President Barack Obama announced the formation of a new IRA program in his State of the Union speech in early 2014 called the “myRA.” Until that new program becomes a reality, today’s investors looking for retirement security tomorrow have a choice to make: is a traditional IRA the right way to go? Or should a Roth IRA be the first consideration? Let’s take a look at what distinguishes these two IRA’s from each other.

How Much Income Do You Make?

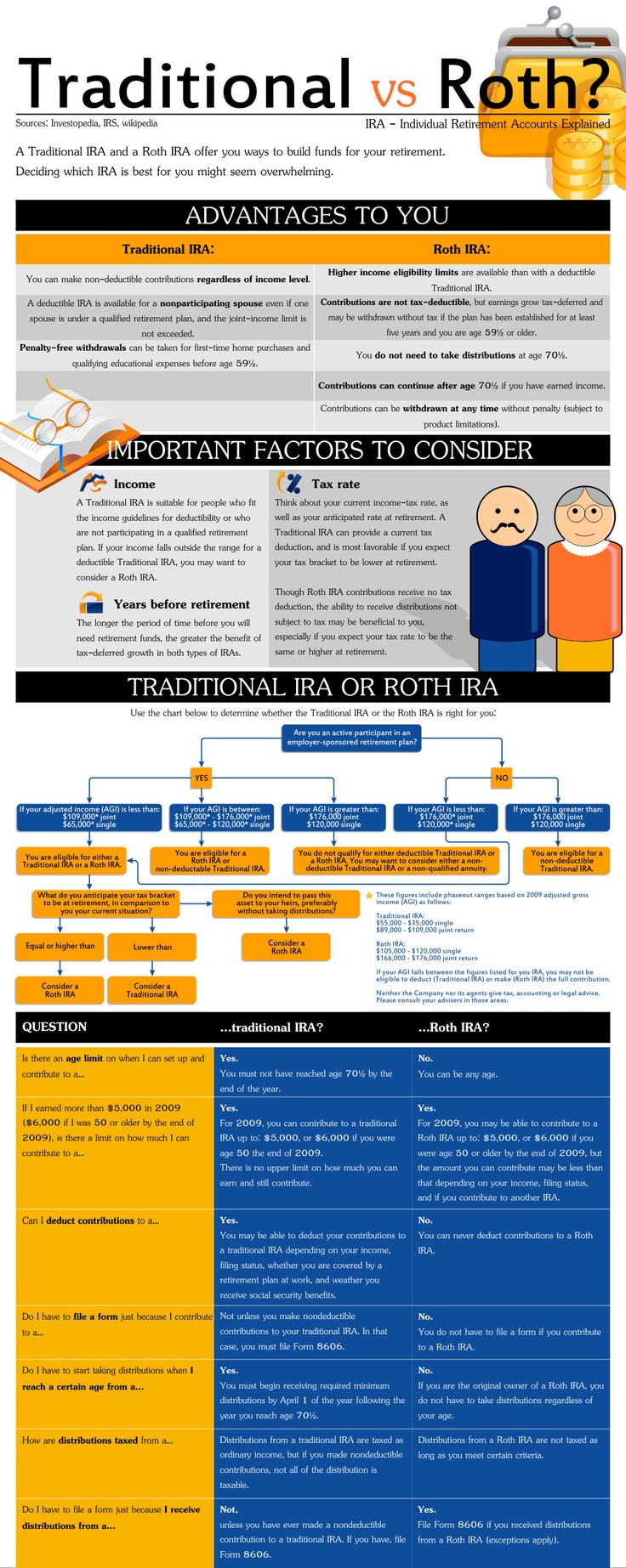

If you make more than $129,000, then you’re not going to be able to contribute to a Roth IRA. You’ll need to have a traditional IRA instead. That’s if you’re a single taxpayer and keep in mind that contribution limits begin phasing out at $114k per IRS statutes. You’ll pay an extensive marriage penalty here as well, because a married couple filing jointly have a contribution limit of $191k. For both IRAs, the maximum contribution in 2014 is $5,500 or 100% of your gross income, whichever is less.

Traditional IRAs don’t have any income limits. You simply contribute to the IRA every year based on the amount you wish to add to it so that it may continue to grow with earnings. You’ll need to make your contribution before the tax filing deadline.

Why Contribute to a Roth IRA If I Can?

Roth IRAs are all about giving you access to your money without having to pay taxes. The Roth IRA gives you tax-free growth and qualified withdrawals from this IRA are also tax-free. On the other hand, the traditional IRA gives you tax-deferred growth, but the contributions could be tax deductible. Any pre-tax income you put into a traditional IRA will be taxed upon distribution.

The Roth IRA also puts fewer restrictions on your age. Contributions are always withdrawn tax-free from a Roth IRA and earnings are tax-free after a 5 year aging period and when certain conditions are met. On the other hand, a traditional IRA will penalize you for any withdrawals made before you reach a specific age unless an exemption applies. You may also pay a 10% penalty on earnings in a Roth IRA if you don’t meet any exemptions.

Both IRAs Have Minimum Investment Programs

If you haven’t opened an IRA before, but you want to do so for the 2013 tax year, then a $2,000 minimum investment is required. You may also want to look at who will be handling your IRA, no matter which kind you decide to get, because some handlers charge servicing, set up, maintenance, and transaction fees.

If your income meets the qualifications for a Roth IRA, then you’re better off contributing to it than a traditional IRA. For some workers, however, they simply make too much money and cannot contribute to a Roth IRA. That’s why the traditional IRA is in place! The Roth IRA is perfect for lower income workers to save for their retirement. The traditional IRA helps everyone else do so as well.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.