The Fico Credit Repair How To

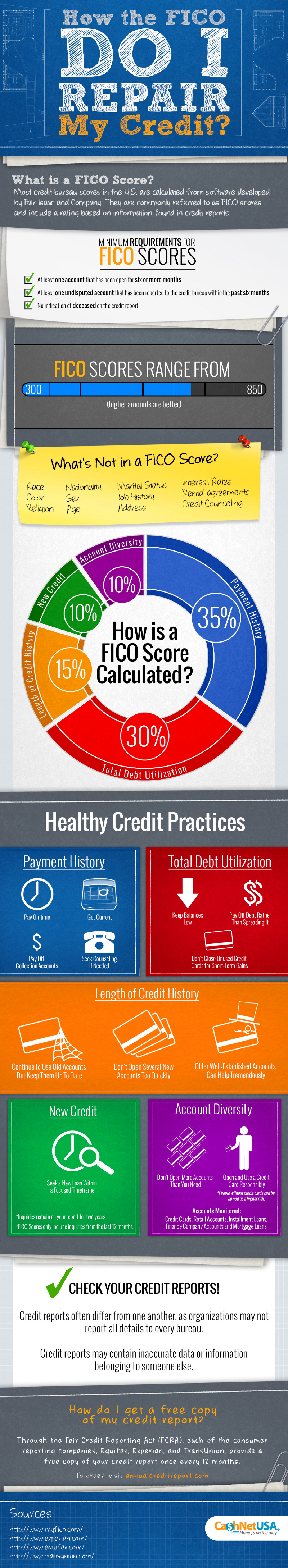

Wondering what a FICO is and how it affects your credit score? First of all FICO stands for Fair Isacc and Company. You will see FICO on your credit report and it is the software created by Fair Isacc and Company developed that most credit bureaus calculate your score with. There are three requirements the FICO require you have. You must have one account at least that has been open for no less than six months. You must have one account that has been undisputed and reported to credit bureaus in the past six months. And lastly you must have no indication of deceased on your report of credit. FICO scores range from 300 to 850. The higher the score you receive the better.

What Your Credit Does Not Include

Things that do not affect and are not included on your FICO report are the rates of interest you have on your loans or credit cards, your marital status, your nationality, your race, your rental agreements, your history of jobs, what sex you are, your color, if you had any credit counseling, your address you reside at, how old you are, or your religion you practice.

FICO Breakdown

FICO score is calculated by a few different things. Thirty five percent of it is based on your history of payments. Your total debt utilization makes up 30% of your FICO score. Length of your credit history affects 15% of the calculation. New credit affects the calculation by 10%. And account diversity also affects your score by 10%.

Tips to Healthy Credit Practices

For healthy credit practices there are a few steps you should take. For payment history make sure you pay on time, get your account current and stay current, seek out counseling for your credit if necessary, and pay those credit collections off. To utilize your total debts properly you should keep all balances as low as possible, do not spread debt out but pay it off quickly, do not close those credit cards just to receive short term gains. For the length of credit stay with those old accounts just keep them current, avoid opening new accounts quickly, and get old accounts established. For new credit only apply for loans with a focused time frame. Credit reports will show any inquiries for up to 1 year, but inquiries will stay on report for two years. For account diversity only opens and uses credit cards responsibly and avoid opening more than needed.

It is also recommended to check your credit score often. Your credit report may be different depending on the company you use to check your score, some companies leave out some information that others may show. Your credit score may also have inaccurate information or data that actually belongs to another person. You can receive a free report every 12 months through Experian, Equifax, and TransUnion.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.