Chocolate. It’s something almost everyone loves, though not everyone is ready to admit their passions publicly. This means there will always be a certain level of strength contained within the chocolate industry trends.

Chocolate is the largest part of the $34.5 billion US confectionary industry, accounting for over 60% of total sales seen every year. This is according to the National Confectioners Association.

That’s not to say that chocolate is just a nice dessert to have. Chocolate is an integral part of some cultural entrees. It is so versatile that it can be used in cakes, to make a candy bar, or to create a spicy sauce. It’s rich in antioxidants as well, especially dark chocolate, and it may even prevent or delay cardiac disease and other health issues.

Combine the love for chocolate with the perceived health values it may have and you’ve got a winning product. No wonder why sales are expected to grow by 6%.

Where People Want to Get Their Chocolate

- The leading seller of chocolate products for the industry today is the grocery store, where 22% of all chocolate sales are made.

- Mass merchandise outlets are a close second in sales, contributing 21% of the total revenues seen.

- 16%. That’s the percentage of chocolate sales that convenience stores contribute to the industry.

- Club stores also have double-digit sales in chocolate, contributing 13% annually to the total revenue number.

- Drug stores, confectionary stores, and value/dollar/discount stores contribute 9%, 5%, and 4% respectively.

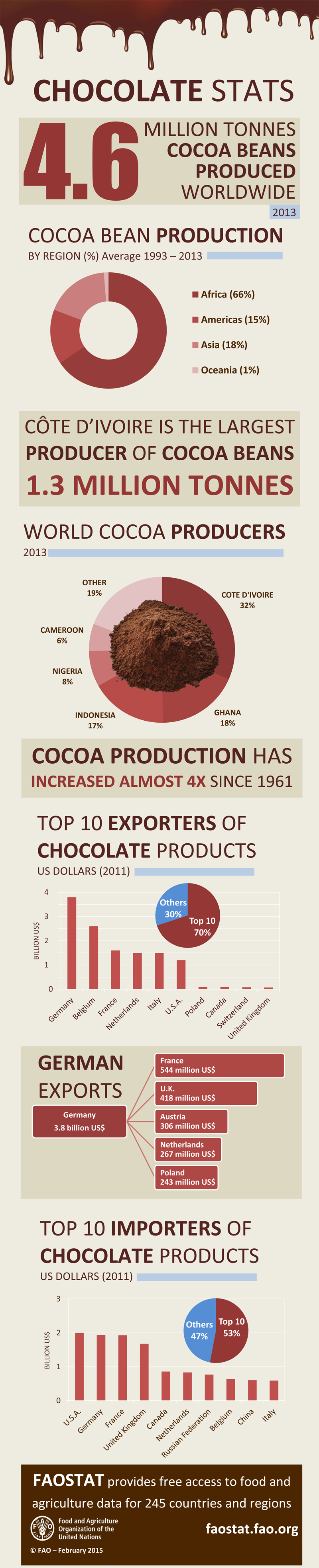

- 70% of the chocolate that people purchase today comes from cocoa production in West Africa. Ghana and the Ivory Coast are the two largest suppliers in the region. Because of ongoing conflicts in this area, supply levels are rarely diversified enough to be normalized.

- 17% of cocoa production comes from North American and South America, with most of it coming from the latter.

- According to the International Cocoa Organization, a new cocoa plant may take up to 5 years to begin producing a crop. This makes it difficult for new farmers to begin production because of the time investment.

- Global production is expected to continue at levels above 4 million tons.

- According to 2014 data, the US doesn’t even crack the top 10 in chocolate consumption. Switzerland leads the world, consuming 12kg of chocolate per person, per year. Despite this fact, 20% of the world’s chocolate is actually sold in North America.

People will get their chocolate wherever it is most convenient for them. It’s often picked up at the grocery store because there are so many varieties available. Forget the candy bars and other treats that are the impulse buys up at the checkout stand for a moment. Chocolate comes from cocoa powder, cooking squares of different purity, and even in the chocolate chips that make up great cookies. You’ll find chocolate in ice cream, in cookies, and even in pasta these days. Since supplies are never really “normal” for this industry, the demand stays strong because there is a thought in the back of a consumer’s head that says, “This might not be here the next time I want it, so I’d better buy it today.”

What Keeps People Coming Back for More

- In the United States, the strongest chocolate segments are premium and dark chocolate products. Perceived health benefits have fueled a 93% growth in launches, allowing dark chocolate to make up 20% of the total US market for this industry.

