1.8 million tons to 3 million metric tons. In 2017, an estimated 5 million tons was achieved. (U.S. Geological Survey)

#14. In 2015, Ghana’s construction sector experienced a 6.2% growth from the previous year, helping to support expanding domestic production levels of cement. (Oxford Business Group)

#15. Cement producers in Ghana were able to increase product pricing by almost 10% in 2015 from figures the year before, to a total cost of $7.30 for a 50kg bag. Depreciating local currency was the main cause of the increase, however, which kept revenue levels relatively static. (Oxford Business Group)

Ghana Cement Industry Trends and Analysis

Ghana currently has more than 2 million tons of cement surplus being produced domestically each year. Another 1 million tons of cement is believed to be imported into the country every year as well. That means pricing within this sector will likely continue to fall until the government of Ghana can gain some measure of control over how much cement is being imported and produced.

Additional causes for concern for the Ghana cement industry are the valuation of the cedi against the U.S. dollar. Its valuation has fluctuated quite sharply in recent years, creating an unpredictable annual valuation of the international market for cement products.

A further challenge exists with the limited limestone reserves which exist in Ghana. At the same time, investments have been capacity capped since 2013 within the industry.

Two new manufacturers are looking to enter the Ghana cement market. There is the potential for growth within the industry, but only if the domestic economy grows enough to support additional building projects.

With added support by the government to require import licensing for new cement imports, domestic demand should continue to grow. Production levels are forecast to reach as high as 9 million tons in the next 5-year period. If domestic demand continues to rise as well, then the Ghana cement industry may soon become stronger than it has ever been.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.