The cash ratio shows the liquidity of a business by measuring the amount of cash available in current assets to pay for current liabilities.

Cash Ratio Formula

Cash ratio = Cash + Cash Equivalents + Invested Capital / Current Liabilities (liabilities due within a year)

It is used to demonstrate business liquidity, and it is different from the quick ratio which shows a company’s ability to pay for current liabilities using assets that can be converted to cash, usually within 90 days, or the current ratio which shows the company’s ability to pay off short term liabilities due within the year with its current assets.

The cash ratio is more restrictive than either the quick ratio or the current ratio and leaves out accounts receivable and assets like inventory or other fixed assets that may be difficult to convert to cash. Investors and creditors like seeing the cash ratio because it shows how much cash the company has in the present moment to pay for liabilities, as accounts receivable may take weeks or even months to collect.

Cash Ratio Calculation Example

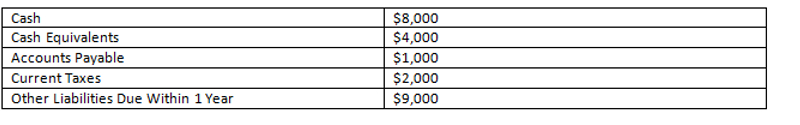

Taylor’s restaurant needs an upgrade to its kitchen that will cost $50,000 in total. He is requesting this amount as a loan from his bank, and the restaurant’s balance sheet looks like the following:

The cash ratio is calculated as ($8,000 + $4,000) / ($1,000 + $2,000 + $9,000) = $12,000 / $12,000 = 1

The cash ratio for Taylor’s restaurant is 1, which means that his restaurant can pay off all of its liabilities with the cash that it has available, and won’t have to rely on selling other assets. Although his restaurant’s cash ratio is 1, the bank does not find this to be acceptable. If he can improve the ratio to be greater than 1 he may be eligible for the loan.

The bank wants to see that the restaurant would be able to make loan payments with its own revenue in the worst case scenario when multiple liabilities become due. But, it should be noted that many other factors go into determining whether or not a business should be eligible for credit, and the cash ratio may or may not be one of those factors.

If a company has a cash ratio of 1 or more, it suggests that the company would still survive in a worst case scenario where all of its current liabilities were due at once.

For a company with a cash ratio of less than 1, it would be in a much worse situation if its liabilities became due all at once. It would likely have to sell other assets such as equipment or be able to collect on accounts receivable quickly.

If a company does not have a cash ratio of 1 it does not necessarily mean it is unstable.

The cash ratio for a particular company does not necessarily have to be at 1 for it to be considered financially healthy. There are some industries that heavily rely on accounts receivable, and operate profitably, but they may have a cash ratio of less than 1 since they pay their liabilities gradually throughout the year. They may be able to operate without risk because they have a very high collection rate.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.