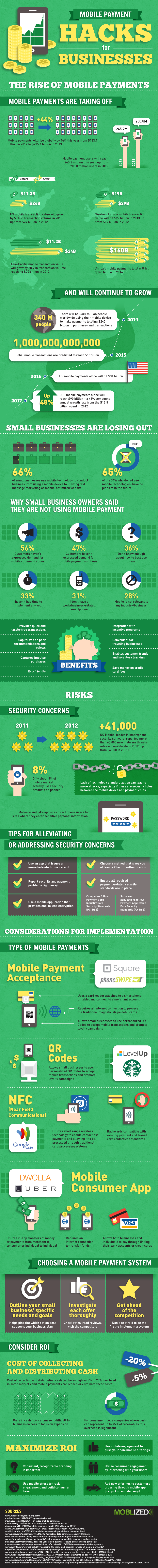

Mobile Payment Hacks for Businesses

Mobile Payments Are Taking Off

Research has revealed that globally, mobile payments will rise by 44% this year. This translates to an increase from $163.1 billion in 2012 to $234.4 billion in 2013. Mobile payment users are projected to reach 245.2 million in 2013, a significant increase from 200.8 million in 2012.

In the United States, Mobile transaction value is expected to increase by 53% in 2013 based on transaction volume, an increase from $24 billion in 2012. In Western Europe, it is expected that mobile transactions will rise from $19 billion in 2012 to $29 billion in 2013.

In Asia-Pacific, the growth of mobile transaction value is expected to grow by 38% which is an increase from $11.3 billion in 2012 to $24 billion in 2013, while in Africa, mobile payments total is expected to hit $160 billion by 2016.

Market Growth

The trend is on the increase and it is expected to continue in growth.

It is expected that by 2014, there will be about 340 million people using mobile devices to make payments world-wide. This translates to an estimated $245 billion in purchases, payments and transactions. By 2015, global online transactions are estimated to reach $1 trillion while by 2016, mobile payments in the United States alone is expected to reach $31 million.

By 2017, in the United States, mobile payments will reach approximately $90 billion. This reflects a 48% compound annual growth rate from 2012 value of $12.8 billion.

Small Businesses Are Losing Out

Studies have revealed that 66% of small businesses make use of mobile technology to conduct businesses. This includes utilizing text messages message marketing or optimization of mobile websites.

Of the remaining 34%, 64% have no use of mobile technologies and have no plan in that direction.

Here are some reasons small business owners gave for not using mobile technologies.

• 56% said customers have not expressed an interest in mobile communications.

• 47% said customers have not expressed an interest in mobile payment options.

• 36% are not knowledgeable enough to make the best use of the development.

• 33% have not had enough time to implement the plan.

• 31% do not have a business related to a mobile device like smart phones.

• 28% say mobile technology is not relevant to their industry and business.

• More than 34% of North American retailers accept PayPal as of December 2016.

• Paypal saw a net revenue of $2.98 billion in its first quarter of 2017.

Benefits of Mobile Technologies

• It provides a fast and trouble free transaction.

• It can be integrated with other incentive programs.

• It thrives on peer recommendation and product reviews.

• It is very convenient for businesses associated with travelling.

• It takes into consideration purchase made on impulse.

• It allows for tracking of inventories and customer trends.

• It is eco-friendly.

• It allows for savings in credit card fees.

The Risk Involved

Top of the list is security concerns. It was reported by BQ Mobile, a leader in smartphone security software that there has been an increase in malware threats, resulting in an increase from 24,000 to 65,000.

It was discovered that only about 8% of the mobile market make use of the security applications on the phones. It is worthy of note that when there is a loophole between the mobile application and the payment processor, resulting from lack of standardization, attacks will be on the rise. Malware operates by directing users to sites where they can enter their passwords and sensitive personal information.

5 Tips for Addressing Security Concerns

1. Make use of an application that issues an electronic receipt immediately upon

completing transaction.

2. Report any security payment issues immediately.

3. Use applications that provide encryption from end to end.

4. Make use of methods that gives multiple authentication factors.

5. Make sure all required payments – related to security standards are in place.

Note that companies follow industry data, payment card, security standards (PCI DSS) while software follow Payment application, Data security and Standards (PA-DSS).

Consideration for implementation

Before implementing a mobile payment, there are some considerations to be made. Basically, you are going to consider the type of mobile payment.

Mobile Payment Acceptance

• Make use of a card reader attached to a smart phone or tablet before connecting to a retail account.

• You would require an internet connection to process the magnetic strip debit card.

• It allows QR codes to be used by small businesses. Thereby accepting transactions and promoting loyalty campaigns.

QR Codes

This allows businesses to accept payments and perform transactions via QR codes and accept loyalty campaigns.

NFC (Near Field Communications)

This makes use of short range wireless technologies allowing payment without contact with a traditional card processing system.

It is backward compatible with previous options of payments. Cards are transmitted through contactless standards.

Mobile Consumer App

It allows users and business to make payments through their banks, account and credit cards.

It requires an internet connection for funds to be transferred.

It makes use of in-app transfer of money or payments between merchant and consumer between individuals.

Choosing a Mobile Payment System

Here are some considerations that should be made before choosing a mobile payment option.

1. Make a list of your specific business needs and goals. By doing this you will be able to pinpoint which option supports your business the most.

2. Run detailed checks on each offer. Check reviews and rates, check the competition.

3. Be ahead of the system. Do not be afraid to be a pioneer of the system.

Consider the Rate of return

The cost of transaction may be as high as 20% in some markets and this can be alleviated by taking advantage of mobile payments. For companies dealing in consumer goods, overhead can be considerate as cash sometimes represents up to 70% of items received.

Maximize Rate of Return

Here are some methods through which rate of return can be maximized.

• It is important that your brand remains consistent and recognizable.

• Make use of mobile offers to track engagement and build a consumer base.

• Make use of mobile engagement to market your non mobile offers.

• Interacting with clients leads to consumer engagements.

• New offerings can be added to customers ordering through mobile applications.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.