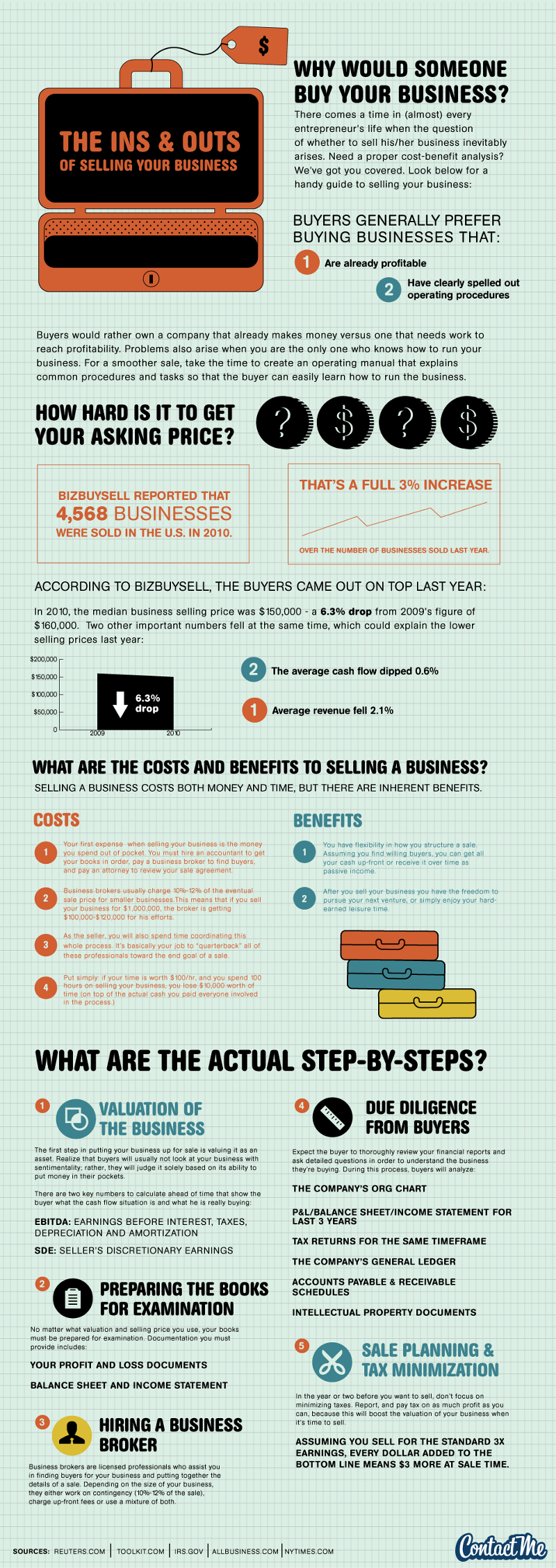

The Ins & Outs of Selling Your Business

In the life of an entrepreneur, there comes a time when he asks himself a question, “Should I sell my business?” If you need a portable cost benefit analysis, that is what this article seeks to analyze.

Generally speaking, buyers prefer buying businesses that are already profitable and have a clearly spelled out operating procedure. Issues might also arise if you are the only one who knows how to run the business. If you want to sell with ease, create an operating manual that explains the daily procedures and duties so the buyer can easily learn the reins of the trade.

Getting Your Asking Price

According to BizBuySell, it was reported that 4,568 businesses were sold in 2010 in the United States alone. This amounts to a 3% increase as compared to the number of 2009. According to the report, the median selling price in 2010 was $150,000 a 6.3%$ drop from the 2009 figure of $160,000. Average cash flow fell by 0.6% and average revenue fell by 2.1%. This accounts for the lower selling price in 2010.

Cost and Benefits of Selling

Despite the fact that there are inherent benefits of selling a business, it costs both time and money to successful sell.

Cost

1. When you are selling your business, there are inevitable expenditures. You will have to hire the services of an accountant to put your books in order, the services of a business broker and a lawyer to review the sale agreement. All these expenditures will come from your pocket.

2. 10-20% of the eventual sale price is normally charged by the business brokers. This implies that if you are selling your business for a million dollars, the business broker will take between $100,000 to $120,000 for his efforts.

3. You will spend time and effort managing the entire process since you are the seller. Basically you will have to quarterback the people involved all the way to the end of the sale.

4. In summary, assuming you are worth $50 a hour, if you spend 100 hours in selling your business, you have lost $5,000 worth of your time. In addition to all the professionals you would have hired.

Benefits

1. After the sale, you can not pursue some other areas of interest or simply go on a long deserved vacation.

2. You can structure the sale pattern. You can receive the one time payment or you can receive it over a period of time as passive income.

Steps to Selling Your Business

1. Value Your Business

The first thing to do before you sell your company is to evaluate your assets. This is necessary because your business will not be looked at with sentiments by prospective buyers, but it will be looked at from an objective point of view and needs to portray the potential of putting money in their pockets.

EBITDA: Earnings before interest, taxes depreciation and amortization.

SDE: Sellers discretionary earnings.

2. Prepare the Books for Examination

Irrespective of the selling price, your records must be in order for examination. The documentation must include the following:

• Profit and loss statement.

• Balance sheet and income statement.

3. Hiring a Business Broker

You need a business broker because it is he who will find a buyer for your business and put the deal together. Depending on the business, they normally charge 10-20%. In some cases, the upfront charge is also demanded.

4. Due Diligence

You should expect your buyers to exercise due diligence in the examination of your financial report, asking questions that will enable them to understand the business you are into. Areas of interest will include the following:

• The company’s organizational chart.

• Profit and loss, balance sheet, income statement for the last three years.

• Tax returns for the same time period.

• The company’s general ledger.

• Accounts payable and receivable schedules.

• Intellectual property documents.

5. Sale Planning & Tax Maximization

Few years prior to selling your business, do not focus on minimizing tax, report, and pay as much tax as you can. This will increase your credibility when selling comes. For instance, if you are selling at the standard 3 times earning, for every dollar added to the base line, there is an increase of $3 at the time of sale.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.