Understanding Money Matters

Nowadays, parents are always spend time with their kids during weekends. They usually open up to their kids about money matters. It is true that money is one of the most significant things in the world. Without money, people cannot purchase and fulfill their every day needs. Money talks are really significant to discuss with the kids because in this way they can realize how they can manage money. In this case, parents can easily make their kids responsible when to come to handling money when they are studying or working.

Teaching Your Children

Teaching children about financial management is the best thing that parents can do to help their children become more mature and responsible in managing their money. This topic is not just a simple one that you usually talk with your kids. It is also true that many people today are suffering from financial difficulties even if they have a regular work. At this point, financial management is really significant to be taught by parents to their children. When their children are at the age of 8 and above, they can easily talk about it because they have the knowledge to understand those things.

Frequency of Discussion

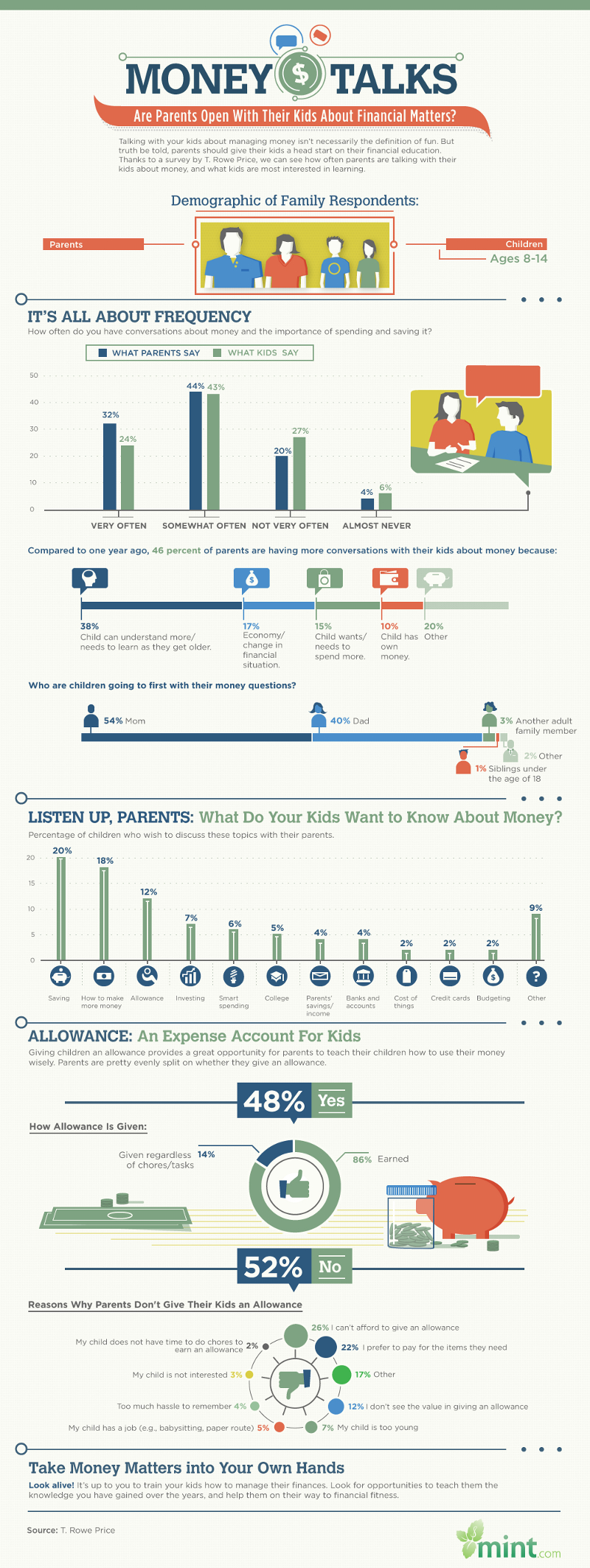

How often parents talk with their kids about spending and saving money? Actually, there are 44 percent of parents who fairly talk about money to and 43 percent of children give reactions and questions. In this percentage, you can see that there are numerous parents who do not usually talk with their kids regarding the significance of saving and spending money wisely. It is really crucial today to give children a lot of ideas about financial management because this will surely help them in managing their money in the future.

Does Gender Matter?

Mothers are the ones who usually talk with their kids about money. They are giving time to talk about it with their kids because their kids can understand it perfectly and learn more as they get older. Aside from that, there is a lot of information that kids need to know, and this information are listed below.

• Saving money.

• How to create their own money.

• Allowance.

• Investing.

• Smart pending.

• College.

• Income of parents.

• Accounts in the bank.

• Cost of the things that they really needed.

• Credit cards.

• Budgeting.

Majority of parents today are giving their children daily allowance because this is also the best way to teach them on how to use their money smartly and to save their extra money. But there are some parents who don’t give their children allowance because their children are too young to handle money, they don’t have enough a lot of income, or they don’t see values in giving their children allowance. Some of them worry about the things that their children will purchase using the money that they will give.

It always depends on the parents on how they will teach their children about spending and saving money. Giving them a lot of information regarding financial management will make them more mature even if they are at a young age.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.