As instability hits the financial market, investors begin to look for options that will help to secure their money outside of traditional stocks. Bonds are often seen as a safe place for money, but so are mutual funds and ETF investments, which are Exchange Traded Funds. There are some key differences between these two funds, even though their structure is the same. Let’s look at them to see which one might be the smarter investment for you.

ETFs Are More Like Long Term Stock Investments

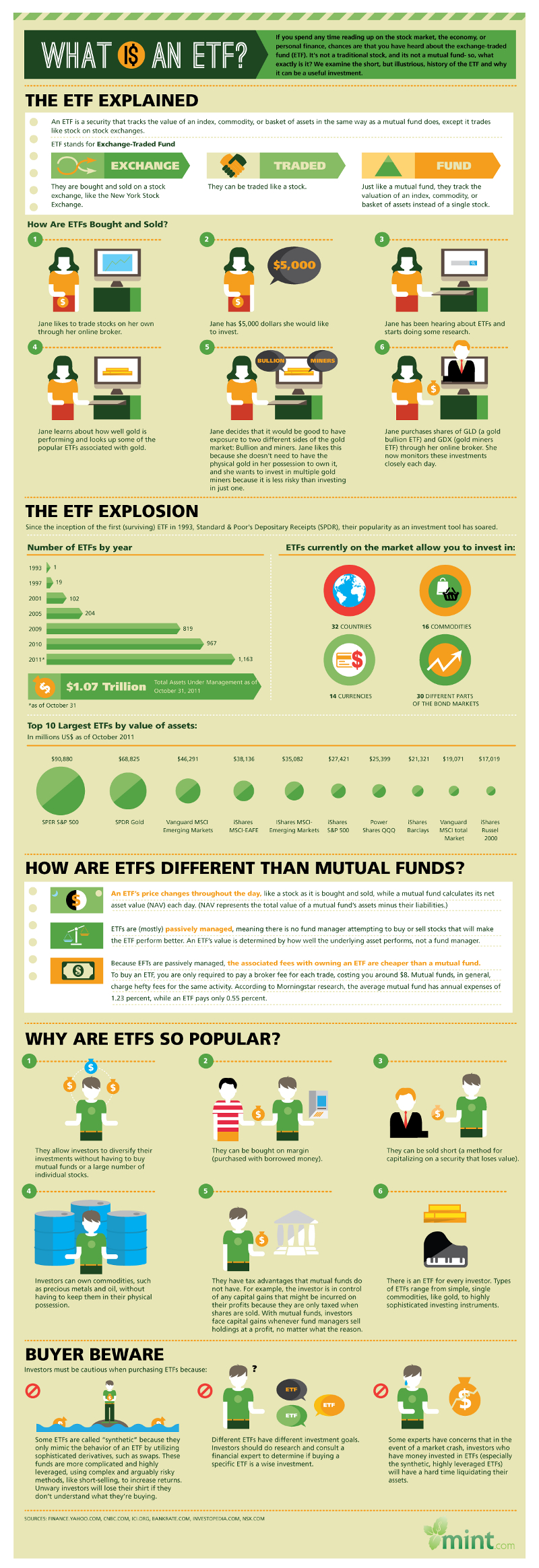

With lower costs and better tax treatment at the end of the year, ETFs are quickly growing in popularity. Like mutual funds, you’re purchasing a pool of stocks and bonds by making an investment into an ETF. What you don’t do, however, is buy and sell stock day after day like a mutual fund does. You’re instead working to buy low and sell high or selling short to get profits from your investments at the best possible time. Because there are no daily transactions, there are fewer costs that need to paid to maintain the account – sometimes saving up to 2.5%!

Because ETFs are like stocks, you can’t just invest a specific amount of money. You’ve got to determine how many shares you wish to purchase based on an active trading price. Just like a stock, you’ll have a bid price and an ask price. You’ll initiate your order at the ask price to determine the amount of shares. You’ll then end up with a purchase price that falls between the bid and ask price once the order is fulfilled. Mutual funds, on the other hand, have a fixed price every day. You simply invest the amount you want and your order is done.

Why Are Tax Implications Less With ETFs?

The tax benefits of ETFs are why they are growing in popularity so fast. When you decide to sell your ETFs, it is sold on an exchange just like a stock is. The underlying securities are not being sold to raise cash for redemption during a transaction. This means that there is no actual cash benefit, and no cash gain means no taxes! ETFs also allow the fund manager to buy and sell based on current market conditions that make sense for specific stocks and bonds within the fund, giving investors a better chance at higher returns.

Because ETFs are exchange based, however, there is a higher risk that a financial loss can occur with them than there is with a mutual fund. Of course any investment has the possibility of creating financial loss, but because mutual funds have their price set at the end of the day, you’ve got an idea of what will happen with your investment on a daily basis and don’t have to follow the stock ticker throughout the day to protect your investment.

Which Investment Is Right For Me?

ETFs are the perfect investment vessel if you’re looking for a higher potential for returns while tempering some of the risks that investing solely in stocks can bring. On the other hand, if you’re looking to manage risk more than bring in income, then mutual funds will make more sense for you. Either way, be sure to meet with the fund manager, get a gauge of their experience, and track their trading history before investing so that you can always get the most out of your money.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.