- Unique products and consumption experiences also help to bring consumers back to one of their favorite products repeatedly.

- Global drivers are also increasing sales, especially within the APAC region. As taste preferences for Western styles of chocolate consumption increase, some forecasts predict up to a 30% increase in Chinese chocolate sales by 2020.

- Euromonitor predicts that sales will continue at record global levels, exceeding $120 billion by 2020, driven by a consistent 2% increase in volume.

- The potential long-term growth in emerging economies – many of which have growing middle classes – is vast. To give just one example: the per capita consumption of chocolate in China is only a tenth of that in Switzerland.

- Despite these growth opportunities, just 8 market drive 70% of industry growth today: Brazil, China, Colombia, India, Russia, South Africa, Turkey and Vietnam.

- According to Euromonitor, in 2013, chocolate consumption in the US rose for the first time in at least 5 years.

Everyone might like chocolate, but even the best-tasting chocolate product gets old if that’s the only thing available to a consumer. What is bringing people back for more chocolate is innovation. New products, new concepts, and new tasting experiences help people to have the variety they want with this product. As demand increases in the developing markets where Western chocolate has been largely unavailable, the industry must be able to start adapting to change in order to meet demand. Sales of chocolate in China have doubled in the last year, but the average consumption rate is 10% of what the Swiss consume.

The Economy and the Chocolate Industry

- A National Confectioners Association survey in 2013 found that 28% of consumers had changed buying habits because of the economy.

- 57% of consumers who changed their buying habits opted to purchase cheaper chocolate products or switched to “value” or “generic” products.

- In the UK, sales of bite-size confectionery grew 40% between 2009 and 2013. Producers like Mondelez are making bite-size chocolates one of their primary global innovation platforms.

- Cémoi reports that private-label chocolate sales have soared 27.5% in the United States since 2009.

- A Hartman Group study estimates that annual sales of dark chocolate are growing by 7.7%. For consumers that purchase this chocolate product, 73% of them say it is because they see dark chocolate as being healthier.

- “Selectionists” now account for around 30% of consumers in the US. These are consumers who consider the origins of the cocoa as part of their purchasing process. 4.8% of chocolate product featured an origin claim last year.

70% of household decision-makers are women. Many are looking to save money when shopping for groceries, but still want to treat themselves with at least one premium product. Often that product is chocolate. Classified by the industry as a “hybrid” customer, the goal is to market the value of the chocolate while still showing how it can be a cost-conscious purchase. The industry must identify changes like these in order to continue the path toward continued growth that it has been experiencing for the past few years.

How the Chocolate Industry is Adapting to Change

- Over $800 million is set to be invested in the coming years to improve farmer productivity in cocoa production around the world. This is expected to have an impact on sourcing costs and living conditions within the farming community.

- Mars fears demand could exceed supply by 1 million metric tons by 2020, which may cause supply shortages. A proposed fix for this issue would be to sequence the genome of cocoa so it can be adapted to more climates.

- With 1 in 3 people in the US being overweight or obese, the chocolate industry must also develop healthier products to defeat taxation policies on chocolate or other regulation restrictions that may be passed in an effort to help people lose weight. Governments, who already spend 7% of their healthcare budgets on weight-related issues according to KPMG, are focusing on diet and the impact of such foods as chocolate.

- As mentioned by KPMG, companies are recognizing the need to go beyond single initiatives with a strategic approach to improve yields and consumer trust.

- The private label market remains relatively underdeveloped: it has 19.1% of the food market, but only 3.6% of the chocolate segment.

- Seasonal sales continue to be the largest component of chocolate sales in many regions. 25% of all chocolate sales in Japan, for example, occur on Valentine’s Day.

- 32% of Chinese consumers who eat chocolate prefer foreign brands over local brands.

- Just 6% of people who purchase their groceries online will purchase chocolate products as part of their final checkout.

- Personalizing chocolate, with tie-ins through 3D printing like that provided by Chocobyte and other technologies, may even help consumers increase chocolate consumption because they can produce their own products at home.

Unlike other industries, the chocolate industry faces a challenge in creating a broader distribution network for fewer products instead of more variety. Mature markets are looking for new products. Absolutely. The developing markets, especially in the APAC region, want what others already have. This means adapting to change for the chocolate industry must include increasing production and distribution of popular current products, yet not ignore the niche demands for dark and premium products. Should this happen, then the 3% annualized growth that has been forecast for this industry should be easily met.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.