Pay Me Now Please: What None Traditional Internets Payment Options Are Available

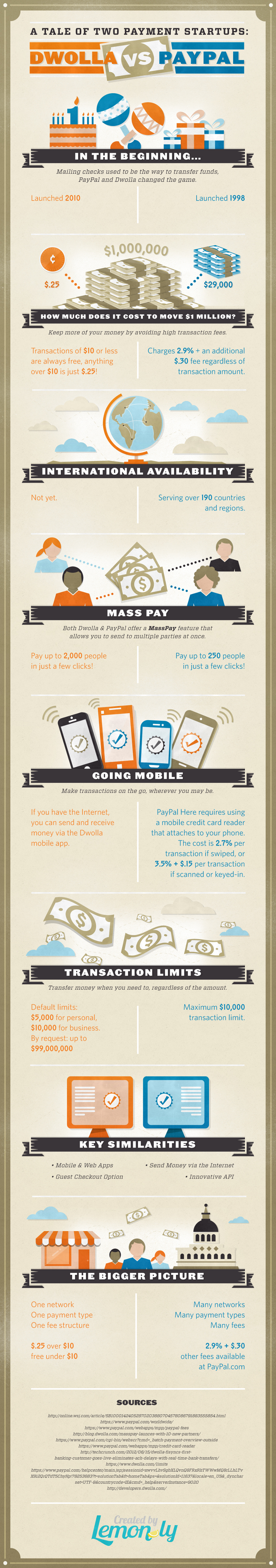

Well for anyone who accepts money online PayPal has led the charge since 1998. Entering the scene a mere 12 years latter in 2010 we have DWOLLA and an interesting impact they have made. Only three years into their infancy they seem to have hit on a veritable mine of gold. Let’s take a closer look at these two start ups.

They are as different as they are similar. Taking us out of the stone ages and giving one a digital alternative to snail mail traditional check writing route of exchanging fiat. In the beginning the way forward was slow; it took a while for the masses to catch the drift. As the younger got older and the older had time to learn new tricks the industry began to take off.

To really hit the highlights it is important to make a virtual visual impact on the unwired mind. Just how much does it take to move 1 million dollars in the digital electronic world, at sub-light speeds of course? Ok only near sub-light speeds. It seems it can take PayPal up to 4 days to deposit your money in your own personal or business related accounts.

When they do transfer the money from a payee into your PayPal account it cost you a fee to receive the money. Both of these digital money purveyors require a fee for providing a safe and secure transfer of funds. PayPal charge you a 2.9% fee plus .30 cents regardless of the level of funds transferred. PayPal limits would prevent this level of transfer but if it could happen 1 million a fee of $29,000 dollars virtually. WDOLLA in the other hand would charge you a mere .25 cents for the transaction.

WDOLLA will let your transfer anything under $10 dollars for free and anything over is .25 cents per transaction. PayPal is as mentioned above 2.9% of the amount of transfer plus .30 cents per transaction for personal accounts. Other types of accounts have varying fees check PayPal out for Business account and upgraded personal accounts.

PayPal the top dog in electronic transfer of funds online is international with over 190 countries represented, while WDOLLA is only available in the US. Both outfits allow you to make mass payments to multiple parties all at once. WDOLLA allows a group up to 2000 individuals and PayPal allows for up to 250 with just a few clicks. Time saved is money earned when it comes to payouts.

Both organizations allow for mobile applications of their platforms. PayPal like other smart phone merchant providers require a card reader that plugs into the phone. Their charges are also comparable to merchant account providers at 3.5% plus .15 cents per transaction if keyed in and 2.7% if the card is swiped. WDOLLA again comes in as the US cost saving option because if you have access to the internet via your mobile device you can transfer funds same deal as another internet connection.

Limits yes the online world has its limits; PayPal limits a transaction to $10.000 dollars end of story. WDOLLA has established default limits of $5,000 dollars for personal accounts and $10.000 dollars for business accounts. With WDOLLA you have an additional option to request a transaction increase up to a max of $9,000,000.

So the both offer mobile and web applications, a guest check out option, an innovative API and the ability to transfer funds over the internet. The overall view looks like this WDOLLA one network with one fee structure and one payment type vs. PayPal with multiple networks, many payment types and several fee structures. There you have it, WDOLLA has come a long way in 3 years and it remains to be seen just how far they will go.

Although millions of people visit Brandon's blog each month, his path to success was not easy. Go here to read his incredible story, "From Disabled and $500k in Debt to a Pro Blogger with 5 Million Monthly Visitors." If you want to send Brandon a quick message, then visit his contact page here.