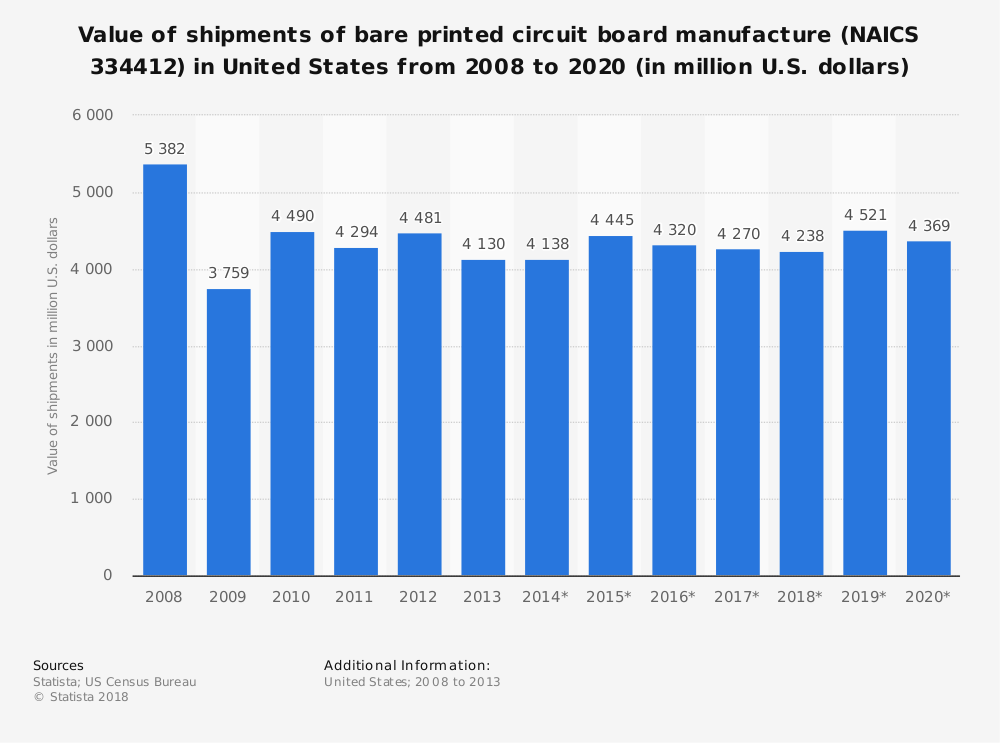

As the U.S. dollar has gained strength against global currencies in recent years, lower import sales and cheaper foreign printed circuit boards have created shifts in this industry. In the United States, about $4 billion in revenues are generated by the PCB industry each year. Since 2013, however, the industry has seen a -2.7% annual decline in revenues within the U.S. market.

Although manufacturers provide about 21,000 direct employment opportunities in the U.S., fewer than 500 firms are now active in this industry.

The PCB industry in China is a very different story. The industry there earns revenues to the tune of $95 billion per year. Since 2013, it has seen an annual growth rate of 8.4%. About 2,500 firms are active within the Chinese segment of the PCB industry, creating about 700,000 direct jobs.

Interesting Printed Circuit Board Industry Statistics

#1. In 2014, the global printed circuit board industry was valued at $65.5 billion. It has been growing each year since 2012, when a decline of $700 million affected the global industry. (Statista)

#2. Operating revenues in China topped $60 billion for the first time in 2016 for the PCB industry. (Statista)

#3. North American shipments for the PCB industry are up 10.8% in 2018, compared to the year before, according to July figures. Bookings increased by 4.9% over the year before, while order growth was up 11.7%. (IPC)

#4. By 2020, the Asia-Pacific region for the printed circuit board industry is expected to account for 85% of total sales. Demand from India, Malaysia, Japan, and Taiwan is expected to supplement the rising demand levels found in China. (Technavio)

#5. The global market for printed circuit boards is expected to grow at 6% through 2021, especially as devices that work with the Internet of Things continue to be adopted by households around the world. (Technavio)

#6. About 30% of the rigid PCB shipments in North America each year are destined to the military and aerospace markets. In August 2016, that figure reached a peak of 45.7%. (IPC)

#7. The U.S. market has seen positive order growth for 13 consecutive months as of July 2018. Positive year-over-year sales reached 10 consecutive months at the same time, while sales growth remained above parity for the 17th consecutive month. (IPC)

#8. Based on geography, China controls 43% of the printed circuit board industry. The next largest share belongs to South Korea, at 16%, then Hong Kong, at 14%. Japan controls an 11% market share. In comparison, the North American share of the industry is just 5%. (Toradex)

#9. 37% of the PCB industry is focused on standards multilayer products. 18% of the industry involves flexible circuits. Then IC substsrate and HDI each control 15% each, while rigid 1-2 sided printed circuit boards account for 11% of industry revenues. (Toradex)

#10. About $7.5 billion of the PCB industry comes from the production of flexible printed circuit boards that are manufactured in China. (TMR Analysis)

#11. About 2% of the PCB industry is focused on producing boards that are above 18 layers. In comparison, boards that are 4 layers control about 13% of the PCB market. (Research Gate)

#12. The average thickness of a PCB is between 0.5mm to 0.7mm under current production standards. Within the next 10 years, the average thickness is expected to decrease to just 0.4mm. Next-generation microprocessors may even work with 0.3mm PCBs. (Toradex)

#13. 90% of the PCB industry uses the contact imaging process for production today. This process creates fine lines with better conductor geometry than other manufacturing methods. (Toradex)

#14. Because multiple materials can be printed on the same layer of a PCB, thick film technology allows each product to offer a wide resistance range. Current processes allow for 20 ohm to 10 Mohm. (Toradex)

Printed Circuit Board Industry Trends and Analysis

The PCB industry may have seen steady declines over the past 5 years, but times are changing. With three-month rolling averages for orders and sales having a book-to-bill ratio greater than 1, this indicates that demand is greater than supply. That is an indicator that future growth is likely. Although semiconductor sales for the industry peaked in Q4 2017, the indexes have been in positive territory for the last 24 months.

There is also a 3/12 rate of change for new orders in the United States for electronics, which continues to push sales upward and keep the industry strong.

Strong orders from China will continue to boost the global industry as well, with 2018 offering 7% growth for the market by itself.

Although the printed circuit board industry works with mature markets, it also provides the fuel for innovative new electronic products. Continued innovation in the equipment and manufacturing services sectors for electronics will keep this industry growing in the next 5-year period, with total values forecast around $70 billion for PCBs.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here. Brandon is currently the CEO of Aided.