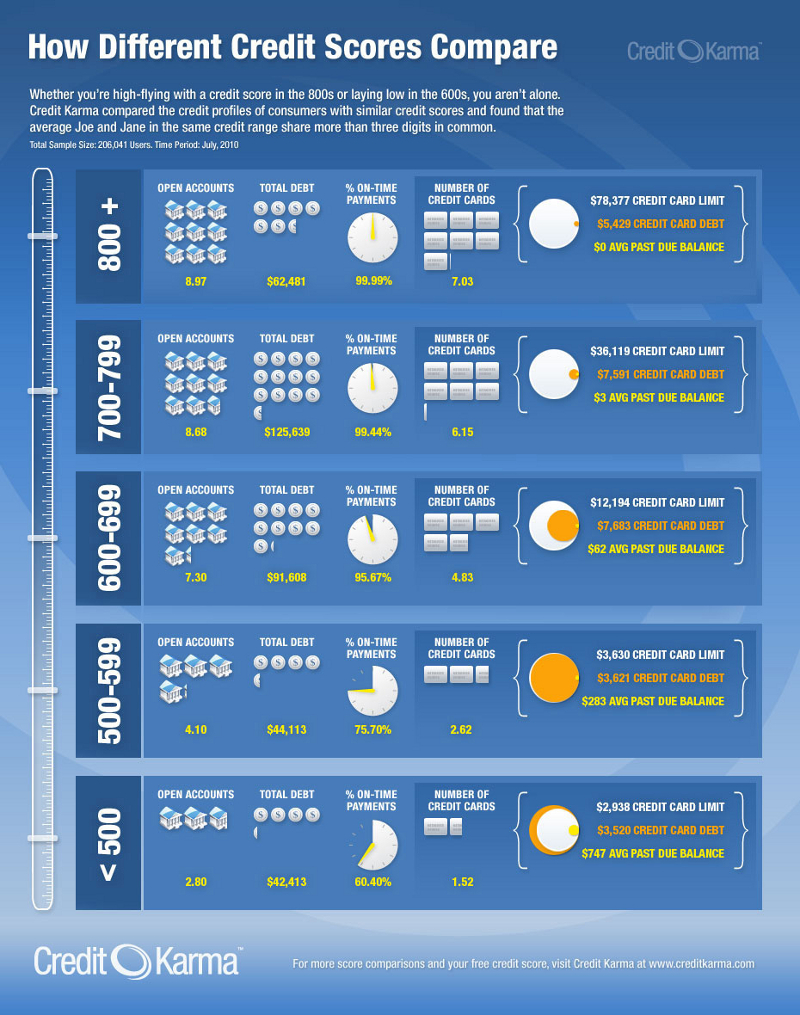

How Different Credit Scores Compare

Credit Karma has shown how different credit scores compare with Total Debt to Number of Open Accounts. Listed below are the credit score categories and the characteristics associated with each.

Group 1: Less than 500 Score

Consumers with less than a 500 credit score had an average of:

Total Debt: $42,413

Credit Card Debt: $3,520

Credit Card Limit: $2,938

Average Past Due Balance: $747

Percent of On-Time Payments: 60.4%

Number of Credit Cards: 1.52

Number of Open Accounts: 2.8

Group 2: 500-599 Score

Consumers with 500-599 credit score had an average of:

Total Debt: $44,113

Credit Card Debt: $3,621

Credit Card Limit: $3,630

Average Past Due Balance: $283

Percent of On-Time Payments: 75.7%

Number of Credit Cards: 2.62

Number of Open Accounts: 4.1

Group 3: 600-699 Score

Consumers with 600-699 credit score had an average of:

Total Debt: $91,608

Credit Card Debt: $7,683

Credit Card Limit: $12,194

Average Past Due Balance: $62

Percent of On-Time Payments: 95.67%

Number of Credit Cards: 4.83

Number of Open Accounts: 4.83

Group 4: 700-799 Score

Consumers with 700-799 credit score had an average of:

Total Debt: $125,639

Credit Card Debt: $7,591

Credit Card Limit: $36,119

Average Past Due Balance: $3

Percent of On-Time Payments: 99.44%

Number of Credit Cards: 6.15

Number of Open Accounts: 8.68

Group 5: 800+ Score

Consumers with 800 + credit score had an average of:

Total Debt: $62,481

Credit Card Debt: $5,429

Credit Card Limit: $78,377

Average Past Due Balance: $0

Percent of On-Time Payments: 99.99%

Number of Credit Cards: 7.03

Number of Open Accounts: 8.97

Facts Between Subcategories

A look at the bigger picture shows interesting facts between the subcategories of each credit score group.

Total Debt

Increases from Group 1 to Group 2 by 4.01%.

Increases from Group 2 to Group 3 by 107.67%

Increases from Group 3 to Group 4 by 37.15%

Decreases from Group 4 to Group 5 by -50.27%

Credit Card Debt

Increases from Group 1 to Group 2 by 2.87%

Increases from Group 2 to Group 3 by 112.18%

Decreases from Group 3 to Group 4 by -1.20%

Decreases from Group 4 to Group 5 by -28.48%

Credit Card Limit

Increases from Group 1 to Group 2 by 23.55%

Increases from Group 2 to Group 3 by 235.92%

Increases from Group 3 to Group 4 by 196.20%

Increases from Group 4 to Group 5 by 117.00%

Average Past Due Balance

Decrease from Group 1 to Group 2 by -62.12%

Decrease from Group 2 to Group 3 by -78.09%

Decrease from Group 3 to Group 4 by -95.16%

Decrease from Group 4 to Group 5 by -100.00%

Percent of On-Time Payments

Increase from Group 1 to Group 2 by 15.30%

Increase from Group 2 to Group 3 by 19.97%

Increase from Group 3 to Group 4 by 3.77%

Increase from Group 4 to Group 5 by .55%

Number of Credit Cards

Increase from Group 1 to Group 2 by 72.37%

Increase from Group 2 to Group 3 by 84.35%

Increase from Group 3 to Group 4 by 27.33%

Increase from Group 4 to Group 5 by 14.31%

Number of Open Accounts

Increase from Group 1 to Group 2 by 46.43%

Increase from Group 2 to Group 3 by 17.8%

Increase from Group 3 to Group 4 by 79.71%

Increase from Group 4 to Group 5 by 3.34%

Summary

In summary, consumers that have a credit score of 500 – 599 and raise their score to 600 – 699 will have the highest Total Debt increase 107.67%, highest increase of Credit Card Debt 112.18%, highest increase of Credit Card Limit 235.92%, highest increase in Number of Credit Cards 84.35%, highest increase of Percent of On-Time Payments 19.97%, and the highest increase in the Number of Credit Cards 84.35%.

In addition, consumers that have a credit score of 600 – 699 and raise their score to 700 – 799 will have the highest increase in Number of Open Accounts. Consumers that have a credit score of 700 – 799 and raise their score to 800 + will have the lowest Average Past Due Balance of 0.

How different credit scores compare provides information that will help the consumer better understand their credit score and the characteristics of the group.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.